HDBank has just announced its “Sustainable Finance Framework” in line with the standards of the International Capital Market Association (ICMA) and the Loan Market Association (LMA).

According to HDBank, this framework was developed with technical support from the International Finance Corporation (IFC) and received a “very good” rating from Moody's.

HDBank is one of the pioneering Vietnamese banks to announce the "Sustainable Finance Framework", clearly affirming the goals and strategic vision in implementing ESG with strong commitments and specific action programs to bring the highest benefits to stakeholders.

The highlight of HDBank's "Sustainable Finance Framework" is to orient the bank's lending towards projects with green assets and social assets.

Accordingly, green assets include renewable energy projects, energy efficiency (EF) initiatives, pollution prevention and control measures, sustainable management of living natural resources and land use, clean transport solutions, sustainable water and wastewater management, climate change adaptation strategies, products, technologies and production processes adapted to the circular economy and green building projects.

Social assets, including providing essential services and providing affordable housing solutions.

The issuance of the “Sustainable Finance Framework” demonstrates HDBank’s commitment to environmental sustainability through providing capital support for green projects, contributing to reducing CO2 emissions and moving Vietnam towards carbon neutrality by 2050.

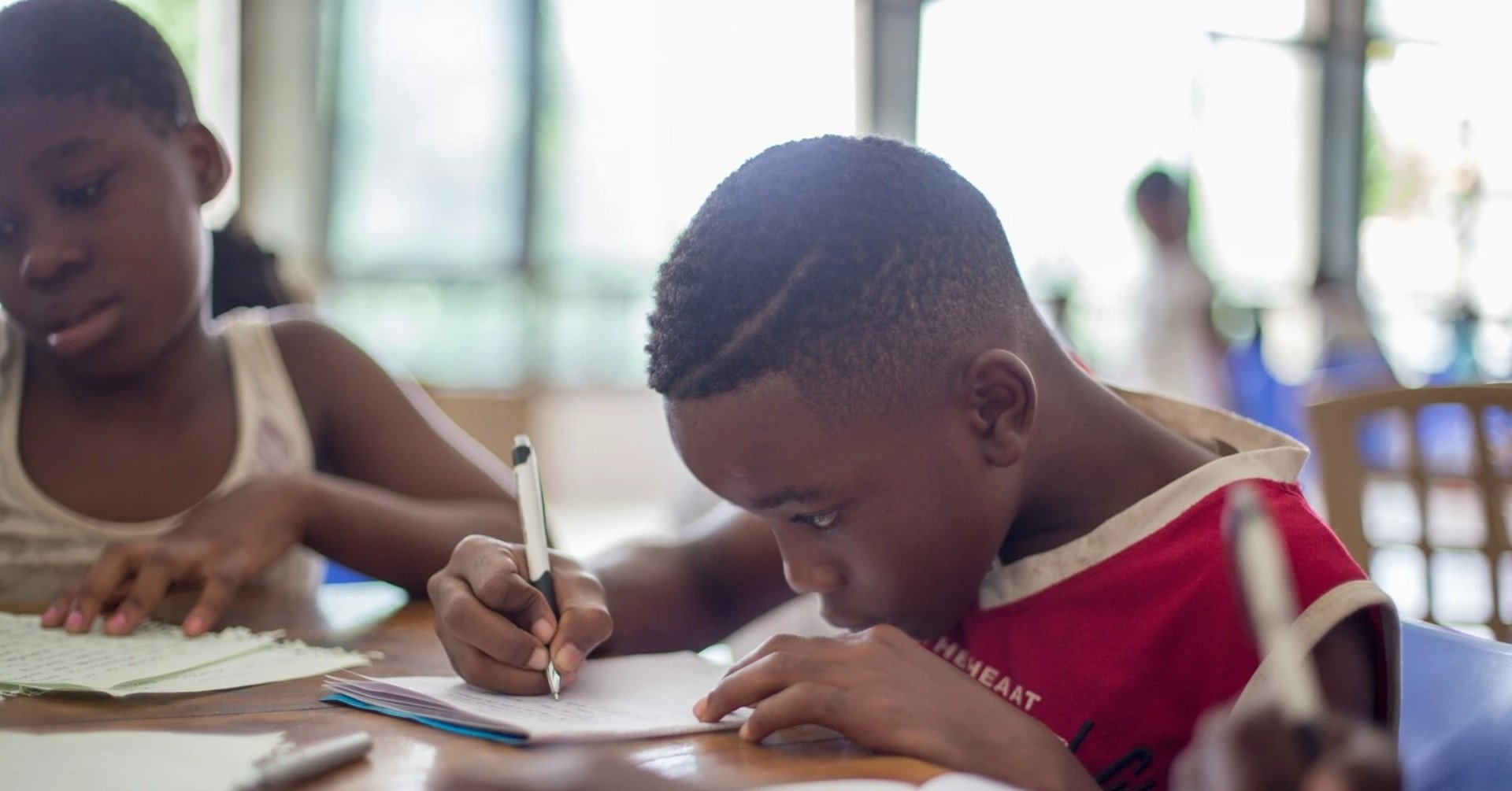

In addition, HDBank's projects also provide capital to serve and support access to essential financial solutions such as healthcare, schools and affordable housing for customers, especially in rural areas, demonstrating responsibility to the community and society, in line with the comprehensive financial policy of the sustainable development strategy that HDBank is implementing.

With a pioneering tradition in the ESG field, HDBank is one of the first banks in Vietnam to provide green credit, build an environmental and social risk management system, and establish an ESG Committee under the Board of Directors to lead and monitor sustainable development initiatives. HDBank is also a pioneer bank to issue a separate report on sustainable development in 2024.

HDBank has been in the Top 20 of the Ho Chi Minh City Stock Exchange (HoSE)'s Sustainability Index for five consecutive years, and has been highly appreciated by international development finance organizations such as IFC, DEG and Proparco for its efforts in climate finance and gender equality.

The announcement of the “Sustainable Finance Framework” is expected to continue to lay a solid foundation, guiding HDBank's values and commitments in integrating sustainable practices into its governance, operations and business activities.

Vinh Phu

Source: https://vietnamnet.vn/hdbank-cong-bo-khung-tai-chinh-ben-vung-2353836.html

![[Photo] Prime Minister Pham Minh Chinh works with state-owned enterprises on digital transformation and promoting growth](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/15/f55bfb8a7db84af89332844c37778476)

![[Photo] Ho Chi Minh City after 50 years of national reunification through buildings and symbols](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/15/a224d0b8e489457f889bdb1eee7fa7b4)

![[Photo] Air Force actively practices for the April 30th celebration](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/15/16fdec3e42734691954b853c00a7ce01)

![[Photo] President Luong Cuong holds talks with General Secretary and President of China Xi Jinping](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/15/f7e4c602ca2f4113924a583142737ff7)

![[Photo] General Secretary To Lam meets with veteran revolutionary cadres, meritorious people, and exemplary policy families](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/15/7363ba75eb3c4a9e8241b65163176f63)

Comment (0)