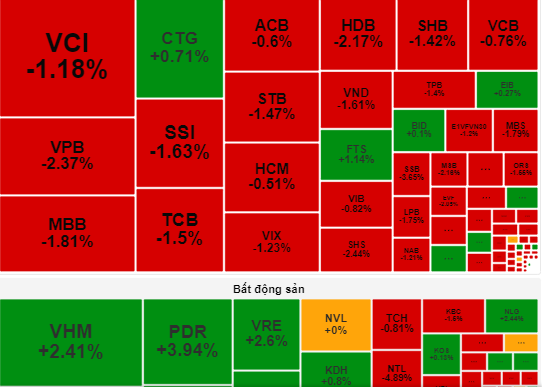

At the end of the session on September 4, the VN-Index decreased by 8 points (-0.63%), closing at 1,275 points.

After the September 2 holiday, Vietnamese stocks fell as soon as they entered the trading session on September 4. This development was largely due to the impact of global stocks falling due to concerns about economic recession, leading to a reduction in the proportion of stocks held by some Vietnamese stock investors.

However, the decline was restrained around 1,270 points and there was an effort to recover in the late afternoon session, when the demand for buying stocks at the bottom focused on some stocks in the real estate, oil and gas, banking sectors... Therefore, many investors expect this trend to continue in the upcoming sessions.

At the end of the session, the VN-Index decreased by 8 points (-0.63%), closing at 1,275 points. Order matching liquidity increased with 588 million shares matched on the HoSE floor.

According to BETA Securities Company, the market is experiencing corrections, along with strong net selling pressure from foreign investors, investors need to be cautious but not panic. Short-term fluctuations can create anxiety, but are also an opportunity to restructure the investment portfolio and look for potential stocks.

"The appearance of bottom-fishing cash flow is a positive signal. This shows that there are still many investors willing to disburse when stock prices fall. To adapt, stock investors should focus on stocks with strong financial foundations and long-term growth prospects; at the same time, maintaining a certain amount of cash is necessary to flexibly seize opportunities when the market adjusts" - BETA Securities Company recommends

Rong Viet Securities Company believes that the VN-Index is being supported to maintain the 1,275 point area. This signal can help the market recover in the near future and re-test the supply in the 1,280 - 1,285 point area before there is a more specific signal. Therefore, investors need to slow down and observe the supply and demand developments to assess the market status; temporarily consider the recovery phase to take short-term profits or restructure the stock portfolio to minimize risks.

Source: https://nld.com.vn/chung-khoan-ngay-mai-5-9-luc-cau-bat-day-co-phieu-se-tiep-dien-196240904184626833.htm

![[Photo] Looking back at the impressive moments of the Vietnamese rescue team in Myanmar](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/11/5623ca902a934e19b604c718265249d0)

![[Photo] "Beauties" participate in the parade rehearsal at Bien Hoa airport](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/11/155502af3384431e918de0e2e585d13a)

![[Photo] Summary of parade practice in preparation for the April 30th celebration](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/11/78cfee0f2cc045b387ff1a4362b5950f)

Comment (0)