In the stock market, investors are still looking for opportunities, especially after the US presidential election results were decided with the victory of Mr. Donald Trump.

In the stock market, investors are still looking for opportunities, especially after the US presidential election results were decided with the victory of Mr. Donald Trump.

Waiting for post-election market impact

The re-election of Donald Trump as US President is the focus of the current world economy, and Vietnam is no exception.

The highlight of Mr. Trump's policy is the comprehensive application of tariffs, increasing taxes from 10-20% on all goods exported to the US.

Analysts from KIS Vietnam Securities Company predict that this policy will affect Vietnam's trade balance as the US is currently Vietnam's largest export partner, which puts pressure on Vietnamese exporters to maintain selling prices to ensure competitiveness in the US consumer market. However, Vietnam can benefit from China's market share as this country faces higher tariffs from the US.

Vietnam could also benefit from the shift in FDI flows. While these tariffs signal a challenging outlook for global trade, the Trump administration’s tough stance on China could prompt multinationals to shift some of their production to neighboring countries. Given its strategic location, Vietnam could be a beneficiary, as was seen during the 2017-2020 trade tensions.

KIS also forecasts that exchange rate pressure will increase. President Donald Trump's policies revolve around asserting America's position, through which he tends to increase spending to stimulate the economy. This will aggravate the pressure on the budget deficit, leading to US government bond yields remaining high. In addition, inflation is expected to increase under Trump, which will partly affect the Fed's interest rate decisions.

With these views, policies under President Donald Trump can have a multi-dimensional impact on industries. For example, industrial real estate and aviation are positively rated, while KIS has a more negative rating for the oil and gas, construction materials and textile industries.

Is the Vietnamese stock market positive in November?

According to SSI's assessment, the attractiveness of the US stock market is expected to remain for 2 months after the election, combined with China's economic stimulus package, which will make the attraction of other developing markets less positive.

This will be the focus of the domestic stock market in November 2024, along with the contents approved in the 8th Session of the National Assembly and the possibility of intervention by the State Bank to reduce exchange rate pressure.

However, some key factors can be considered as positive factors supporting the market in the coming period such as the estimated one-year valuation of VN-Index decreased slightly to 11.9 times at the end of October from 12.1 times at the beginning of the month. This shows that the market is under pressure to reduce prices and has not reflected many positive changes in the results of Q3/2024, while Q3 profits continue to expand to many industry groups, with many industries achieving high growth rates of over 30%.

At the same time, Circular 68, together with the amendment of the Securities Law, raises the expectation that foreign investment funds may consider increasing their proportion in Vietnam.

SSI said that after Circular 68 came into effect regarding foreign institutional investors being able to buy stocks without having to have enough money, a small number of transactions were made. Combined with the amendment of the Securities Law, there is a high possibility that active funds will tend to allocate a clearer proportion to Vietnam in 2025.

With the above factors, SSI believes that the stock market in November is expected to remain volatile. However, market valuations are returning to a more attractive level in the context of corporate profits continuing to recover. Therefore, investors should focus on companies with strong profit growth, as this is still expected to be the main factor driving stock prices in 2024 and 2025.

Textiles, seafood (pangasius), ports and shipping are sectors that could benefit from the shifting supply chains and new US trade policies. While it is necessary to continue monitoring policy developments from the US, interest rates and exchange rate movements are two domestic macro factors that need to be closely monitored in the risk management process.

From MBS's perspective, the analysis team said that the domestic stock market often has a fairly good growth cycle from November to the end of February of the following year.

In the last two years, 2022 and 2023, the VN-Index bottomed out in November and started a strong recovery streak afterwards. In addition to the cyclical/seasonal factors that are supporting the market's recovery, the market can expect supportive news such as the US Federal Reserve (Fed) lowering interest rates and, towards the end of the year, the pace of policy easing may be faster through promoting public investment disbursement and stronger credit growth.

With the credit growth target this year being 15%, while by the end of September it had only reached more than 9% compared to the beginning of the year and increased by 16% compared to the same period last year, the remaining lending space of the credit institution system is still quite large in this fourth quarter.

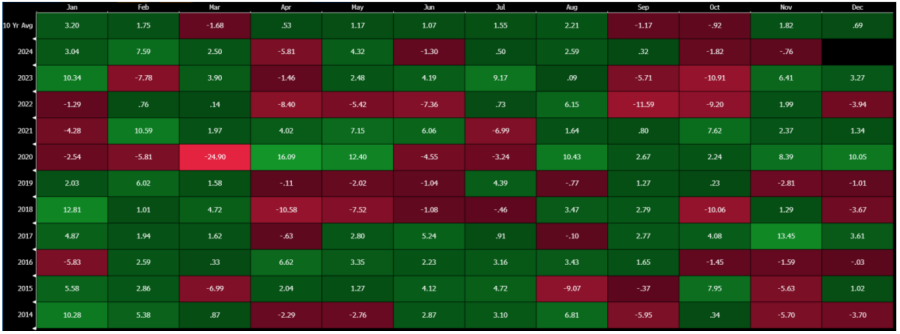

VN-Index has a history of quite good growth in the November period with 4 consecutive increases in the past 4 years, while the US stock market (S&P 500), November also has the highest probability of increasing points with the number of increases reaching 9/10 in the past years.

|

| History of increase and decrease of Vn-Index in the past 10 years. Source: MBS |

Source: https://baodautu.vn/hau-bau-cu-my-chung-khoan-viet-nam-thang-11-tang-hay-giam-d229546.html

![[Photo] Ministry of Defense sees off relief forces to the airport to Myanmar for mission](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/30/245629fab9d644fd909ecd67f1749123)

![[Photo] Prime Minister Pham Minh Chinh chairs meeting to remove difficulties for projects](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/30/7d354a396d4e4699adc2ccc0d44fbd4f)

![[REVIEW OCOP] An Lanh Huong Vet Yen Cat](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/27/c25032328e9a47be9991d5be7c0cad8c)

Comment (0)