Despite a wave of Western sanctions, Russia is about to enter its third year of war with Ukraine with unprecedented revenue from oil sales.

According to the budget law signed by Russian President Vladimir Putin in November 2023, Moscow's revenue in 2024 is expected to reach more than 35 trillion rubles (nearly 394 billion USD), in 2025 it is nearly 377 billion USD and in 2026 it is more than 382 billion USD.

This is a significant increase for Russia, after the country achieved a record revenue of 320 billion USD in 2023, despite having to spend significantly on defense to serve the war in Ukraine, while coping with a series of unprecedented sanctions from the West.

The bulk of Russia’s revenues over the past year have come from oil exports, despite the West’s efforts to restrict Moscow’s energy flows. As Russia’s crude and gas exports to Europe have plummeted, Washington’s strategic partner India has emerged as a major customer.

Russia’s crude oil sales to India hit a record $37 billion in 2023, according to analysis by the Center for Research on Energy and Clean Air (CREA). India’s oil purchases from Russia have increased more than 13 times since before the Ukraine conflict broke out.

Some oil trade between Russia and India is done openly and directly. Windward, an Israeli maritime artificial intelligence company, said tankers made 588 direct voyages from Russia to India last year.

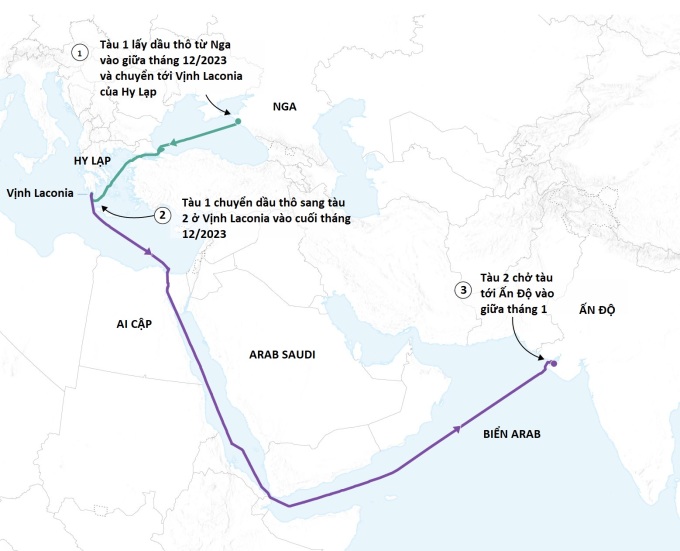

However, some trade between the two countries takes a more complicated route. Pole Star Global, a UK-based shipping monitoring company, has tracked shipping data and found that more than 200 oil tankers from Russia have transferred their cargo to another vessel in the Gulf of Laconia in Greece, before being re-shipped to India.

“The oil trade is done legally, but sometimes they also use some sanctions evasion measures,” said David Tannenbaum, a member of Pole Star Global.

CNN also spotted similar complex trading activities off the Greek port of Gythio earlier this month. Two oil tankers were anchored side by side offshore, transferring cargo from one to the other. Both had picked up oil cargoes from Russia weeks earlier.

One of the vessels is owned by an India-based company accused of violating Western sanctions. The other is owned by an individual on a separate US sanctions list.

The transit route that brings crude oil from Russia via Greece to India. Graphics: CNN

The United States and its Western allies agreed in late 2022 to cap oil prices, pledging not to buy Russian crude above $60 a barrel. They also banned their shipping and insurance companies from facilitating trades of Russian crude above the cap.

Earlier this month, the US Treasury Department issued a new package of sanctions against ships and companies suspected of helping transport Russian crude oil in violation of sanctions.

Russia's huge profits from crude oil sales despite sanctions are believed to be thanks to the "shadow fleet" that Moscow set up to conceal transactions and maximize profits, according to CNN analysts Nick Paton Walsh and Florence Davey-Attlee.

The “shadow fleet” was initially estimated to number around 600, or 10% of the world’s total fleet of large oil tankers. These vessels once shipped oil to Iran and Venezuela to avoid Western sanctions, but have recently switched to carrying Russian crude.

“There is some evidence that they are often hiding their activities by turning off their AIS transponders,” Matthew Wright, senior cargo analyst at Belgium-based data collection company Kpler, said of the fleet. AIS is a system that identifies and locates ships at sea, so turning it off means that monitoring experts lose track of the ships at sea.

Viktor Katona, head of crude oil data analysis at Kpler, said the Western-imposed price ceiling on Russia was the trigger for the effort to create the “shadow fleet.” “The longer the supply chain, the harder it is to determine the real price of a barrel of Russian oil after it has been transferred from one vessel to another,” Katona said.

The shadow fleet allows Russia to create a parallel shipping system and potentially bypass Western sanctions, with tankers of unclear ownership. Windward estimates the fleet tripled in size to 1,800 vessels last year.

India is the second largest buyer of Russian crude oil after China. This helps Russia to ease the pain of Western oil sanctions. At the same time, this revenue also helps to ensure the budget for Russia's campaign in Ukraine, according to observers.

Russia spent about $100 billion on the war in Ukraine last year, with spending expected to be even higher in 2024, CNN analysts said.

India’s decision to buy large quantities of Russian oil also helps to weaken the effectiveness of Western sanctions against Moscow. The US and many of its allies are unhappy with India’s decision, but it is unlikely to put much pressure on the country.

India is a member of the Quad grouping, along with the US, Australia and Japan. The US is relying heavily on cooperation with Quad members across a range of areas to maintain momentum for its Indo-Pacific strategy, experts say. New Delhi is also seen as a key link in US efforts to counter China, which Washington sees as a “threat”.

India explains its oil purchases from Russia as a way to curb global energy prices, as it does not compete with Western countries for oil supplies from the Middle East.

“If we start buying more oil from the Middle East, oil prices will not remain at $75-76 per barrel. It will be $150,” Indian Petroleum Minister Hardeep Singh Puri said.

An oil tanker anchors at the port of Kozmino, Nakhodka Bay, near the city of Nakhodka, Russia, December 2022. Photo: Reuters

India’s role in the global oil trade is also reflected in how it handles its oil purchases from Russia. Some of the Russian crude is refined at refineries on India’s west coast and then exported to the United States and other countries that have joined the sanctions against Russian oil.

CREA’s analysis estimates that the United States was the largest buyer of Indian refined petroleum products last year, with a total value of about $1.3 billion. U.S. allies also significantly increased their refined petroleum product imports last year, with an estimated $9.1 billion, up 44 percent from the previous year.

Refined oil products outside Russia are not covered by Western sanctions. Moscow is believed to be looking to exploit this loophole in the sanctions wall to earn more money from oil sales.

One of the Indian refineries that receives Russian crude is in Vadinar and is operated by Nayara Energy, which is 49.1% owned by Russian oil giant Rosneft. CREA estimates that the US imported $63 million worth of refined oil from Vadinar in 2023, and about half of the crude used at the plant came from Russia.

Analysts say the profits that parties can reap from sanctions evasion strategies will be huge.

“You’re talking about something incredibly lucrative. And there’s a huge temptation for traders to do that,” said Ami Daniel, chief executive of Windward.

Thanh Tam (According to CNN, TASS, PTI )

Source link

![[Photo] Celebrating the 70th Anniversary of Nhan Dan Newspaper Printing House](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/15/a7a2e257814e4ce3b6281bd5ad2996b8)

![[Photo] Vietnamese and Chinese leaders attend the People's Friendship Meeting between the two countries](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/15/7d45d6c170034d52be046fa86b3d1d62)

![[Photo] Prime Minister Pham Minh Chinh works with state-owned enterprises on digital transformation and promoting growth](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/15/f55bfb8a7db84af89332844c37778476)

![[Photo] President Luong Cuong holds talks with General Secretary and President of China Xi Jinping](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/15/f7e4c602ca2f4113924a583142737ff7)

Comment (0)