“It takes at least three years to build an offshore wind farm and start operating, which means construction must begin in 2027,” the expert shared.

Need more incentives and mechanisms

According to the National Power Development Plan for the 2021-2030 period, with a vision to 2050 (Power Plan VIII), approved in May 2023, Vietnam aims to reach 6,000 MW of offshore wind power capacity by 2030. However, since then, no project has been approved or assigned for investment. Many investors have been conducting offshore wind power research for many years, but so far they have been "standing still". Some investors have "discouraged" and left.

At the recent Green Economy 2024 Forum and Exhibition, Mr. Bruno Jaspaert, Chairman of the European Chamber of Commerce in Vietnam (EuroCham), noted that apart from the approval of the Power Master Plan VIII and the first steps in establishing an offshore wind market, little has changed.

“European companies are having difficulty implementing the first offshore wind projects. To be more precise, everything is just at the planning stage on paper, not yet implemented in practice,” said Mr. Jaspaert.

Meanwhile, according to Power Plan VIII, Vietnam is facing an extremely ambitious goal and really needs to take drastic action.

“It takes at least three years to build an offshore wind farm and start operating, which means construction would have to start in 2027, followed by three to four years of project development before financial close. That means all permits need to be in place and any obstacles need to be resolved within the next six months to have a chance of achieving the above target,” the EuroCham Chairman noted.

Referring to offshore wind power in the latest report, the Ministry of Industry and Trade said: International experience shows that for new energy sources, renewable energy in the early stages of development, investment rates and electricity production costs are often greater than traditional power sources.

To ensure the feasibility of the investment model for new energy and renewable energy, the Draft Law has stipulated the contents of incentive and support policies for each type of renewable energy and new energy electricity in accordance with the development goals and socio-economic conditions of each period, with incentive and support policies and breakthrough mechanisms for offshore wind power development, other incentive and support mechanisms for offshore wind power development.

For example, the electricity buyer and the electricity seller have the right to agree in the electricity purchase contract on the rate of ensuring the mobilization of minimum annual electricity output, exemption from sea area rental fees, exemption from land use fees during the investment and construction phase until the time the plant is put into operation to generate electricity, enjoy the highest level of corporate income tax incentives, support policies for self-produced and self-consumed electricity from renewable energy sources, etc.

Reporting further on offshore wind power, the Ministry of Industry and Trade assessed that this is a new field for Vietnam, so there is no practical experience in implementing projects related to this field. The exploitation and use of offshore wind is governed by many Laws and is under the management of different ministries and branches, in which, regulations related to the purpose of producing electricity from wind energy are under the scope of the electricity sector.

“Therefore, when finalizing regulations related to offshore wind power development, it is necessary to consider and develop corresponding regulations in other relevant Laws and only regulate contents within the scope of this Draft Law,” the Ministry of Industry and Trade stated its opinion.

Construction must begin in 2027.

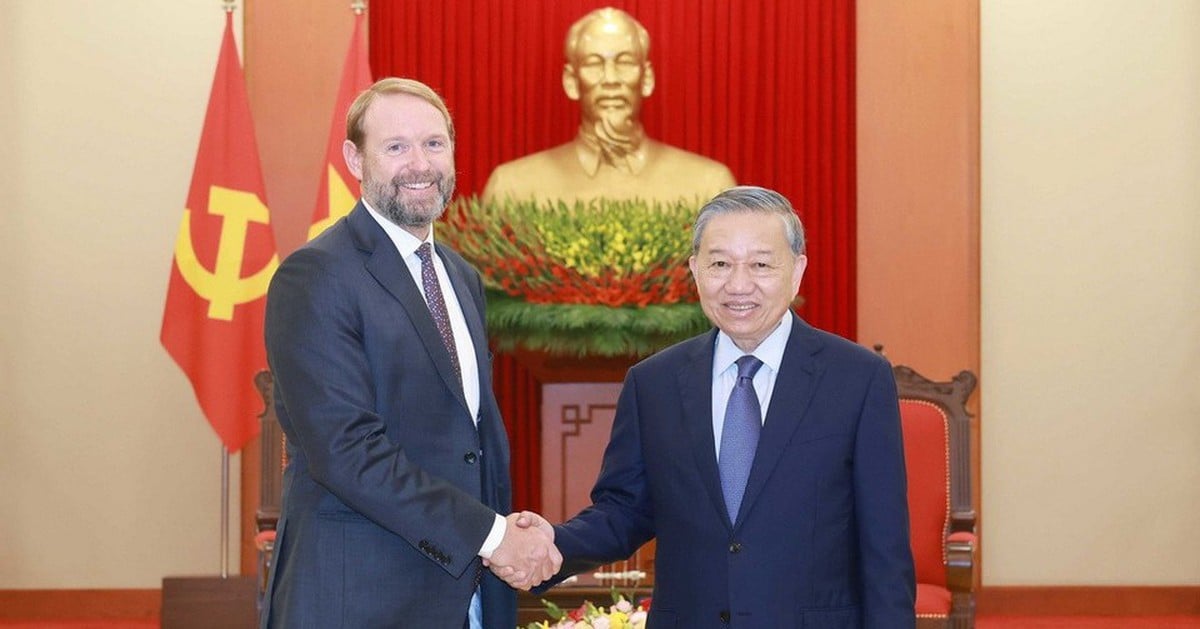

Sharing with VietNamNet, Mr. Mark Hutchinson, Chairman of the Southeast Asia Working Group of the Global Wind Energy Council (GWEC), highly appreciated the content of the draft Electricity Law, which he said was quite advanced.

GWEC representatives agreed with the idea of combining SOEs and international partners with experience in offshore wind power, similar to what has happened in Vietnam’s oil and gas industry. GWEC leaders proposed that the Government allow SOEs to cooperate with international developers, and that the National Assembly try to pass the Electricity Law during this session if possible.

“International partners bring expertise, experience, technological capabilities, access to capital and supply chains, while domestic partners have an understanding of politics, culture and the ability to build domestic supply chains,” Mr. Hutchinson assessed.

In the same vein, EuroCham Chairman Jaspaert fully agreed with the importance of state-owned enterprises in developing the first and pilot offshore wind projects in Vietnam. At the same time, he also mentioned many lessons that can be learned from Europe. For example, Denmark has managed a huge industry by promoting offshore wind development, while the UK is increasingly reducing its dependence on fossil fuels.

“I think there are many examples from Europe that show why Vietnam urgently needs to build a clear, transparent legal framework and supportive policies for the offshore wind industry,” said Mr. Jaspaert.

He emphasized that the participation of foreign developers in Vietnam not only provides technical support but also brings large capital sources, ensuring that projects are implemented according to international standards, managing technical risks, thereby ensuring sustainability.

Regarding the offshore wind power pilot mechanism, the representative of Vietnam Oil and Gas Technical Services Corporation (PTSC) said: There are economies that have developed offshore wind power before Vietnam that can be referred to, that is Taiwan (China). PTSC proposed to develop in 3 phases as Taiwan is doing. The first phase is a pilot, the next phase is development with support from the State, the next phase is when the market has developed well and there is competition, then move towards free development, organizing bidding to select investors.

"After the pilot in 2013, Taiwan's offshore wind power market is now competitive, from generation, distribution, transmission to electricity sales. When the market is competitive, the State only needs to play a regulatory role," said a PTSC representative.

Source: https://vietnamnet.vn/lam-gi-de-co-du-an-dien-gio-ngoai-khoi-dau-tien-2338512.html

![[Photo] "Beauties" participate in the parade rehearsal at Bien Hoa airport](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/11/155502af3384431e918de0e2e585d13a)

Comment (0)