Energy markets saw an impressive week of gains as all commodities rallied, with crude oil being the main highlight with a 6% gain.

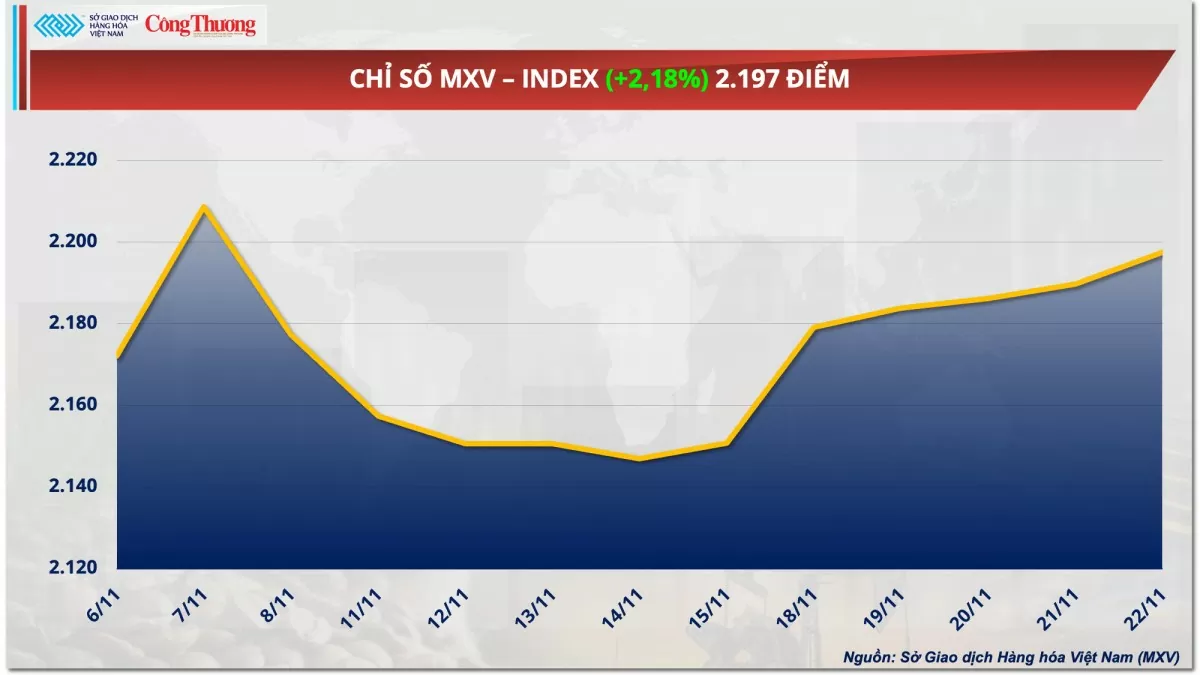

According to the Vietnam Commodity Exchange (MXV), green dominated the world raw material price list last week (November 18-24). At the close, the MXV-Index increased by 2.18% to 2,197 points. Notably, the energy market saw all five commodities increase in price by 4-10% amid complicated developments in global geopolitics.

|

| MXV-Index |

World oil prices skyrocket

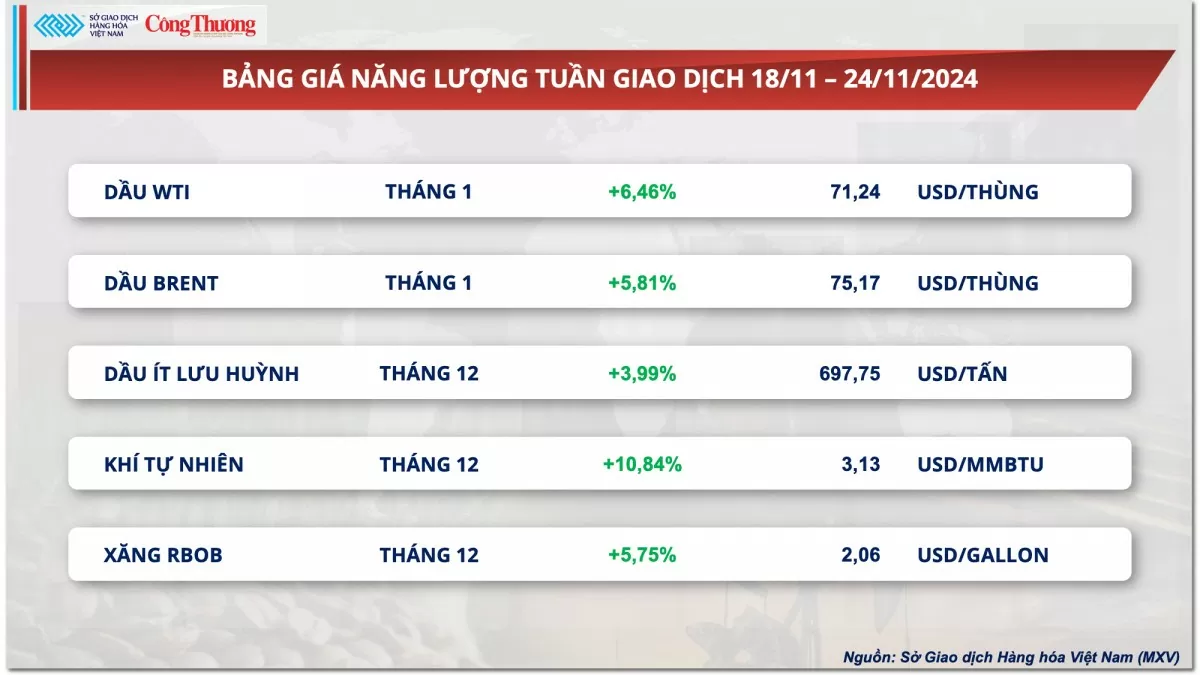

The energy market witnessed an impressive week of gains as all commodities improved, with crude oil being the main highlight with a 6% increase, completely erasing the 4% decline of the previous week. The market's bottom-fishing buying power, increasing geopolitical tensions and concerns about short-term oil supply shortages in some major oil-producing regions were the reasons for the sharp increase in world oil prices last week.

|

| Energy price list |

In the first trading session of last week, oil prices jumped in the context of the conflict in the Middle East that showed no signs of cooling down. The change in US policy regarding the war in Ukraine has pushed the market to worry that global crude oil supplies could be disrupted. In addition, the power outage that led to the temporary suspension of production at the largest oil field in Western Europe, the Johan Sverdrup field, has also increased concerns about the disruption of crude oil supplies in the North Sea. These factors have pushed world oil prices up.

A decline in crude oil storage on tankers around the world also helped support prices. Ship tracking firm Vortexa said crude oil storage on tankers fell 14% to 50.97 million barrels in the week ended November 15 from a week earlier.

On the oil demand side, the market received a series of positive signals from the world's largest consuming markets last week. On November 21, in the context that the US may impose a tariff of 60% or more on goods imported from China, the Chinese government announced measures to promote trade activities and support the import of energy products. In addition, the oil demand outlook was further improved after information that crude oil imports into China in November could reach 11.4 million barrels/day, the highest level since August, as the country took advantage of the low price range in September to buy and stockpile. In addition, crude oil imports into India - the world's third largest consuming market, also increased by 4.2% in October 2024 compared to the same period last year. This information supported oil prices to rise last week.

Source: https://congthuong.vn/thi-truong-hang-hoa-hom-nay-25112024-gia-dau-the-gioi-tang-vot-360688.html

![[Photo] Air Force actively practices for the April 30th celebration](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/15/16fdec3e42734691954b853c00a7ce01)

![[Photo] Prime Minister Pham Minh Chinh works with state-owned enterprises on digital transformation and promoting growth](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/15/f55bfb8a7db84af89332844c37778476)

![[Photo] Ho Chi Minh City after 50 years of national reunification through buildings and symbols](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/15/a224d0b8e489457f889bdb1eee7fa7b4)

![[Photo] President Luong Cuong holds talks with General Secretary and President of China Xi Jinping](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/15/f7e4c602ca2f4113924a583142737ff7)

Comment (0)