Regional developments optimistic in the second half of the year

Savills APIQ Q2/2024 report shows that Asia-Pacific real GDP has been revised up to 3.9% in 2024, driven by India’s strong economic performance and a strong export recovery. However, the resilient US economy has pushed back the Fed’s rate cut timeline and monetary policy is expected to remain unchanged across most major markets. The higher interest rate backdrop is likely to persist through the end of the year, with the exception of Japan and China.

Investors remained cautious in making decisions in the second quarter of 2024 in the slowing region, resulting in a 28.1% year-on-year decline in preliminary investment volumes, with total investment value falling to $26.3 billion (counting transactions worth more than $10 million, excluding development sites and pending transactions).

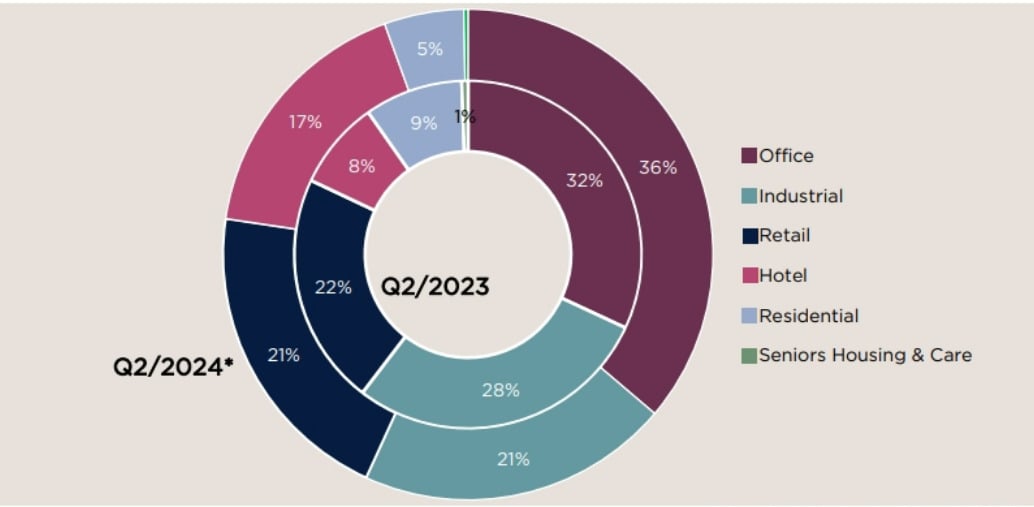

Real estate investment volume in Asia-Pacific region in Q2/2024 compared to the same period last year (Photo: Savills)

“While investment volumes remain subdued, there are signs of more positive growth across the region. Interest rate cuts are on the horizon and are expected to contribute to a more upbeat second half of the year, even as the US election and ongoing geopolitical tensions could slow the recovery,” said Simon Smith, head of Savills research and consultancy.

The report found that across the region, commercial real estate including office, retail and industrial/logistics continued to drive investment volumes in the second quarter, accounting for over 75%. However, hotel investment doubled during the quarter, indicating a continued shift towards alternative assets that could potentially offer higher returns.

Looking ahead, the report forecasts a rate cut later this year as inflationary pressures ease and economic growth slows, while the regional property market is expected to gradually recover in the coming quarters. However, the US election and ongoing geopolitical tensions could impact the region’s recovery.

FDI inflows into Vietnam will continue to be stable.

Savills' report also noted that Vietnam's consumer price index in the first five months of 2024 increased by 4% compared to the same period last year. In addition, Standard Chartered Bank recently revised Vietnam's GDP growth forecast for 2024 down to 5.3% in the second quarter, slightly down from the bank's forecast in the first quarter of 5.7%.

Although the results also show a slowing trend, the overall recovery is still maintained. Challenges such as geopolitical tensions, global inflationary pressures and low investment demand may persist into the third quarter, potentially affecting the recovery.

"Economic challenges are likely to persist in Q3/2024, amid weak global purchasing power, geopolitical tensions and inflationary pressures, but positive domestic FDI and infrastructure investment will boost the economy," said Troy Griffiths, Deputy CEO of Savills.

Mr. Troy Griffiths, Deputy Managing Director, Savills Vietnam

According to Savills experts, the FDI disbursement rate in May increased by 7.8% compared to the same period last year to USD 8.3 billion, which is a positive sign for the economy. The industrial real estate sector will see stable demand, supported by FDI inflows and infrastructure development. This will encourage developers to expand their portfolios, such as VSIP, which is building a 600-hectare industrial park in Lang Son and Gaw NP Industrial, which is introducing nearly 100,000 square meters of ready-built factories and warehouses in Ha Nam.

The residential real estate market is still moving cautiously. In the context of economic fluctuations and potential buyers taking a wait-and-see attitude, investors continue to launch new projects to gauge market sentiment.

Some highlights in the M&A market are concentrated in potential areas such as Kim Oanh Group and partners such as NTT Urban Development, Sumitomo Forestry, Kumagai Gumi Co Ltd to develop a 50-hectare residential area in Binh Duong; Nishi Nippon Railroad acquired 25% of shares in the 45.5-hectare Paragon Dai Phuoc Project from Nam Long Group for more than VND660 billion; Tripod Technology Corporation acquired an 18-hectare industrial land plot in Ba Ria - Vung Tau from Sonadezi Chau Duc...

Binh Duong is a potential market and also the place where many M&A deals have taken place in recent times.

In the commercial real estate segment, rising rents and limited space are driving businesses away from the city centre. Hanoi forecasts 48% of new office space will be in emerging CBD/new urban areas such as West Lake by 2025, while Ho Chi Minh City is seeing a shift towards Thu Thiem with new green-certified developments.

Source: https://www.congluan.vn/dong-von-fdi-vao-bat-dong-san-tiep-tuc-on-dinh-voi-nhieu-thuong-vu-ma-duoc-ghi-nhan-post306101.html

![[Photo] Looking back at the impressive moments of the Vietnamese rescue team in Myanmar](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/11/5623ca902a934e19b604c718265249d0)

![[Photo] "Beauties" participate in the parade rehearsal at Bien Hoa airport](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/11/155502af3384431e918de0e2e585d13a)

![[Photo] Summary of parade practice in preparation for the April 30th celebration](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/11/78cfee0f2cc045b387ff1a4362b5950f)

Comment (0)