| Commodity market today, October 11: Strong buying power returns to the world raw material market Commodity market today, October 14: Red covers the metal market |

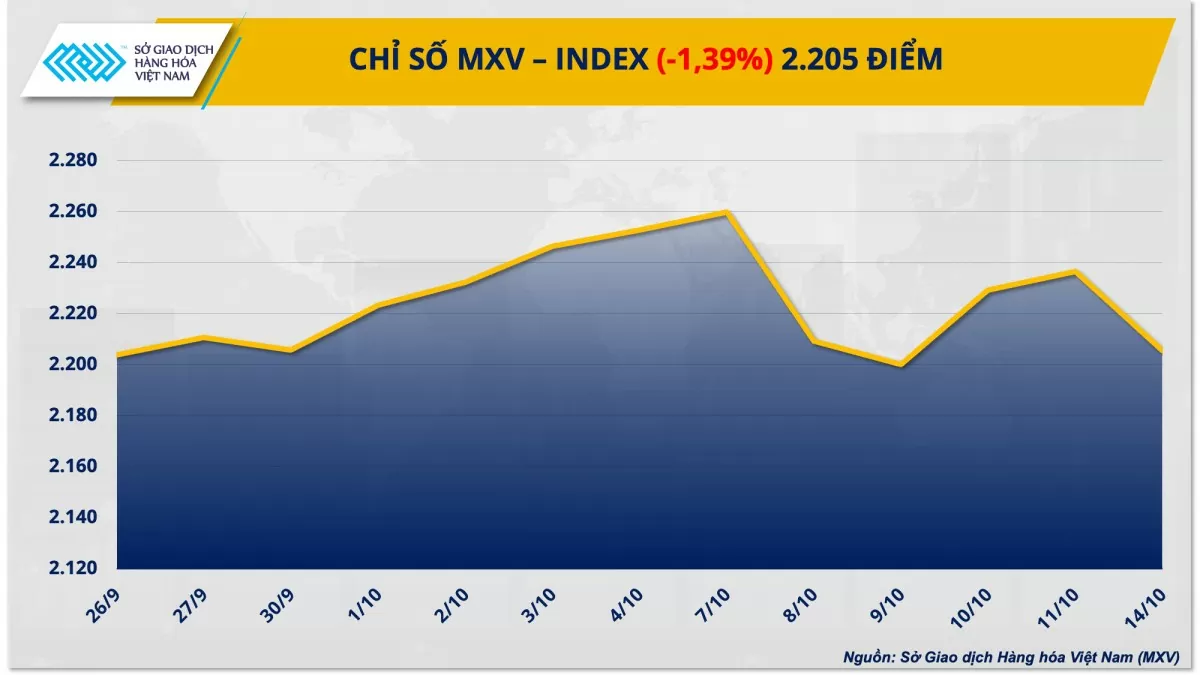

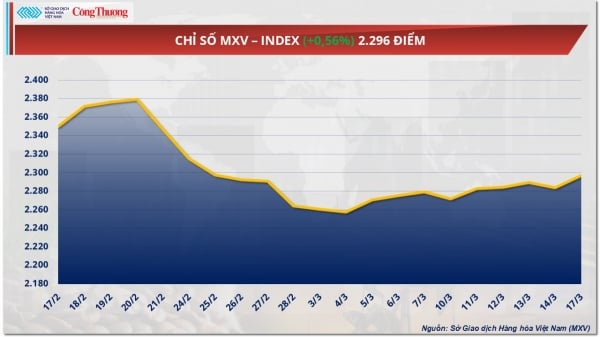

Notably, in the energy market, all commodities in the group fell sharply, leading the general trend of the entire market. In addition, in the agricultural market, corn and wheat prices also continued to weaken due to improved crop prospects in major producing countries. Closing, the MXV-Index fell 1.39% to 2,205 points.

|

| MXV-Index |

World oil prices continue to weaken

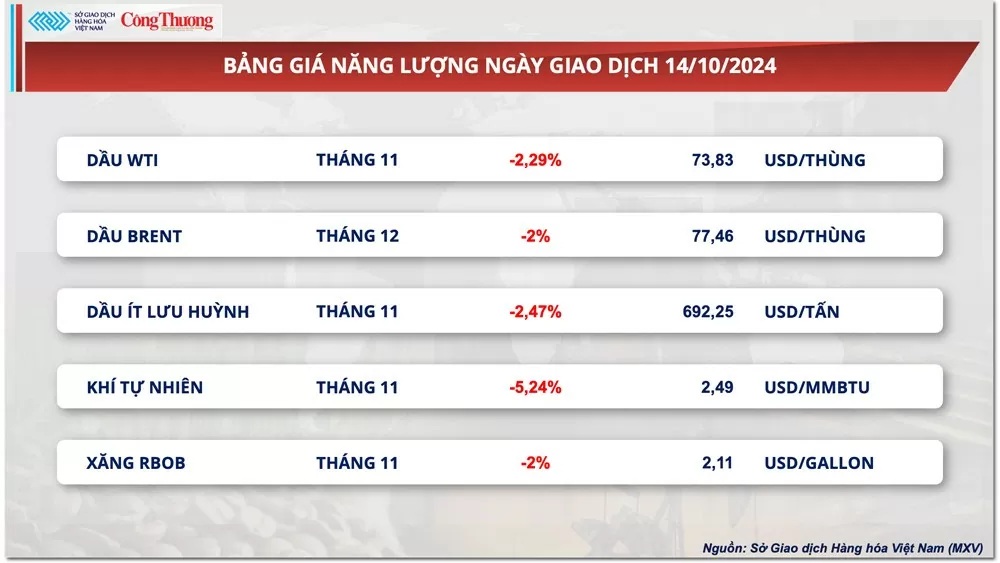

At the close of trading on October 14, the energy market was deep in red. In particular, world oil prices continued to weaken in the first trading session of the week due to negative import data from China and less optimistic forecasts about global crude oil demand from the Organization of the Petroleum Exporting Countries (OPEC). At the end of the trading session, WTI crude oil fell 2.29% to 73.83 USD/barrel and Brent crude oil fell 2% to 77.46 USD/barrel.

|

| Energy Price List |

Pressure appeared on the market after OPEC cut its estimate for global oil demand growth in its October report. This was the third consecutive time the exporting group has been cautious in its estimate for global oil demand. Specifically, OPEC said oil demand growth in 2024 would reach 1.93 million barrels per day (bpd), 110,000 bpd lower than the estimate given in September. China, the world's largest crude importer, accounted for the bulk of the 2024 downgrade as OPEC cut its growth forecast to 580,000 bpd from 650,000 bpd.

In addition, the Chinese government's economic stimulus packages appear to be failing to revive market confidence. The latest import data from the world's No. 1 crude oil importer also continues to show the current pressures on the country's economy. Data from the General Administration of Customs showed that China's imports in September increased by only 0.3%, much lower than analysts' forecasts of 0.9%. China's crude oil imports in the first nine months of the year also fell nearly 3% year-on-year to 10.99 million barrels per day due to the increase in electric vehicle use and slowing economic growth after the pandemic.

However, concerns about Israel’s response to an Iranian attack on October 1 that could disrupt oil production in the Middle East have eased somewhat after the US urged Israel to calibrate its response to avoid a wider war. President Joe Biden has also expressed concern about attacks on the country’s energy infrastructure.

Corn and wheat prices fall sharply

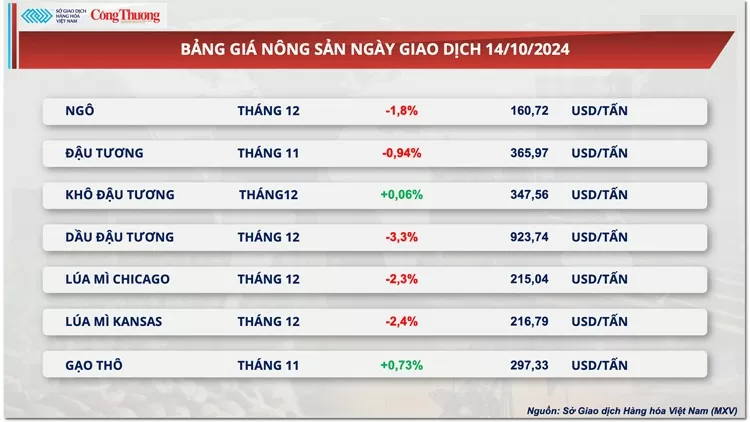

The trading session on October 14 witnessed red covering the agricultural market. In particular, the price of December corn contract closed the first session of the week with a decrease of 1.8% to 160 USD/ton, recording the third consecutive session of weakness due to the more positive crop situation in major producing countries.

|

| Agricultural product price list |

In the US, dry weather in the Midwest - the US's key corn growing region last week created favorable conditions for harvesting. This is expected to be the second largest corn crop in US history, contributing to a more abundant global corn supply next year.

Meanwhile, in South America, drought conditions have improved significantly in both Brazil and Argentina. Rains fell in Brazil over the weekend and are expected to continue over the next 10 days, restoring soil moisture and boosting soybean planting. This will also have a positive impact on the outlook for the second corn crop, which accounts for more than 70% of Brazil’s annual corn production, as the crop is seeded and matured in an ideal time frame and yields better when planted after a favorable soybean crop.

Wheat was the biggest loser among the agricultural commodities, falling 2.3% to $215 a tonne. In addition to the pressure from falling corn prices and the strengthening US dollar, improved weather conditions in Argentina were also the main reason for the decline in wheat prices. The Rosario Grains Exchange (BCR) said that continuous rains throughout last week helped prevent a decline in wheat yields in Argentina, especially in Santa Fe province, one of the country's largest wheat growing areas, with rainfall ranging from 30 to 90 mm. This eased market concerns about the outlook for the Argentine crop and put a lot of pressure on wheat prices.

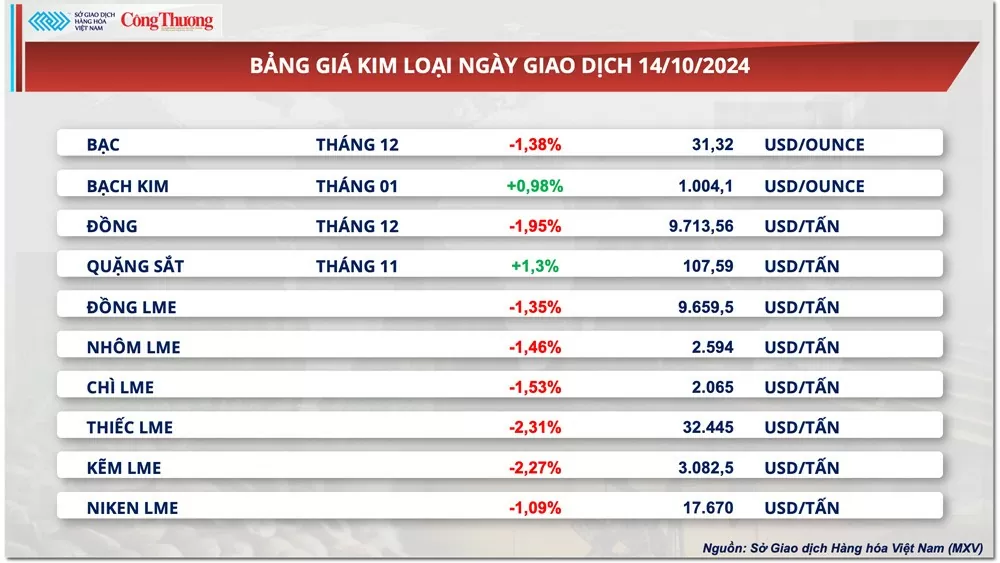

Prices of some other goods

|

| Metal price list |

|

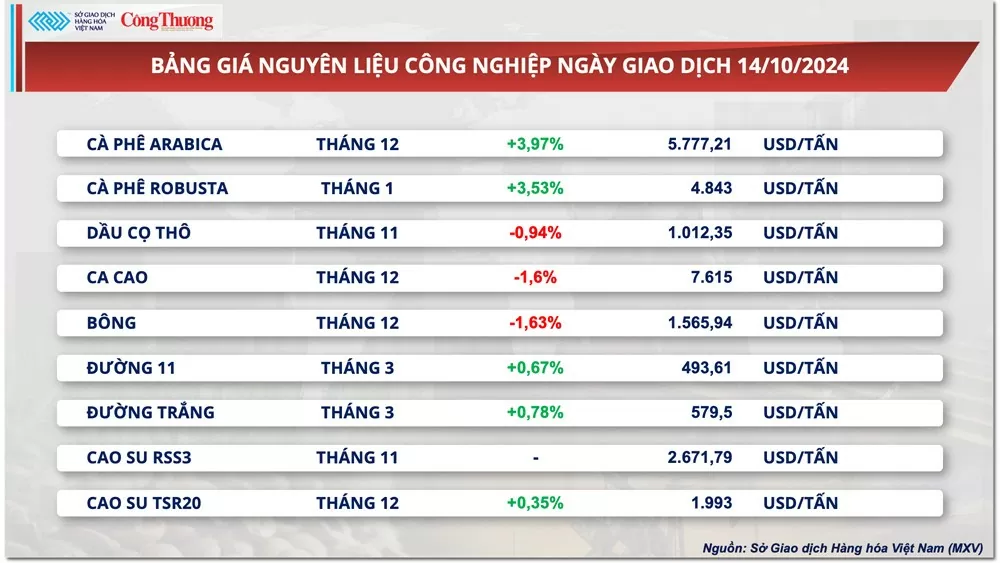

| Industrial raw material price list |

Source: https://congthuong.vn/thi-truong-hang-hoa-hom-nay-ngay-15102024-gia-nang-luong-ruc-do-dan-dat-xu-huong-toan-thi-truong-hang-hoa-352467.html

![[Photo] Prime Minister Pham Minh Chinh chairs meeting to urge highway projects](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/29/6a3e175f69ea45f8bfc3c272cde3e27a)

![[Photo] Prime Minister Pham Minh Chinh and Brazilian President Luiz Inácio Lula da Silva attend the Vietnam-Brazil Economic Forum](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/29/f3fd11b0421949878011a8f5da318635)

![[Photo] Dong Ho Paintings - Old Styles Tell Modern Stories](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/29/317613ad8519462488572377727dda93)

Comment (0)