The Fed is facing a decline in global influence. The structure of the world economy has changed, with the US and its allies accounting for a smaller share.

|

| The Fed is facing a decline in global influence. (Source: Reuters) |

In the 1990s and early 2000s, stock markets around the world moved to the beat of Wall Street, while central banks either followed the lead of the US Federal Reserve or faced an influx or withdrawal of “hot money” that put currency values and price stability at risk.

The situation in major economies is very different. In the US, the problem over the past two years has been post-pandemic inflation. Europe has been under similar pressure, made worse by the conflict in Ukraine, which has cut off cheap Russian gas supplies.

In Japan, higher inflation is to be expected, as a sign that the country's weak economy may be recovering. In China, the problem is not that prices are too high, but that they are too low.

As a result, many central banks are moving at different speeds, or even in different directions. The Fed was late in raising rates when inflation was strong and late in cutting rates when inflation was moderate. The European Central Bank and the Bank of England, as well as many emerging market central banks, started cutting rates before the Fed.

In China, by contrast, policymakers are scrambling to stem a quiet property collapse and shore up the stock market, while the Bank of Japan (BoJ) is raising interest rates instead of lowering them.

When central banks choose different paths, strange things happen. For example, the Japanese yen fell in the first half of the year, then soared in the summer, then plunged again on the possibility that the Fed and the BoJ were going in different directions.

Currency fluctuations have consequences. A weaker yen means more profits for Japanese companies and a rise in the Nikkei. When the yen strengthens, Japanese stocks fall 12% in a single day in August 2024.

For global markets, the 4 trillion yen ($26.8 billion) interest rate differential trade (investors borrowing at low interest rates in Japan and investing in high-yielding assets elsewhere) is the main driver.

As the yen rose, making these trades unprofitable, investors quickly pulled their money out, dealing a blow to everything from US stocks to the Mexican peso to bitcoin.

The Fed is facing a decline in global influence. The structure of the world economy has changed, with the US and its allies accounting for a smaller share. In 1990, the US accounted for 21% of global GDP and the Group of Seven (G7) accounted for 50%. By 2024, those numbers will have fallen to 15% and 30%, respectively.

The US dollar remains the world’s main reserve currency, but it is no longer as strong as it once was. According to the International Monetary Fund, the greenback’s share of global central bank foreign exchange reserves has fallen from 72% in 2000 to 58% in 2023.

Figures from the People's Bank of China (the central bank) show that the country now settles a quarter of its trade transactions in yuan, up from zero more than a decade ago.

It is no surprise that America’s appeal has waned. Other economies, especially China, are starting to gain more influence. The pace and scale of the Fed’s rate cuts will be crucial in the coming months.

But China’s stimulus package may be more significant. The package China announced in late September 2024 will add about $300 billion to global GDP next year, and more if the country’s finance ministry implements fiscal stimulus.

Source: https://baoquocte.vn/fed-da-het-thoi-290759.html

![[Photo] Workshop "Future for the Rising Generation" continues the profound value and strong message from the article of General Secretary To Lam](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/4/ec974c5d9e8e44f2b01384038e183115)

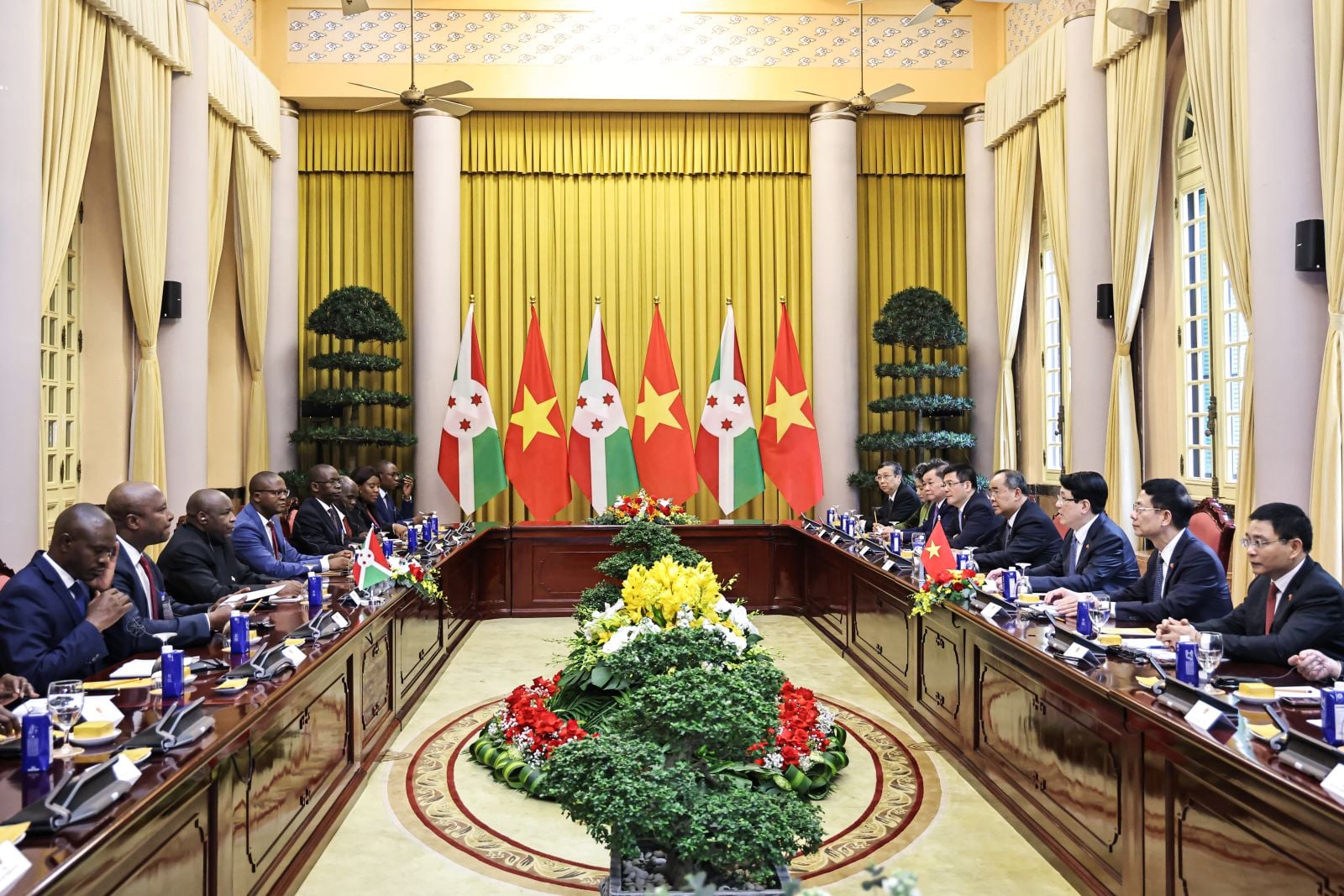

![[Photo] General Secretary To Lam receives President of the Republic of Burundi Évariste Ndayishimiye](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/4/d6df4662ecde41ef9bf55f1648343454)

![[Photo] Parade rehearsal on the training ground in preparation for the April 30 celebration in Ho Chi Minh City](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/4/e5645ddf85f647e6a25164d11de71592)

![[Photo] Prime Minister Pham Minh Chinh meets with President of the Republic of Burundi Evariste Ndayishimiye](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/4/979010f4c7634f6a82b8e01821170586)

![[Photo] President Luong Cuong presides over the official welcoming ceremony for Burundian President Évariste Ndayishimiye](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/4/63ceadc486ff4138abe2e88e93c81c91)

Comment (0)