High food prices and a weak yen will push Japan's core consumer price index (CPI) up 3.1% in 2023.

Official data released on January 19 showed that Japan's core inflation (excluding fresh food prices) was 3.1% last year, the highest since 1982. The main reason was high food prices and a weak yen, which made imports more expensive.

Core inflation was 2.3% in December alone, down from 2.5% in November. This has exceeded the Bank of Japan's (BOJ) 2% target for 21 consecutive months.

The December figures were in line with economists’ forecasts in a Reuters survey. Hotel room rates in Japan rose 59 percent in December, while electricity prices fell 20.5 percent, according to Japan’s Internal Affairs and Communications Ministry.

December figures showed that inflation was slowing. Compared to 2022, food price increases have slowed, said Kanako Nakamura, an economist at the Daiwa Institute of Research. Food prices have risen sharply here due to higher import costs, logistics costs and domestic wages.

The inflation data comes as the Japanese government urges companies to raise wages ahead of annual negotiations between managers and unions. The report also comes amid market expectations that the BOJ will end its negative interest rate policy early this year.

"The question now is whether consumption can pick up the pace to keep prices rising. Weak consumption will drag down inflation, making it harder to maintain the 2% target this year," said Yoshiki Shinke, an economist at Dai-ichi Life Research Institute.

However, observers believe that the BOJ will not change its monetary policy at next week's meeting. The 1-year reference rate here is currently -0.1%.

Ha Thu (according to Nikkei Asia Review, Kyodo News)

Source link

![[Photo] General Secretary To Lam receives Russian Ambassador to Vietnam](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/2/b486192404d54058b15165174ea36c4e)

![[Photo] Prime Minister Pham Minh Chinh receives CEO of Standard Chartered Group](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/2/125507ba412d4ebfb091fa7ddb936b3b)

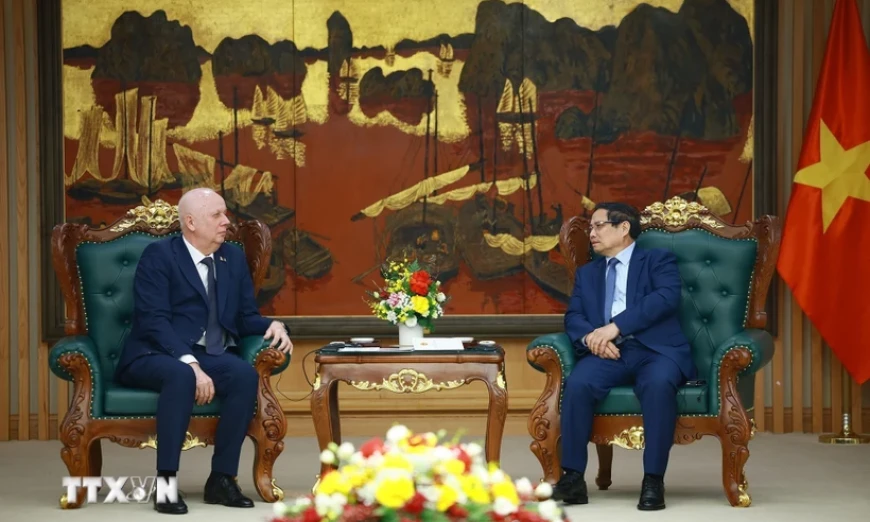

![[Photo] Prime Minister Pham Minh Chinh receives Deputy Prime Minister of the Republic of Belarus Anatoly Sivak](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/2/79cdb685820a45868602e2fa576977a0)

![[Photo] Comrade Khamtay Siphandone - a leader who contributed to fostering Vietnam-Laos relations](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/3/3d83ed2d26e2426fabd41862661dfff2)

![[Podcast] News on March 26, 2025](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/3/c3d9c3c48b624fd9af79c13ff9e5c97a)

Comment (0)