On the morning of September 19, the price of gold bars was stable at 82 million VND/tael. Similarly, the price of gold rings was stable at over 79 million VND/tael. Currently, the gold prices of the brands are listed specifically as follows:

SJC gold bars are being sold by Agribank, BIDV, Vietcombank, VietinBank and gold and gemstone companies at VND82 million/tael. On the buying side, the gold price of the brands is listed at VND80 million/tael.

At Mi Hong Gold and Gemstone Company, the price of Mi Hong gold at the time of survey listed the price of SJC gold at 81.0-82.0 million VND/tael (buy - sell).

SJC gold price at Bao Tin Minh Chau Company Limited is also traded by the enterprise at 80.0-82.0 million VND/tael (buy in - sell out). Meanwhile, at Bao Tin Manh Hai, it is being traded at 80.0-82.0 million VND/tael (buy in - sell out).

For ring gold, the listed price of SJC 9999 gold is 77.9 million VND/tael for buying and 79.2 million VND/tael for selling, unchanged from yesterday morning. DOJI in Hanoi and Ho Chi Minh City markets adjusted the buying price up by 100,000 VND to 78.1 million VND/tael but kept the selling price the same as yesterday morning at 79.2 million VND/tael. The buying and selling prices of PNJ brand ring gold are fixed at 78 million VND/tael and 79.2 million VND/tael.

The price of Bao Tin Minh Chau's plain round rings is currently at 77.98 million VND/tael for buying and 79.18 million VND/tael for selling. Phu Quy SJC is buying gold rings at 78 million VND/tael and selling at 79.2 million VND/tael, unchanged from early this morning.

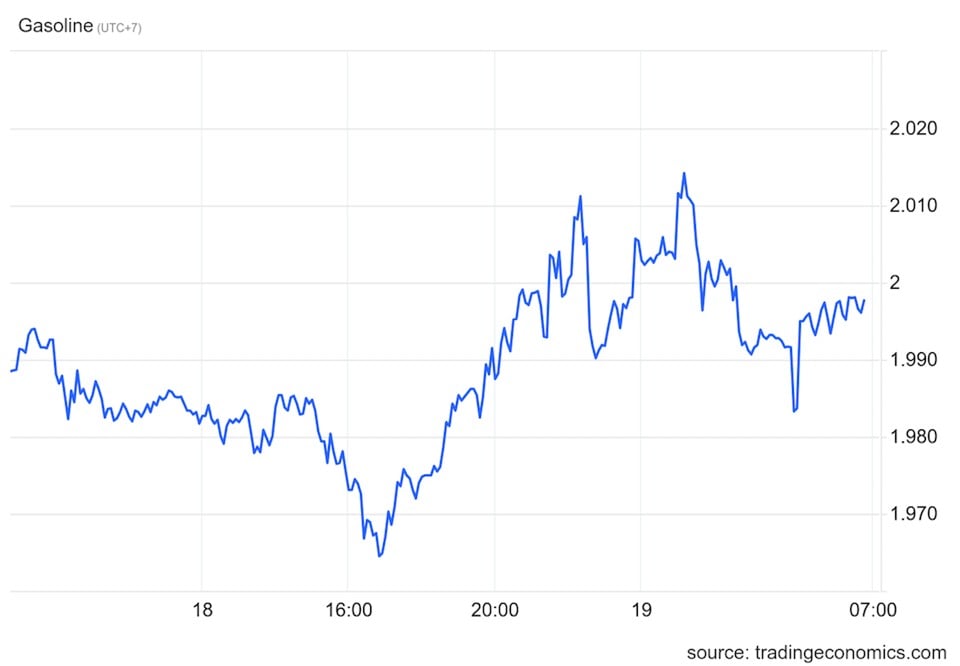

World gold price turns down sharply

According to Kitco, the world gold price recorded at 5:00 a.m. today, Vietnam time, was at 2,559.87 USD/ounce. The gold price decreased by 0.39 USD compared to yesterday's gold price. Converted according to the current exchange rate at Vietcombank, the world gold price is about 75.168 million VND/tael (excluding taxes and fees). Thus, the price of SJC gold bars is still 4.832 million VND/tael higher than the international gold price.

The yellow metal was little changed from its early-morning high, but it fell sharply during the day. Earlier, gold rose to an all-time high of $2,592.30 an ounce as the US Federal Reserve cut interest rates by 50 basis points, signaling the start of a broader easing cycle.

The Fed said the half-percentage-point decision was made after considering inflation, economic data and risks. Along with the policy pivot, many economists noted that there will be more than one rate adjustment this year. Accordingly, the dot plot shows that the central bank expects rates to fall to 4.4% by the end of the year, down from the 5.1% estimate in June.

Investors are now looking to comments from Chairman Jerome Powell for more information on the policy path. Forexlive.com chief currency strategist Adam Button said the new dot plot implies a 25 basis point cut at both the November and December meetings. However, Button expects Fed Chairman Powell to emphasize that more aggressive action will be taken if the employment situation or outlook deteriorates.

“A further significant rate cut of 50 basis points could push gold prices even higher… Future rate cuts would be the main driver of gold prices reaching the $3,000/ounce peak,” said Julia Khandoshko, CEO of European brokerage Mind Money.

“As the Fed begins to ease policy, the question will not be if gold prices will reach all-time highs, but when,” Khandoshko said.

Gold prices are always sensitive to US interest rate adjustments. As the USD weakens, gold becomes more attractive to investors.

Goldman Sachs bank notes the possibility of gold prices falling in the event of a 25 basis point rate cut by the Fed. Gold prices could reach their target of $2,700/ounce by early 2025.

Gold prices broke above a technical level of $2,550 an ounce, with investors optimistic about the prospect of the Fed cutting interest rates, said Soni Kumari and Daniel Hynes, senior commodity strategists at ANZ.

Lower interest rates and a weaker dollar could boost demand for gold. Experts expect increased investment demand, further pushing gold prices higher. Two experts predict gold prices could rise to $2,900 an ounce by the end of next year.

Source: https://doanhnghiepvn.vn/kinh-te/gia-vang-ngay-19-9-2024-thi-truong-the-gioi-giam-gia-manh/20240919080634684

![[Photo] Third meeting of the Organizing Subcommittee serving the 14th National Party Congress](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/2/3f342a185e714df58aad8c0fc08e4af2)

![[Photo] General Secretary To Lam receives Russian Ambassador to Vietnam](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/2/b486192404d54058b15165174ea36c4e)

![[Photo] Relatives of victims of the earthquake in Myanmar were moved and grateful to the rescue team of the Vietnamese Ministry of National Defense.](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/2/aa6a37e9b59543dfb0ddc7f44162a7a7)

Comment (0)