Taking advantage of the long holiday season and increased demand for online services, scammers have used many tricks to steal money from customers' accounts/cards.

ACB Bank has just warned customers about fraud situations impersonating bank employees along with safety principles to note when making online transactions.

According to ACB, a common situation today is that scammers impersonate bank employees to assist with biometric installation.

Impersonators create virtual accounts such as: Bank staff, Customer Support,... contact customers via phone, text message, social networks (Zalo, Facebook...) or interact with customer comments below posts on the bank's official Fanpage to support customers in registering for face authentication.

The purpose of the subject is to ask customers to provide: personal information, security information of online banking services, citizen identification images, customer facial images... or can request a video call to collect more voice and gestures.

Next, it will lure customers to access a strange link to download and install a fake application that supports biometric collection on the phone,...

Another common situation is that people impersonate bank employees to support preferential loan packages, increase credit card limits, lock cards, etc.

Common tricks are introducing preferential loans with attractive interest rates and simple procedures; increasing credit card limits, supporting card locking, etc.

The purpose of the scammer is to ask customers to take photos of their cards, photos of their identification documents, transfer application fees/insurance fees/service fees, etc., or provide confidential information (username, password, Safekey Pin code, OTP code, card information, etc.), or click on strange links, etc.

The risk and damage to customers if they follow the subject's request is that their confidential information (username, password, Safekey Pin code, OTP code, card information, etc.) will be revealed/lost. Money in the customer's account/card may be stolen or defrauded.

The general safety principle set by ACB as well as all other banks for customers is: only register for face authentication on the bank's only application or at the bank's branches and transaction offices. Do not click on strange links or install applications of unknown origin. Do not provide security information (username, password, Safekey Pin code, OTP code,...) and card image information, identity document images,... to others.

Register your main phone number and set up notifications of account and card balance changes on the bank's application.

Regularly check account and card transaction history and follow bank notifications via email/banking application.

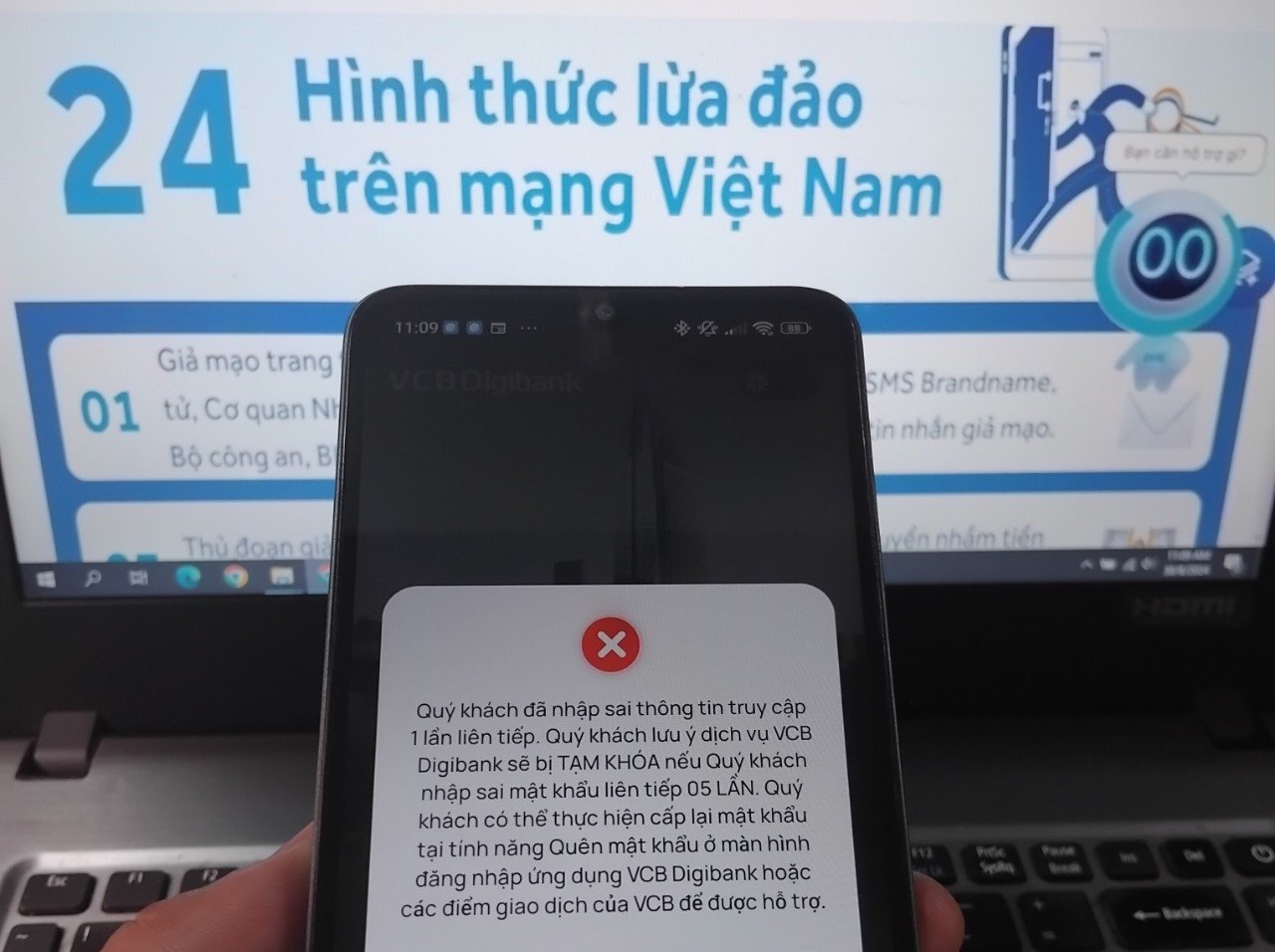

Actively enter the wrong password 5 times to lock the access to the electronic banking service or actively lock the card on the electronic service channel immediately when detecting signs or suspecting fraud/confidential information leakage.

Only download and install applications directly from official app stores Apple App Store or Google Play Store (CH Play).

Source: https://vietnamnet.vn/ngan-hang-chi-cach-giu-tien-hay-nhap-sai-mat-khau-5-lan-2317026.html

![[Photo] 2nd Conference of the Party Executive Committee of Central Party Agencies](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/31/8f85b88962b34701ac511682b09b1e0d)

![[Photo] General Secretary To Lam receives US Ambassador to Vietnam Marc E. Knapper](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/31/5ee45ded5fd548a685618a0b67c42970)

![[Photo] Prime Minister Pham Minh Chinh receives delegation of leaders of US universities](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/31/8be7f6be90624512b385fd1690124eaa)

![[Photo] Speeding up construction of Ring Road 3 and Bien Hoa-Vung Tau Expressway](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/31/f1431fbe7d604caba041f84a718ccef7)

![[REVIEW OCOP] An Lanh Huong Vet Yen Cat](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/27/c25032328e9a47be9991d5be7c0cad8c)

Comment (0)