Foreign investors assess that establishing an international financial center (IFC) in Ho Chi Minh City requires a long-term strategy, administrative reform and a transparent financial system to attract investment and build trust.

Mr. Alexander Ziehe, Chairman of the German Business Association in Vietnam (second from right) and representatives attending the ceremony to announce the construction of a regional and international financial center in Vietnam - Photo: NVCC

"Vietnam is at an important crossroads"

On January 4, in Ho Chi Minh City, Prime Minister Pham Minh Chinh attended the ceremony to announce the construction of a regional and international financial center in Vietnam; and to announce the planning of Ho Chi Minh City for the 2021-2030 term, with a vision to 2050.

Mr. Rich McClellan, country director of the Tony Blair Institute for Global Change (TBI) in Vietnam and Mr. Alexander Ziehe, chairman of the German Business Association (GBA) in Vietnam also attended the event.

"The energy in the room that day reflected the government's deep commitment to this transformational initiative. IFC is not just a nominal project, but a driving force for financial and economic innovation for Vietnam," Mr. Rich McClellan recalled before discussing more on this topic with Tuoi Tre Online .

TBI is an organization with many activities and cooperation with ministries and sectors in Vietnam, aiming to promote cooperation between Vietnam and the UK.

Previously, in July 2024, Prime Minister Pham Minh Chinh received Mr. Tony Blair, former British Prime Minister and Executive Chairman of TBI, and discussed cooperation opportunities in trade, investment and financial sector development.

As TBI representative in Vietnam, Mr. Rich believes that establishing IFC in Ho Chi Minh City is a bold and timely vision.

“Vietnam is at a critical crossroads,” said Rich, citing its dynamic economy, strategic location and growing human resources as factors well suited for Ho Chi Minh City to lead this strategy.

However, IFC's success will depend on a clear implementation plan, with a phased roadmap and aligning Vietnam's financial systems with global standards.

According to Mr. Alexander Ziehe, IFC's development strategy in Ho Chi Minh City is "very promising".

He also stressed the importance of close coordination between administrative agencies and early involvement of the private sector.

VBA in Vietnam is currently a community of about 400 members, including leading German financial institutions such as Deutsche Bank, Allianz and HDI.

Last year, the unit organized visits for German banks, venture capital firms and insurance companies to learn about and evaluate their strategies for Vietnam.

“However, they are largely in a wait-and-see phase, waiting for details on administrative reforms and the establishment of financial centres,” said Mr Ziehe.

Hybrid model between local and available model

Each country has its own characteristics. According to Mr. Alexander Ziehe, Vietnam should take advantage of its strengths from the manufacturing sector in developing IFC and providing complementary solutions for trade finance and sustainable development.

Referring to models from Singapore, Hong Kong, Dubai... can all be considered and adjusted to suit the characteristics of Vietnam.

The hybrid model, or combining the strengths of the IFCs, which have been well-known and adjusted to local characteristics, is also the model Mr. Rich McClellan suggests. It is important that Vietnam designs investment incentives that are specific to each sector, such as asset management and investment for sustainable development.

“The key is to develop a realistic roadmap for each phase that is consistent with Vietnam’s economic goals while remaining flexible to global market trends,” said Rich McClellan.

Mr. Rich McClellan, country director of the Tony Blair Institute for Global Change (TBI) in Vietnam - Photo: NVCC.

Prioritize platform reform

Foreign investors all agree that Vietnam’s financial sector needs further upgrading, with better policies and administrative reforms. The establishment of IFC can help address market challenges by creating the right ecosystem.

It will welcome foreign financial institutions and lead in liberalization, advanced financial governance, and integration into the global economy.

"But to achieve this, the Government needs to be cautious and comprehensive in opening up the country, creating a friendly environment for international investors and talents. Foreign talents will play an important role," said Mr. Alexander Ziehe.

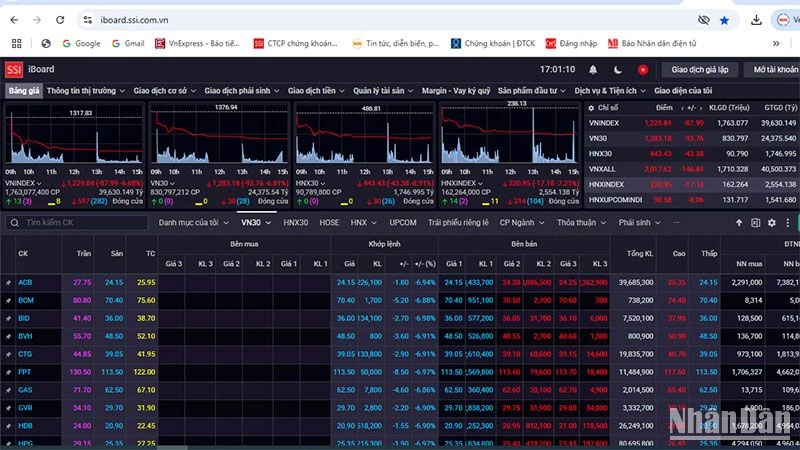

According to Mr. Rich McClellan, Vietnam's top priority should be to focus on strengthening the core pillars of the banking system, capital market and stock market.

Once the fundamentals are in place, Vietnam can focus on niche areas such as fintech, digital banking, green finance, ESG investing, and capital market innovation. These areas will help differentiate and align with global trends.

In addition, the development of legal frameworks on currency convertibility and capital flows also needs to be considered.

“This reflects broader issues of financial liberalization and confidence in regulatory systems. A successful IFC needs not only mechanisms to attract capital inflows but also flexible, transparent systems for capital outflows to ensure investor confidence,” Mr. Rich shared.

According to Mr. Danny Kim, economist in charge of forecasting for Vietnam at Moody's Analytics, establishing IFC requires a phased strategy, focusing on long-term goals and ensuring transparent and effective financial regulations.

Balancing free capital flows and maintaining effective financial regulation is a major challenge.

"The ambition is there, but for IFC to succeed, it will require sustained efforts and regulatory reform. Vietnam also needs to develop more high-quality human resources to meet the requirements of an IFC and compete with long-standing rivals," Mr. Danny shared.

Source: https://tuoitre.vn/foreign-investors-expect-what-to-do-in-the-financial-center-in-hcm-20250112110910639.htm

![[Photo] Special relics at the Vietnam Military History Museum associated with the heroic April 30th](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/3/a49d65b17b804e398de42bc2caba8368)

![[Photo] General Secretary To Lam receives Japanese Ambassador to Vietnam Ito Naoki](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/3/3a5d233bc09d4928ac9bfed97674be98)

![[Photo] Prime Minister Pham Minh Chinh chairs meeting after US announces reciprocal tariffs](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/3/ee90a2786c0a45d7868de039cef4a712)

![[Photo] A brief moment of rest for the rescue force of the Vietnam People's Army](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/3/a2c91fa05dc04293a4b64cfd27ed4dbe)

![[Photo] Moment of love: Myanmar people are moved to thank Vietnamese soldiers](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/3/9b2e07196eb14aa5aacb1bc9e067ae6f)

![[Infographic] Government bond market March 2025](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/3/e13239cdbcfd4968abc836c201204c43)

Comment (0)