Many banks have recorded good growth again in the insurance business and services sector. This is a positive signal for the bancassurance channel (cross-selling insurance through banks) after a difficult period.

Techcombank is the bank that recorded good growth again in the insurance sector - Photo: QUANG DINH

Statistics from the third quarter financial reports of this year of some banks with detailed explanations of revenue from service activities, many places reported good growth again in the insurance sector.

Net interest margin narrows

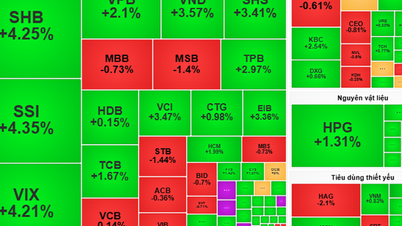

According to data analysis group Fiingroup, after-tax profits of 27/27 listed banks exceeded VND56,000 billion in the third quarter of this year, up nearly 18% over the same period last year.

But it should be noted that this growth rate was lower than the 21.6% increase in the previous quarter. The quality of profit growth is deteriorating in the context of a broad-based narrowing of NIM (net interest margin).

Fiingroup experts said that this was a worse-than-expected business result in the banking industry in the context of slowing credit growth and poor non-credit business, causing interest and non-interest income to decrease by 2.1% and 14.2% respectively compared to the previous quarter.

According to statistics, the industry-wide NIM has decreased to 3.3% in the third quarter of 2024, equivalent to the bottom level of the post-Covid-19 period. The main reason pointed out by the group of analysts is that the cost of capital mobilization increased again when the mobilization interest rate level was higher.

Data: Fiingroup

In fact, since the beginning of the year, many banks have increased deposit interest rates while lending interest rates remain quite stable to attract borrowers. Especially since the beginning of November, many small banks have increased interest rates, with 12-month terms fluctuating around 5.7 - 5.9%/year.

In addition, the data unit also said that asset returns continued to decline as lending rates continued to move sideways amid the government's policy of stabilizing interest rates to support growth.

Fiingroup experts predict that banks are facing the risk of NIM continuing to decrease in the coming time because credit costs may increase due to increasing bad debt pressure when Circular 02 on debt restructuring expires (expected on December 31, 2024).

Many banks increase insurance segment

In the structure of service revenue, many banks recorded improvements in insurance business activities.

At a bank that announced its Q3-2024 financial report with an explanation of revenue from service activities, many places recorded double-digit growth in the insurance segment.

Specifically, the third quarter 2024 financial report shows that revenue from insurance service fees brought Techcombank VND 594 billion in the first 9 months of this year, an increase of nearly 30% over the same period.

Last year, Techcombank's insurance cooperation revenue reached VND667 billion, down nearly 62% compared to 2022 after the market experienced a crisis of confidence in the insurance industry.

Recently, Techcombank and Manulife Vietnam announced their decision to terminate their exclusive partnership from October 14, 2024. After that, the bank contributed capital to establish Techcom non-life insurance company.

Another bank that also recorded high growth in the insurance sector is KienlongBank. As shown in the financial report for the third quarter of this year, revenue from insurance brought KienlongBank nearly 40 billion VND, an increase of nearly 73% over the same period.

Last year, KienlongBank's insurance revenue reached 36.3 billion VND, "evaporating" 44% compared to 2022 in the context of general difficulties.

Similarly, VPBank also had a significant recovery in the insurance cross-selling segment. In the first 9 months of this year, insurance revenue brought VPBank 2,820 billion VND, an increase of nearly 52%.

In 2023, VPBank also "felt" the common difficulties when revenue from insurance only brought in 2,937 billion VND, down nearly 13% compared to 2022.

Meanwhile, insurance is considered a "goose that lays eggs" for many banks. For example, in 2022, VPBank's revenue from insurance business and services reached VND3,353 billion, while spending on insurance services was only VND57 billion.

At SeABank, according to the financial report for the third quarter of this year, revenue from insurance agency services brought in more than 87 billion VND, an increase of more than 14% over the same period last year.

Strong differentiation

In contrast to the growth of many of the above banks, the financial report for the third quarter of 2024 shows that MBBank's revenue from insurance services in the first 9 months of this year remained unchanged compared to the same period last year at VND 5,989 billion.

Although not growing, this bank has a large source of income from insurance, contributing up to 57% of total income from service activities.

TPBank is also stable compared to the same period when in the first 9 months of this year, revenue from insurance and consulting services reached nearly 290 billion VND.

Meanwhile, LPBank, VIB… still recorded a decline in insurance revenue. For example, at LPBank, revenue from insurance agents only reached 383 billion VND, down 28% over the same period. VIB also decreased by half compared to the same period, down to only 345 billion VND…

Source: https://tuoitre.vn/nhieu-ngan-hang-thu-dam-tro-lai-tu-ban-cheo-bao-hiem-20241123131053508.htm

![[Photo] National Assembly Chairman Tran Thanh Man holds talks with New Zealand Parliament Chairman](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/8/28/c90fcbe09a1d4a028b7623ae366b741d)

![[Photo] Red flag with yellow star flutters in France on National Day September 2](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/8/28/f6fc12215220488bb859230b86b9cc12)

![[Photo] General Secretary To Lam presents the 45-year Party membership badge to comrade Phan Dinh Trac](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/8/28/e2f08c400e504e38ac694bc6142ac331)

![[Photo] General Secretary To Lam attends the opening ceremony of the National Achievements Exhibition](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/8/28/d371751d37634474bb3d91c6f701be7f)

![[Photo] Politburo works with the Standing Committee of Cao Bang Provincial Party Committee and Hue City Party Committee](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/8/28/fee8a847b1ff45188749eb0299c512b2)

Comment (0)