In the stock market, recent positive net buying sessions in large stocks show signs that Vietnamese stocks are attracting foreign capital to return.

Large stocks attract foreign investors

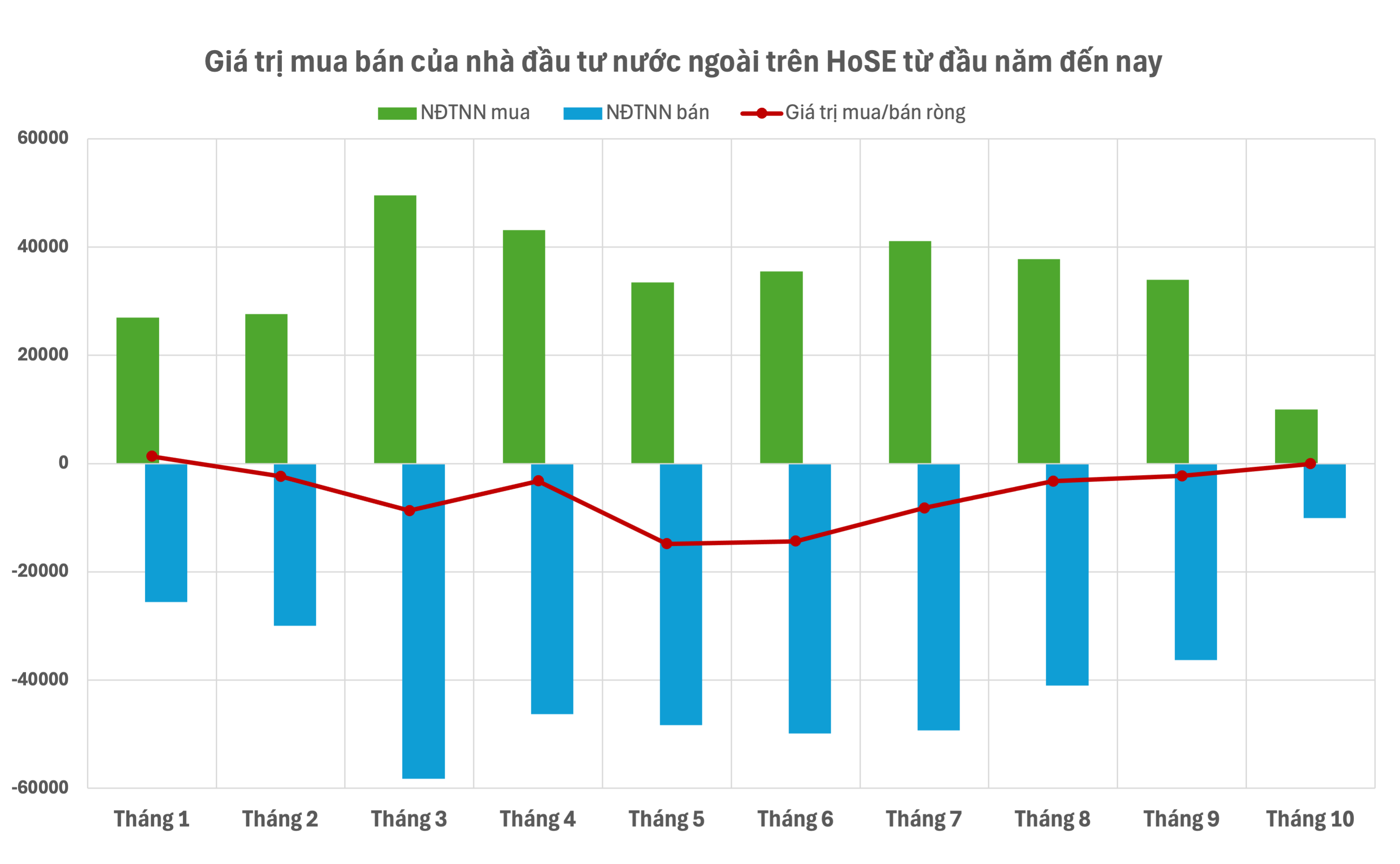

Except for net buying of more than a trillion VND in the first month of the year, since February 2024, foreign investors have always maintained a net selling status in the Vietnamese stock market. In particular, in the period of May - June, more than tens of trillion VND were withdrawn from Vietnamese stocks each month, causing concern for market members.

However, developments in recent sessions are bringing more positive sentiment.

In today's trading session (October 10), foreign investors net bought more than 500 billion VND on the HoSE floor, focusing mainly on bluechips such as MSN (366.8 billion VND), FPT (311 billion), TCB (135 billion) or NTL (157 billion).

It has been a long time since foreign investors have been interested in MSN shares like today, when the number of net buying sessions of over a hundred billion VND can be counted on the fingers of one hand over the past year, while before that, they continuously sold net with large volumes, especially at the end of March and the beginning of April. This is also the session when foreign investors have bought the largest amount of MSN since the beginning of the year.

HPG shares have also had 5 consecutive sessions of net foreign capital attraction after a period of continuous net selling, especially attracting attention in the session on October 9 with a net purchase value of over VND 236 billion. FPT continued to conquer a new historical price peak in today's session with support from foreign net buying of over VND 311 billion.

Foreign investors’ cash flow has shown signs of turning to attractive large-cap stocks in recent sessions. Along with the selling momentum of ETFs that has decreased in September and positive information showing a positive outlook for the Vietnamese stock market in the final months of the year.

On HoSE, up to now, foreign investors have been net selling more than 54 billion VND since the beginning of October, a figure that has decreased significantly compared to last month.

|

Many positive forecasts for the stock market

Globally, investment sentiment in equity funds has been more positive following the US Federal Reserve’s decision to cut interest rates, along with economic data that favors a “soft landing” scenario or strong stimulus measures from China.

Data from SSI Securities Company shows that in September, capital flows into developed markets were not much different from those into emerging markets. Money flowing into emerging markets was 21.4 billion USD, most of which was from ETF funds allocated to the Chinese market (15.5 billion USD), concentrated in the second half of September. Money flows also showed signs of starting to return to the Southeast Asian region.

According to SSI's assessment, the cash flow of investment funds into the Vietnamese stock market often lags behind that of other countries in the region. With the net inflow trend in Malaysia and Indonesia, it is expected that active funds will continue to allocate their weight to Vietnam in the coming time.

In the Vietnamese stock market, last September also marked a clear improvement in foreign capital flow.

The withdrawal value of ETF funds in September recorded 713 billion VND, the lowest since the beginning of the year. The withdrawal pressure is still most concentrated in the Fubon fund (-627 billion), which has had a net withdrawal of -5,100 billion since the beginning of 2024. In addition, the DCVFM VN30 funds (-195 billion), VanEck (-109 billion) and SSIAM VNFIN Lead (-26 billion) continued to have net withdrawals but with a decreasing scale.

On the other hand, DCVFM VNDiamond fund recorded a net inflow of VND231 billion for the first time after 9 months of net withdrawal with a total value of -10.25 trillion. Besides, KIM Growth VN30 fund (bought VND88 billion) maintained positive inflow.

Active funds remained net sellers in September, with a much lower rate of decline than in August. Notably, cash flow from active funds investing only in Vietnam began to return in the last week of September, with a strong trend from the Thai fund group. In total, active funds investing only in Vietnam withdrew about VND320 billion in September (lower than VND600 billion in August).

While the withdrawal scale of ETFs continues to shrink, active funds show signs of net buying again through the order matching channel and are most concentrated in the securities group, thanks to the positive impact of the transaction support roadmap for foreign investors. The proportion of foreign investors' transactions also increased to nearly 14% on HoSE, the highest since April 2023.

Last September, the Ministry of Finance officially issued a Circular amending four circulars related to foreign institutional investors being able to trade and buy stocks without requiring sufficient funds and a roadmap for information disclosure in English. This product also helps foreign investment funds to proactively manage cash flow and thereby improve trading liquidity.

SSI forecasts that in October, the Vietnamese stock market is likely to continue to receive mostly positive events. In terms of capitalization, the proportion of transaction value allocated to the VN30 group is at 50% - the highest since the beginning of the year thanks to stronger transactions in the banking group and some pillar real estate codes. At the same time, stronger growth in listed corporate profits towards the end of 2024 and 2025 will bring the stock market back to an upward trend.

Source: https://baodautu.vn/dong-von-ngoai-dang-quay-lai-voi-chung-khoan-viet-d227111.html

![[Photo] Looking back at the impressive moments of the Vietnamese rescue team in Myanmar](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/11/5623ca902a934e19b604c718265249d0)

![[Photo] "Beauties" participate in the parade rehearsal at Bien Hoa airport](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/11/155502af3384431e918de0e2e585d13a)

![[Photo] Summary of parade practice in preparation for the April 30th celebration](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/11/78cfee0f2cc045b387ff1a4362b5950f)

Comment (0)