From November 2, foreign institutional investors will be able to buy stocks in Vietnam without having enough money (non-pre-funding) when placing orders. To do this, securities companies must assess the capacity of their customers to determine the agreed margin level.

Many securities companies are ready to deploy non pre-funding services - Photo: Q. DINH

Regulations on payment procedures and handling when foreign institutional investors lack money... have also been mentioned in detail in Circular No. 68 of the Ministry of Finance.

Speaking with Tuoi Tre, securities companies said they have prepared business processes, human resources, systems, risk management mechanisms and capital to implement the new regulations.

What do you get from non pre-funding (NPS)?

Mr. Tran Duc Anh - Director of Macroeconomics and Market Strategy of KB Securities (KBSV) - said that with the new regulations, reputable foreign institutional investors only need a small amount of money or even no cash to place orders and can pay on T+1, T+2 days. While previously, they were required to deposit 100%.

According to Mr. Duc Anh, the untying of this knot is very important for attracting foreign capital. "Suddenly, there is a session when the VN-Index drops sharply, foreign investors want to disburse immediately but do not have money available. With the new regulation from November 2, they can pick up the phone and call the securities company to place an order," said the KBSV expert.

According to this expert, all four markets in the region such as Indonesia, Malaysia, Philippines and Thailand have applied non-pre-funding, only Vietnam has not. This is one of the reasons why foreign transactions in Vietnam are still relatively "reserved" compared to the market size.

In fact, recently, rating organizations such as MSCI, FTSE Russell and international financial institutions also believe that the requirement for pre-transaction margin is a barrier that Vietnam needs to change.

When the margin bottleneck is resolved, many experts predict that there is a high possibility that the Vietnamese stock market will be considered for an upgrade by FTSE Russell in the final review period of 2025.

To date, Vietnam remains a frontier market - the "bottom" of the rankings. Upgrading the market towards higher liquidity and stability is essential.

Mr. Huynh Hoang Phuong, an asset management expert at FIDT, said that it will be difficult to recover the value of foreign net sales since the beginning of the year if there is no official upgrade story, even when the Fed has started the roadmap to lower interest rates.

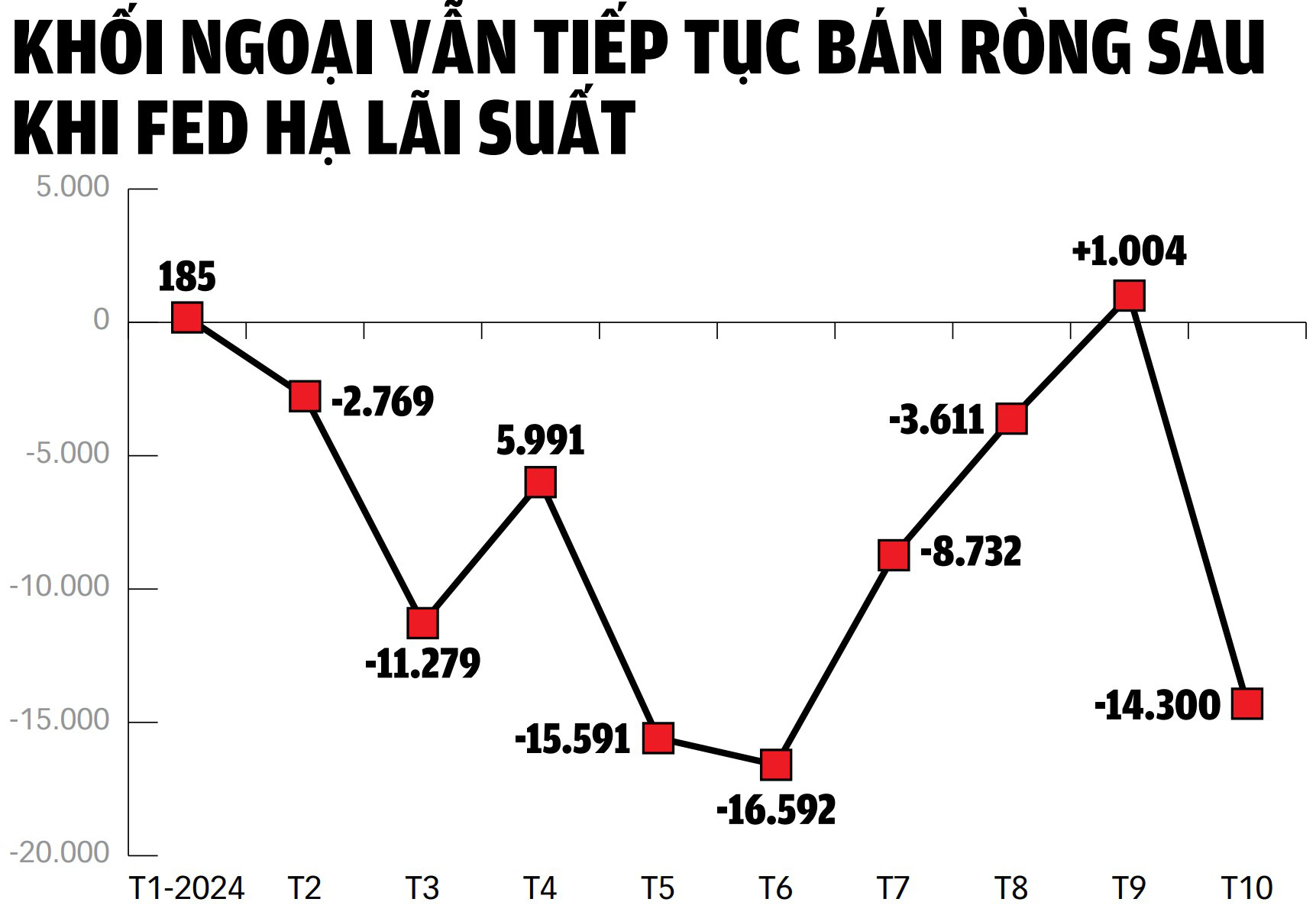

According to this expert, in the context of Vietnam's efforts to upgrade its market, from the beginning of the year to the end of September, the total net selling value of foreign investors reached VND66,100 billion (equivalent to USD2.7 billion). The proportion of foreign investors' transactions also decreased to 10% in September from 12% in the previous month.

By October, the net selling trend has narrowed, but still has a psychological impact on the market. However, according to Mr. Phuong, the application of non-pre-funding also needs time to be put into practice, and foreign investors need to have experience and evaluation.

"Although we cannot expect foreign capital to flow into Vietnamese stocks as soon as the margin bottleneck is removed, it is an important premise for the market in the upgrading process," said this expert.

Risk management when investors do not pay

Mr. Bui Hoang Hai, Vice Chairman of the State Securities Commission, said that Circular No. 68 with important content on non-pre-funding is the result of an urgent document drafting process to continue towards the goal of upgrading and maintaining the upgrading results.

Previously, at the conference to deploy new regulations with market members organized by the Securities Commission, securities companies said many customers responded positively to the new regulations.

Without having to deposit enough money, foreign institutional investors can invest in the Vietnamese stock market at lower costs, minimizing risks of exchange rates, portfolio swaps, etc.

Securities companies also said they are actively preparing full business processes, human resources, systems, risk management mechanisms and capital to implement the circular.

Speaking to Tuoi Tre, a leader of DNSE Securities Company said that they are ready to implement non-pre-funding from the beginning of November. "So far, we have not seen any difficulties. There are also some foreign customers who have agreed to trade under this new mechanism," he revealed.

To meet customers' trading needs but lack of money, securities companies need to ensure sufficient capital.

Many large units in the market such as VCI, HCM or SS also said that they are ready with resources to provide counterpart capital for stock purchase transaction services that do not require sufficient funds for foreign investors.

Citing the average purchase transaction value of foreign investors in the entire market of several thousand billion VND/session, the leader of a securities company affirmed: this is a rather small number compared to the scale and room to provide transaction limits for lack of money of current securities companies.

What many securities companies are more concerned about is the risk management plan and how to handle the assumption that foreign investors do not pay on time, or even "skip" the money.

Because according to Circular 68, if foreign institutional investors lack money, securities companies will pay the shortfall through their own trading accounts.

Referring to the risk management process with customers not needing to deposit, the leader of DNSE Securities said that there will be a careful assessment of customers based on criteria such as fund establishment time, performance, and total assets.

"The list of non-pre-funding codes will include codes with good liquidity, which will be evaluated more strictly than the current margin lending portfolio," he said.

A leader of SHS Securities also said that they will have to calculate how to handle cases where limits are granted to customers for transactions but they do not pay.

"In the worst case, if the customer does not pay, they can only wait for the goods to arrive and then sell them. But there may be potential losses," he said, adding that the process of handling this collateral requires the cooperation of the custodian bank.

Source: VDSC - Compiled by: BINH KHANH - Graphics: TUAN ANH

The market needs more new products.

According to Mr. Vu Duy Khanh, director of analysis at Smart Invest Securities, there are many reasons for capital withdrawal from the Vietnamese market.

In addition to the story of interest rate differences, capital withdrawal from many countries, not just Vietnam, can also come from delays in upgrading the stock market and basic bottlenecks in goods.

The expert emphasized that in order for the market to attract both domestic and foreign capital, it needs attractive incentives, many quality goods, and new products. Meanwhile, the Vietnamese market is lacking both.

There are only a few old products around, the number of businesses listed in recent years can be counted on the fingers, good products are full of foreign "room", there are no new products to trade.

"If the quality of goods and products cannot be improved, foreign capital flows into Vietnam will hardly be vibrant even after being upgraded," said Mr. Khanh.

According to this expert, VN-Index does not represent the economy as the index depends on banking, real estate, and securities. This group accounts for about 70% of the total market capitalization, so Vietnamese securities do not fully reflect the real economy and make it difficult for foreign investors to invest.

In addition, in terms of rules, foreign funds allocate investment proportions according to market rankings. Therefore, by delaying market upgrades, according to Mr. Khanh, Vietnam also misses the opportunity to welcome capital flows.

With the upgrade to emerging market, SSI Research once estimated that capital flows from ETF funds could reach up to 1.7 billion USD, not including capital flows from active funds.

More comprehensive long-term solutions needed

Ms. Nguyen Hoan Nien - Shinhan Securities analyst - said that Circular 68, with the most important content allowing foreign institutional investors to place orders to buy shares without requiring sufficient funds, will have a positive impact on the transaction value of foreign investors in the market.

"Securities companies with large foreign institutional client bases and abundant available capital such as VCI, HCM, SSI... will especially benefit from becoming the main non-pre-funding service providers," said Ms. Nien, adding that the market share and business results of these companies will also improve, especially HCM and Vietcap - the two leading companies in terms of institutional client market share.

However, Ms. Nien also noted that in the short term, the NPS solution can help FTSE upgrade the Vietnamese market.

But in the long term, Vietnam still has to find a comprehensive solution to deploy the operation of the central clearing system (CCP).

Source: https://tuoitre.vn/nut-that-duoc-go-cho-von-ngoai-vao-chung-khoan-20241031225613112.htm

![[Photo] "Beauties" participate in the parade rehearsal at Bien Hoa airport](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/11/155502af3384431e918de0e2e585d13a)

![[Photo] Looking back at the impressive moments of the Vietnamese rescue team in Myanmar](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/11/5623ca902a934e19b604c718265249d0)

![[Photo] Summary of parade practice in preparation for the April 30th celebration](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/11/78cfee0f2cc045b387ff1a4362b5950f)

Comment (0)