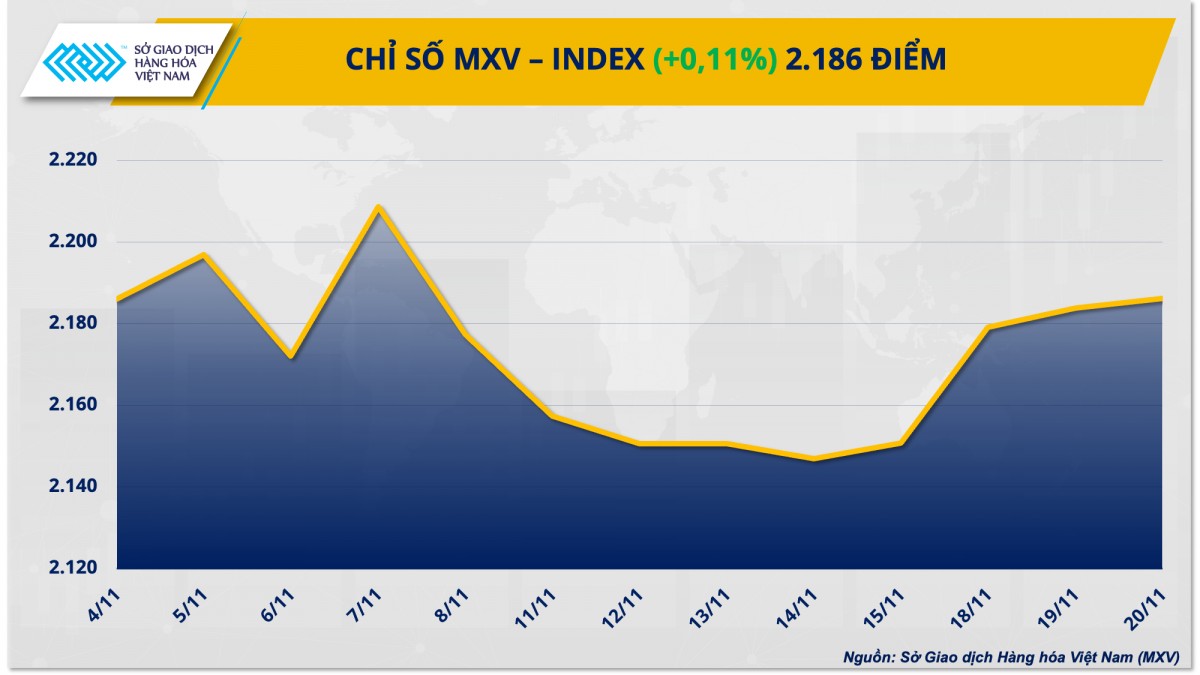

According to the Vietnam Commodity Exchange (MXV), the world raw material market was relatively diversified in yesterday's trading session (November 20).

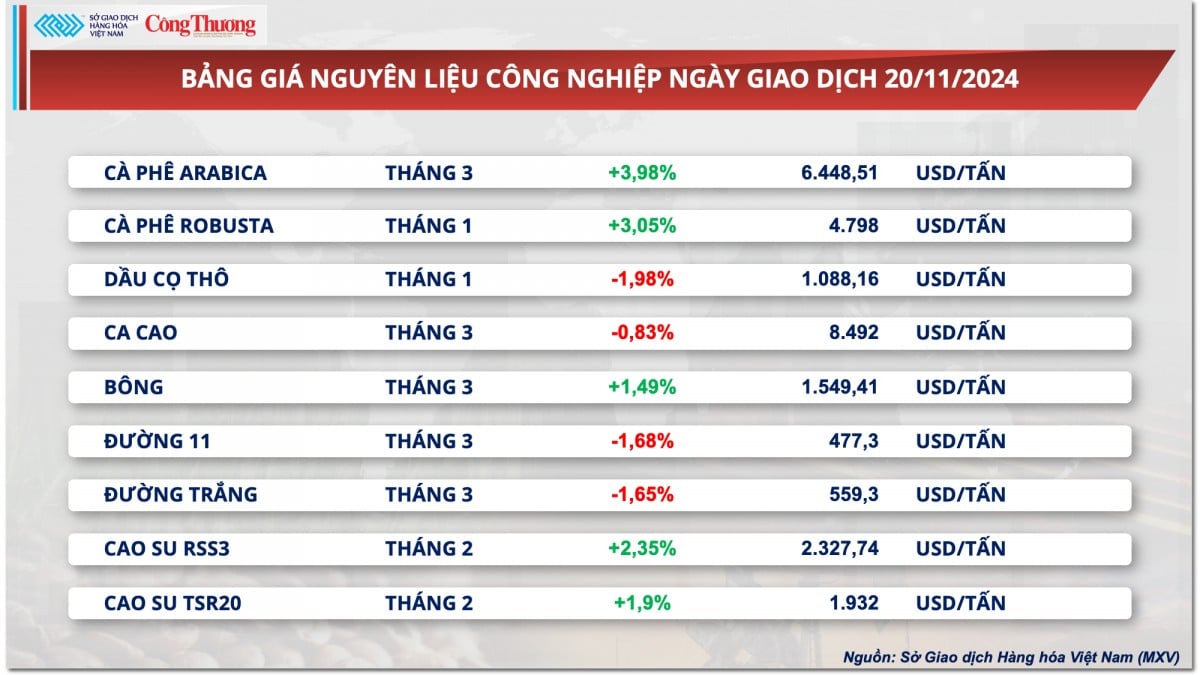

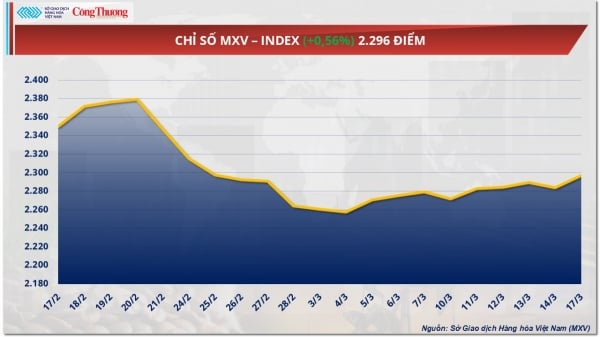

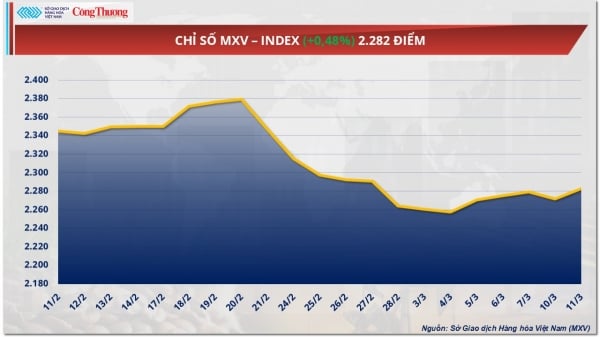

At the close, the MXV-Index rose slightly by 0.11% to 2,186 points, extending its four-session winning streak. Green dominated the industrial raw material market, notably, the prices of two coffee commodities, Arabica, climbed to their highest peak since 2011, and Robusta, returned to their highest level in more than a month due to concerns about supply from Brazil and Vietnam.

|

| MXV-Index |

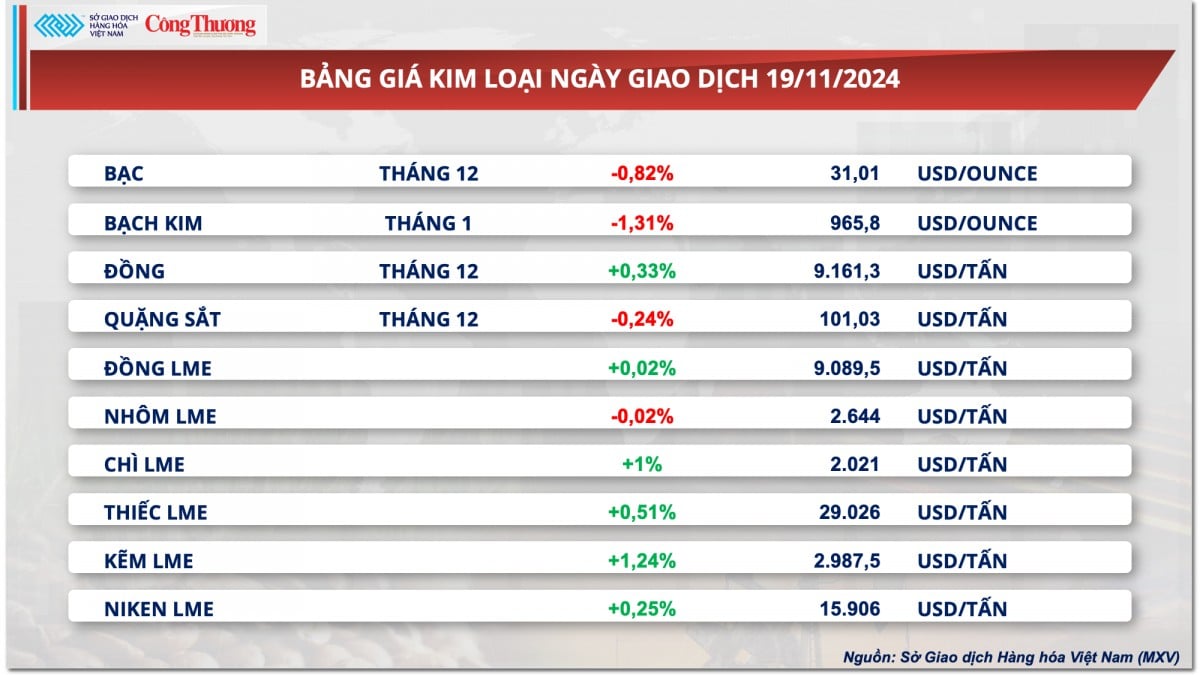

Precious metal prices return to decline due to pressure from USD

According to MXV, the metal market was relatively mixed yesterday. For precious metals, silver and platinum prices both fell again due to pressure from the USD. Of which, silver prices fell 0.82% to 31 USD/ounce. Platinum prices turned down 1.31% to 965.8 USD/ounce, ending the previous 4 consecutive sessions of increase.

|

| Metal price list |

The precious metal continued to benefit from escalating tensions between Russia and Ukraine yesterday, with Ukraine firing missiles made by the UK and the US into Russian territory for the first time since the conflict began in 2022. This not only increased tensions between Russia and Ukraine, but could also worsen relations between the West and Russia.

However, the stronger US dollar has put strong pressure on the precious metal, overshadowing its role as a safe haven. The Dollar Index recovered after three consecutive sessions of declines and returned to a one-year high, closing up 0.45% at 106.68 points. Investors continued to rush to buy the greenback following the "Trump trade" wave and due to concerns that the US Federal Reserve (FED) may keep interest rates high for longer. CME Group's FedWatch interest rate tracker showed that market expectations for a December rate cut have dropped significantly, with the odds now at 55.7%, down from 82.5% just a week ago.

For base metals, iron ore prices fell the most in the group, down 0.26% to $101.03/ton. In the context of weak demand in China, the Chinese government's failure to introduce new economic stimulus policies has disappointed investors, causing cash to continue to leave the market.

Yesterday (November 20), the People's Bank of China (PBOC) kept the one-year loan prime rate (LPR) unchanged at 3.1%, and the five-year LPR (applied to long-term investment loans such as home loans and mortgages) unchanged at 3.6%.

Adding to the pressure on prices, analysts at BMI Analytics, a division of Fitch Solutions, have forecast further declines in iron ore prices due to weak demand in top consumer China. The average iron ore price in 2025 is expected to reach $100 per tonne, down from an average of $104 per tonne in 2024. In the medium term, BMI forecasts iron ore prices will fall to $78 per tonne by 2033.

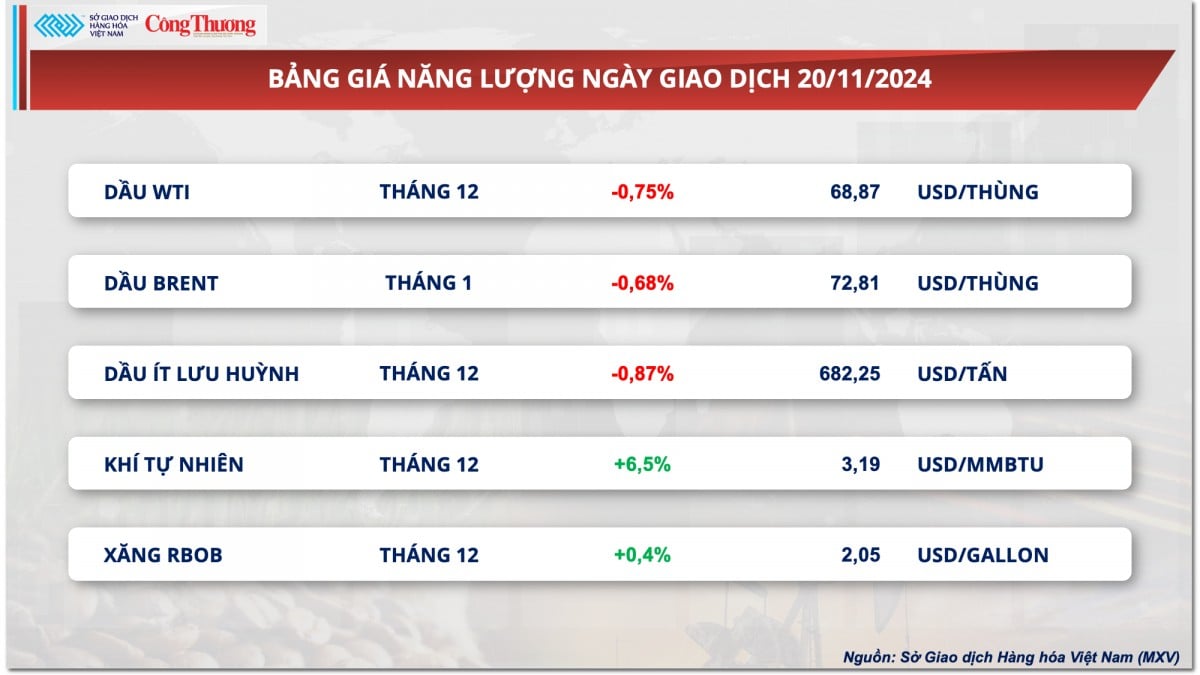

Prices of some other goods

|

| Energy price list |

|

| Industrial raw material price list |

|

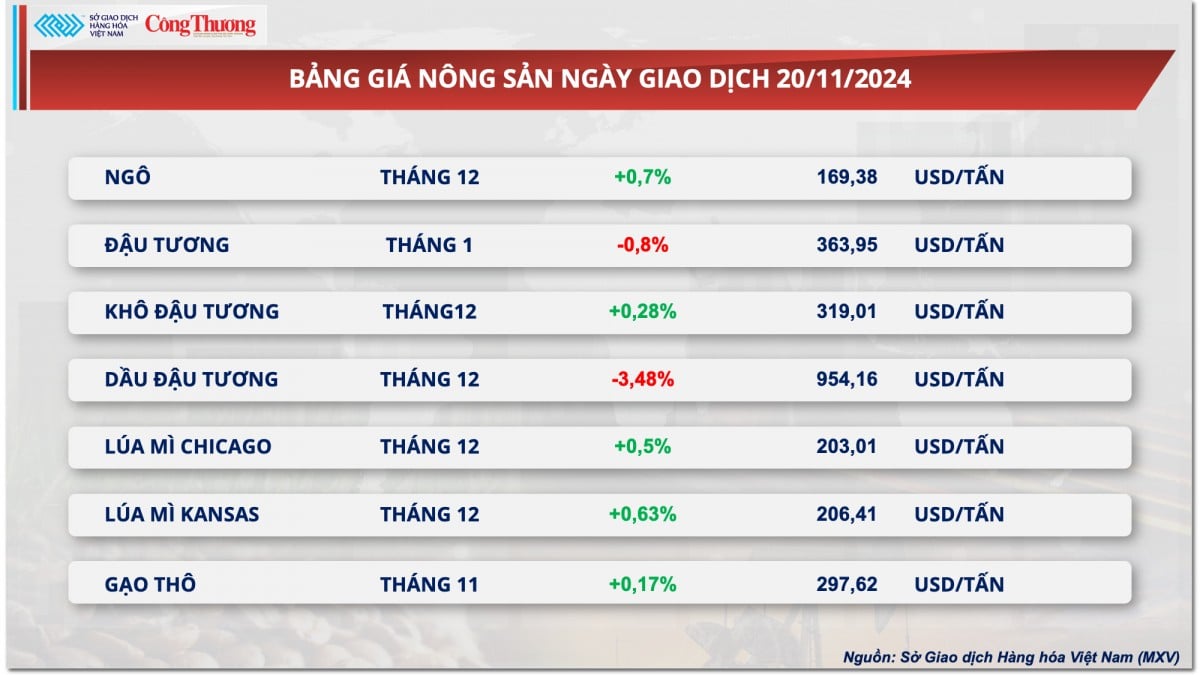

| Agricultural product price list |

Source: https://congthuong.vn/thi-truong-hang-hoa-hom-nay-ngay-2111-mxv-index-tang-phien-thu-4-lien-tiep-359996.html

![[Photo] Visiting Cu Chi Tunnels - a heroic underground feat](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/8/06cb489403514b878768dd7262daba0b)

Comment (0)