Domestic gold price today March 28, 2025

At the time of survey at 11:30 a.m. on March 28, 2025, domestic gold prices continued to increase, gold ring prices and gold bar prices surpassed the 100 million VND/tael mark. Specifically:

DOJI Group listed the price of SJC gold bars at 98.4-100.4 million VND/tael (buy - sell), an increase of 1 million VND/tael for buying - an increase of 1.5 million VND/tael for selling compared to yesterday.

At the same time, the price of SJC gold bars was listed by Saigon Jewelry Company Limited - SJC at 98.4-100.4 million VND/tael (buy - sell), an increase of 1 million VND/tael in buying - an increase of 1.5 million VND/tael in selling compared to yesterday.

At Mi Hong Jewelry Company, the price of Mi Hong gold at the time of survey was listed at 98.7-100.0 million VND/tael for buying and selling. Compared to yesterday, the gold price decreased by 30 thousand VND/tael for buying and decreased by 20 thousand VND/tael for selling compared to yesterday.

SJC gold price at Bao Tin Minh Chau Company Limited is traded by businesses at 98.5-100.4 million VND/tael (buying - selling, up 1 million VND/tael in buying direction - up 1.5 million VND/tael in selling direction compared to yesterday.

SJC gold price at Phu Quy is traded by businesses at 98.4-100.4 million VND/tael (buy - sell), gold price increased by 1 million VND/tael in buying direction - increased by 1.5 million VND/tael in selling direction compared to yesterday.

As of 11:30 a.m. today, the price of 9999 Hung Thinh Vuong round gold rings at DOJI is listed at 98.6-100.6 million VND/tael (buy - sell); an increase of 1.4 million VND/tael in buying - an increase of 1.1 million VND/tael in selling compared to yesterday.

Bao Tin Minh Chau listed the price of gold rings at 98.6-100.6 million VND/tael (buy - sell); increased by 1 million VND/tael for buying - increased by 900 thousand VND/tael for selling.

The latest gold price list today, March 28, 2025 is as follows:

| Gold price today | ||||

|---|---|---|---|---|

| Buy | Sell | |||

| SJC in Hanoi | 98.4 | ▲1000 | 100.4 | ▲1500 |

| DOJI Group | 98.4 | ▲1000 | 100.4 | ▲1500 |

| Red Eyelashes | 98.7 | ▼30 | 100.0 | ▼20 |

| PNJ | 98.4 | ▲1000 | 100.4 | ▲1500 |

| Vietinbank Gold | 100.4 | ▲1500 | ||

| Bao Tin Minh Chau | 98.6 | ▲1000 | 100.6 | ▲900 |

| Phu Quy | 98.5 | ▲1000 | 100.5 | ▲800 |

| 1. DOJI - Updated: March 28, 2025 11:30 - Source website time - ▼/▲ Compared to yesterday. | ||

| Type | Buy | Sell |

| AVPL/SJC HN | 98,400 ▲1000K | 100,400 ▲1500K |

| AVPL/SJC HCM | 98,400 ▲1000K | 100,400 ▲1500K |

| AVPL/SJC DN | 98,400 ▲1000K | 100,400 ▲1500K |

| Raw material 9999 - HN | 98,400 ▲1200K | 99,500 ▲900K |

| Raw material 999 - HN | 98,300 ▲1200K | 99,400 ▲900K |

| AVPL/SJC Can Tho | 98,400 ▲1000K | 100,400 ▲1500K |

| 2. PNJ - Updated: March 28, 2025 11:30 - Time of the source website - ▼/▲ Compared to yesterday. | ||

| Type | Buy | Sell |

| HCMC - PNJ | 98,400 ▲1000K | 99,400 ▲1000K |

| HCMC - SJC | 98,400 ▲1000K | 100,400 ▲1500K |

| Hanoi - PNJ | 98,400 ▲1000K | 100,400 ▲1500K |

| Hanoi - SJC | 98,400 ▲1000K | 100,400 ▲1500K |

| Da Nang - PNJ | 98,400 ▲1000K | 100,400 ▲1500K |

| Da Nang - SJC | 98,400 ▲1000K | 100,400 ▲1500K |

| Western Region - PNJ | 98,400 ▲1000K | 100,400 ▲1500K |

| Western Region - SJC | 98,400 ▲1000K | 100,400 ▲1500K |

| Jewelry gold price - PNJ | 98,400 ▲1000K | 100,400 ▲1500K |

| Jewelry gold price - SJC | 98,400 ▲1000K | 100,400 ▲1500K |

| Jewelry gold price - Southeast | PNJ | 98,400 ▲1000K |

| Jewelry gold price - SJC | 98,400 ▲1000K | 100,400 ▲1500K |

| Jewelry gold price - Jewelry gold price | PNJ 999.9 Plain Ring | 98,400 ▲1000K |

| Jewelry gold price - Jewelry gold 999.9 | 97,300 ▲500K | 100,300 ▲1000K |

| Jewelry gold price - Jewelry gold 999 | 97,700 ▲1000K | 100,200 ▲1000K |

| Jewelry gold price - Jewelry gold 99 | 96,900 ▲990K | 99,400 ▲990K |

| Jewelry gold price - 916 gold (22K) | 89,480 ▲920K | 91,980 ▲920K |

| Jewelry gold price - 750 gold (18K) | 72,880 ▲750K | 75,380 ▲750K |

| Jewelry gold price - 680 gold (16.3K) | 65,850 ▲680K | 68,350 ▲680K |

| Jewelry gold price - 650 gold (15.6K) | 62,850 ▲650K | 65,350 ▲650K |

| Jewelry gold price - 610 gold (14.6K) | 58,830 ▲610K | 61,330 ▲610K |

| Jewelry gold price - 585 gold (14K) | 56,330 ▲590K | 58,830 ▲590K |

| Jewelry gold price - 416 gold (10K) | 39,380 ▲420K | 41,880 ▲420K |

| Jewelry gold price - 375 gold (9K) | 35,260 ▲370K | 37,760 ▲370K |

| Jewelry gold price - 333 gold (8K) | 30,750 ▲330K | 33,250 ▲330K |

| 3. SJC - Updated: 3/28/2025 11:30 - Source website time - ▼/▲ Compared to yesterday. | ||

| SJC Gold 1L, 10L, 1KG | 98,400 ▲1000K | 100,400 ▲1500K |

| SJC gold 5 chi | 98,400 ▲1000K | 100,420 ▲1500K |

| SJC gold 0.5 chi, 1 chi, 2 chi | 98,400 ▲1000K | 100,430 ▲1500K |

| SJC 99.99% gold ring 1 chi, 2 chi, 5 chi | 98,200 ▲1000K | 100,200 ▲1500K |

| SJC 99.99% gold ring 0.5 chi, 0.3 chi | 98,200 ▲1000K | 100,300 ▲1500K |

| Jewelry 99.99% | 98,200 ▲1000K | 99,900 ▲1500K |

| Jewelry 99% | 95,910 ▲1485K | 98,910 ▲1485K |

| Jewelry 68% | 65,088 ▲1020K | 68,088 ▲1020K |

| Jewelry 41.7% | 38,812 ▲626K | 41,812 ▲626K |

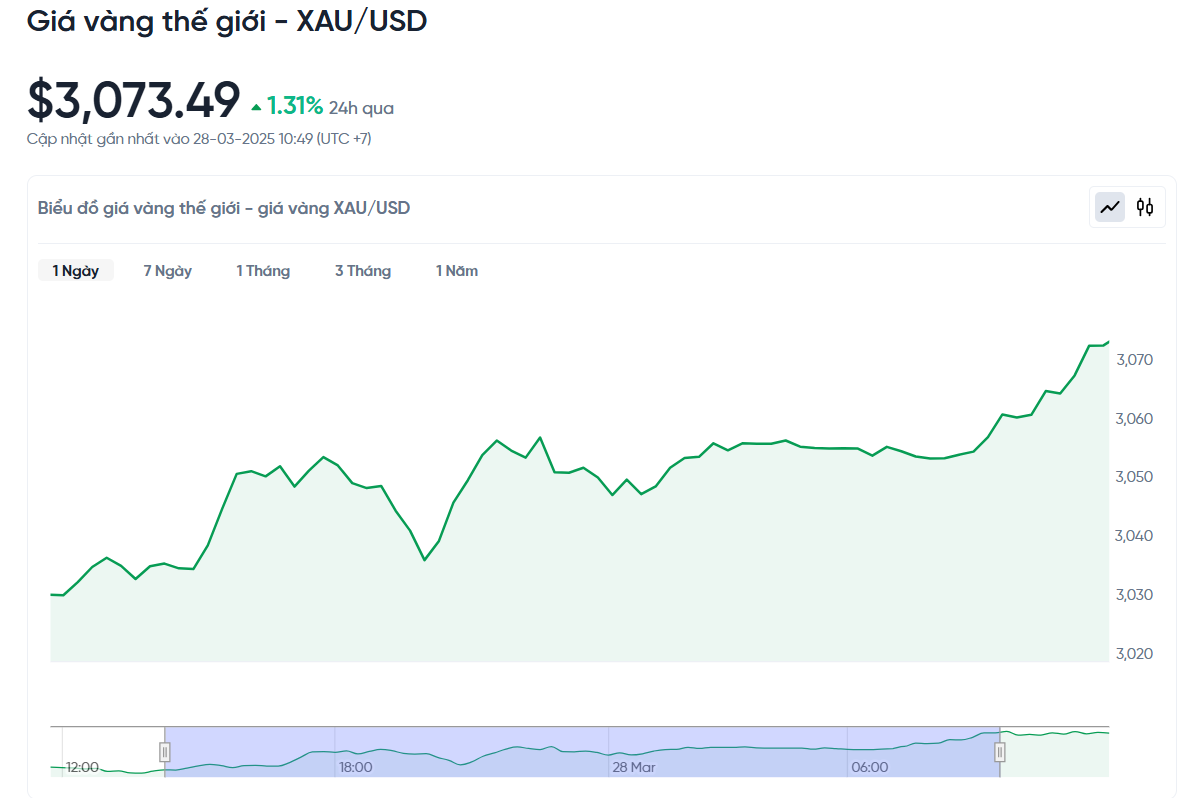

World gold price today March 28, 2025 and world gold price fluctuation chart in the past 24 hours

According to Kitco, the world gold price recorded at 11:30 today, Vietnam time, was at 3073.49 USD/ounce. Today's gold price increased by 40.31 USD/ounce compared to yesterday.

Stock markets in Asia fell sharply on March 28, especially in South Korea and Japan, as US President Donald Trump imposed new tariffs that raised fears of a full-blown trade war. Meanwhile, the price of gold, a safe haven asset that many seek during times of market turmoil, rose to a record high.

Specifically, Mr. Trump has decided to impose a 25% tax on imported cars into the US, and this policy will take effect next week. This decision has caused many harsh reactions from politicians and industry leaders around the world. Major car manufacturers warn that the new tax may increase car prices. This trade war, which started when Mr. Trump returned to the White House, has shaken global financial markets, especially the stocks of major car companies.

In Asia, Japan’s Nikkei fell more than 2%, with Toyota and Honda shares falling sharply. In South Korea, the main index also hit a two-week low, down 1.3%. The auto industry is a crucial part of both countries’ economies, so the impact of the new tariffs is huge. But in Hong Kong, the Hang Seng index rose slightly by 0.6%, seemingly unaffected by the auto tariffs. Mr Trump also said he was willing to reduce tariffs on China if a deal was reached regarding the sale of TikTok’s parent company, ByteDance.

Fred Neumann, an economist at HSBC, said the US tariffs on imported cars were not a surprise because they had been anticipated. He explained that carmakers could adjust by shifting production locations or passing on some of the increased costs to US buyers. In fact, some carmakers, including Volvo, Volkswagen’s Audi, Mercedes-Benz, Hyundai and Ferrari, have already announced plans to move some production elsewhere. Ferrari, which makes all its cars in Italy, said it would raise prices on some models by up to 10%.

Now, everyone is waiting to see what the US will announce in retaliation on April 2. Mr. Trump has hinted that these measures may not be what he promised. A financial expert, Mr. Thierry Wizman of Macquarie, said that these tariffs will slow economic growth and at the same time push up commodity prices, causing inflation.

In currency markets, the US dollar fell against other currencies on concerns that the new tax would hurt the US economy. The euro held steady at $1.07942, up 4% in the first quarter. The Japanese yen also strengthened slightly, reaching 150.76 yen to the dollar, up nearly 4% in the quarter. Many expect the Bank of Japan to raise interest rates again, as new data showed inflation in Tokyo accelerating, driven largely by rising food prices.

As for gold, the precious metal hit a record high on March 28 as investors rushed to buy it to protect their assets against the threat of a trade war. Spot gold rose 0.58% to $3,073.31 an ounce. It has gained more than 17% year-to-date, its biggest quarterly gain since 1986. Meanwhile, oil prices were little changed as investors weighed the tightening supply of oil and the impact of new taxes on the global economy. Brent crude fell 0.07% to $73.98 a barrel, while U.S. West Texas Intermediate (WTI) crude also fell 0.07% to $69.87 a barrel.

Gold Price Forecast

Gold prices are rallying strongly thanks to a number of supportive factors, according to Capital.com expert Kyle Rodda. He said US trade and fiscal policies, geopolitical tensions, and a slowing global economy are making gold a safe-haven option. He predicted that gold prices could soon hit $3,100 an ounce, a key level.

Bank of America (BofA) has also just raised its gold price forecast for the next two years. They expect the average gold price in 2025 to reach $3,063/ounce and increase to $3,350/ounce in 2026. This is much higher than the previous forecast of $2,750 and $2,625 for the two years, respectively, due to concerns about uncertainty from US trade policy.

According to Kitco, the world gold price continued to increase thanks to the demand for safe havens and positive signals from the market. Comex gold futures reached a record high of 3,071.3 USD/ounce, while the April contract increased by 41.7 USD, closing at 3,063.9 USD/ounce.

The US stock market has been mixed. After the US announced new tariffs on imported cars, many investors became more cautious and turned to gold to protect their assets, causing a sharp increase in demand for gold.

Aakash Doshi, an expert at SPDR ETF Strategy, predicts that gold prices could surpass $3,100 an ounce in the second quarter. If the economic situation and market demand continue to be favorable, gold prices could rise another 8% to 10% by the end of 2025.

Technically, investors have the advantage in the short term. Gold buyers are aiming to hold prices above $3,100 an ounce, while sellers are looking to push prices below $2,900 an ounce. Currently, key levels to watch are $3,071.30 and $3,085 an ounce, while the nearest support levels are $3,050 and $3,022.30 an ounce.

Additionally, Nymex crude oil is currently at $69.75 a barrel. The yield on the 10-year US Treasury note is around 4.4%, indicating that interest rate pressure is still there but not high enough to dampen the appeal of gold at this time.

Source: https://baoquangnam.vn/gia-vang-hom-nay-28-3-2025-gia-vang-trong-nuoc-va-the-gioi-dot-pha-dinh-lap-ky-luc-moi-3151646.html

![[Photo] Prime Minister Pham Minh Chinh receives delegation of leaders of US universities](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/31/8be7f6be90624512b385fd1690124eaa)

![[Photo] General Secretary To Lam receives US Ambassador to Vietnam Marc E. Knapper](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/31/5ee45ded5fd548a685618a0b67c42970)

![[Photo] 2nd Conference of the Party Executive Committee of Central Party Agencies](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/31/8f85b88962b34701ac511682b09b1e0d)

![[Photo] Ministry of Defense sees off relief forces to the airport to Myanmar for mission](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/30/245629fab9d644fd909ecd67f1749123)

![[REVIEW OCOP] An Lanh Huong Vet Yen Cat](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/27/c25032328e9a47be9991d5be7c0cad8c)

Comment (0)