According to the audited financial report for 2024, HDBank achieved its best business results ever with VND 16,730 billion in pre-tax profit, an increase of 28.5% compared to 2023 and completing 106% of the plan.

Along with sustainable business growth, HDBank continues to affirm its role as a bank for the community. |

Profitability indicators ROA reached 2.04% and ROE reached 25.71%, both higher than the same period last year and continued to be among the leading groups in the industry. Capital adequacy ratio CAR (Basel II standard) reached over 14%. Bad debt ratio was controlled at a low level (according to Circular 11) of only 1.48%, along with other safety indicators at a positive level.

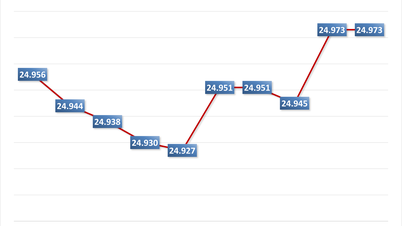

As of December 31, 2024, HDBank's total assets reached VND 697,366 billion, an increase of 15.8% compared to 2023; capital mobilization exceeded VND 621 trillion, an increase of 15.7%, of which deposits from economic organizations and residents increased by 18%; total outstanding loans reached over VND 437 trillion, an increase of 23.9%, targeting sectors that are drivers of economic growth such as agriculture, rural areas, SMEs, chain finance, etc.

Along with sustainable business growth, HDBank continues to affirm its role as a community bank by actively implementing social security programs, accompanying people and businesses across the country in economic development, improving the quality of life, and sustainable development.

In 2024, HDBank will continue to make a strong mark in the international arena and in the business community with many prestigious awards, typically: "Best Green Financing in Vietnam" awarded by The Asian Banker; "Bank with the most sustainable development activities in 2023"; "Best Retail Bank in Vietnam 2024" and the title of "Best Workplace in Asia" for the 7th consecutive time, recognizing a humane, cohesive and innovative working environment.

Source: https://thoibaonganhang.vn/hdbank-loi-nhuan-nam-2024-sau-kiem-toan-tren-16700-ty-dong-tang-truong-285-162147.html

![[Photo] Prime Minister Pham Minh Chinh chairs conference on anti-smuggling, trade fraud, and counterfeit goods](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/14/6cd67667e99e4248b7d4f587fd21e37c)

Comment (0)