USD exchange rate today October 24, 2024: The USD continues to increase in price, reaching a 3-month high against the Yen due to the economic strength of the United States...

USD exchange rate today 10/24/2024

USD exchange rate today October 24, 2024, the USD rose above 153 against the Yen for the first time in nearly 3 months due to the economic strength of the United States and the expected difference between the pace of interest rate cuts by major global central banks.

Opening today's trading session, the State Bank announced the central exchange rate of the Vietnamese Dong to the USD increased by 10 VND, currently at 24,250 VND.

Currently, the permitted exchange rate of commercial banks fluctuates from 23,400 - 25,450 VND/USD. The USD exchange rate has also been brought to the buying and selling range of 23,400 to 25,450 VND/USD by the State Bank of Vietnam.

The USD exchange rate at Vietcombank is currently at 25,190 - 25,462 VND. The current USD buying and selling prices range from 24,000 - 25,500 VND/USD.

| 1. VCB - Updated: October 24, 2024 15:00 - Time of website supply source | ||||

| Foreign currency | Buy | Sell | ||

| Name | Code | Cash | Transfer | |

| AUSTRALIAN DOLLAR | AUD | 16,440.01 | 16,606.08 | 17,138.80 |

| CANADIAN DOLLAR | CAD | 17,912.93 | 18,093.87 | 18,674.33 |

| SWISS FRANC | CHF | 28,583.37 | 28,872.09 | 29,798.31 |

| YUAN RENMINBI | CNY | 3,475.64 | 3,510.75 | 3,623.37 |

| DANISH KRONE | DKK | - | 3,607.43 | 3,745.57 |

| EURO | EUR | 26,710.07 | 26,979.87 | 28,174.60 |

| Sterling Pound | GBP | 32,001.08 | 32,324.33 | 33,361.30 |

| HONGKONG DOLLAR | HKD | 3,187.58 | 3,219.78 | 3,323.07 |

| INDIAN RUPEE | INR | - | 301.42 | 313.47 |

| YEN | JPY | 160.64 | 162.26 | 169.98 |

| Korean Won | KRW | 15.91 | 17.68 | 19.19 |

| KUWAITIAN DINAR | KWD | - | 82,781.19 | 86,090.60 |

| MALAYSIAN RINGGIT | MYR | - | 5,785.64 | 5,911.82 |

| NORWEGIAN KRONER | NOK | - | 2,270.33 | 2,366.72 |

| RUSSIAN RUBLE | RUB | - | 251.90 | 278.85 |

| SAUDI RIAL | SAR | - | 6,747.80 | 7,017.56 |

| SWEDISH KRONA | SEK | - | 2,352.09 | 2,451.95 |

| SINGAPORE DOLLAR | SGD | 18,739.79 | 18,929.08 | 19,536.33 |

| THAILAND | THB | 664.70 | 738.56 | 766.84 |

| US DOLLAR | USD | 25,203.00 | 25,233.00 | 25,473.00 |

| 2. Agribank - Updated: 01/01/1970 08:00 - Time of website source | ||||

| Foreign currency | Buy | Sell | ||

| Name | Code | Cash | Transfer | |

| USD | USD | 25,215.00 | 25,233.00 | 25,473.00 |

| EUR | EUR | 26,857.00 | 26,965.00 | 28,052.00 |

| GBP | GBP | 32,203.00 | 32,332.00 | 33,278.00 |

| HKD | HKD | 3,204.00 | 3,217.00 | 3,318.00 |

| CHF | CHF | 28,760.00 | 28,876.00 | 29,722.00 |

| JPY | JPY | 162.49 | 163.14 | 170.14 |

| AUD | AUD | 16,549.00 | 16,615.00 | 17,101.00 |

| SGD | SGD | 18,873.00 | 18,949.00 | 19,466.00 |

| THB | THB | 732.00 | 735.00 | 766.00 |

| CAD | CAD | 18,035.00 | 18,107.00 | 18,616.00 |

| NZD | NZD | 15,014.00 | 15,499.00 | |

| KRW | KRW | 17.63 | 19.37 | |

| 3. Sacombank - Updated: 11/25/2002 07:16 - Time of website source | ||||

| Foreign currency | Buy | Sell | ||

| Name | Code | Cash | Transfer | |

| USD | USD | 25200 | 25200 | 25473 |

| AUD | AUD | 16549 | 16649 | 17219 |

| CAD | CAD | 18026 | 18126 | 18677 |

| CHF | CHF | 28913 | 28943 | 29737 |

| CNY | CNY | 0 | 3534.8 | 0 |

| CZK | CZK | 0 | 1040 | 0 |

| DKK | DKK | 0 | 3670 | 0 |

| EUR | EUR | 26918 | 27018 | 27890 |

| GBP | GBP | 32399 | 32449 | 33552 |

| HKD | HKD | 0 | 3280 | 0 |

| JPY | JPY | 164.02 | 164.52 | 171.03 |

| KHR | KHR | 0 | 6,032 | 0 |

| KRW | KRW | 0 | 18 | 0 |

| LAK | LAK | 0 | 1,054 | 0 |

| MYR | MYR | 0 | 6027 | 0 |

| NOK | NOK | 0 | 2312 | 0 |

| NZD | NZD | 0 | 15097 | 0 |

| PHP | PHP | 0 | 415 | 0 |

| SEK | SEK | 0 | 2398 | 0 |

| SGD | SGD | 18850 | 18980 | 19701 |

| THB | THB | 0 | 697.3 | 0 |

| TWD | TWD | 0 | 790 | 0 |

| XAU | XAU | 8700000 | 8700000 | 8900000 |

| XBJ | XBJ | 8200000 | 8200000 | 8850000 |

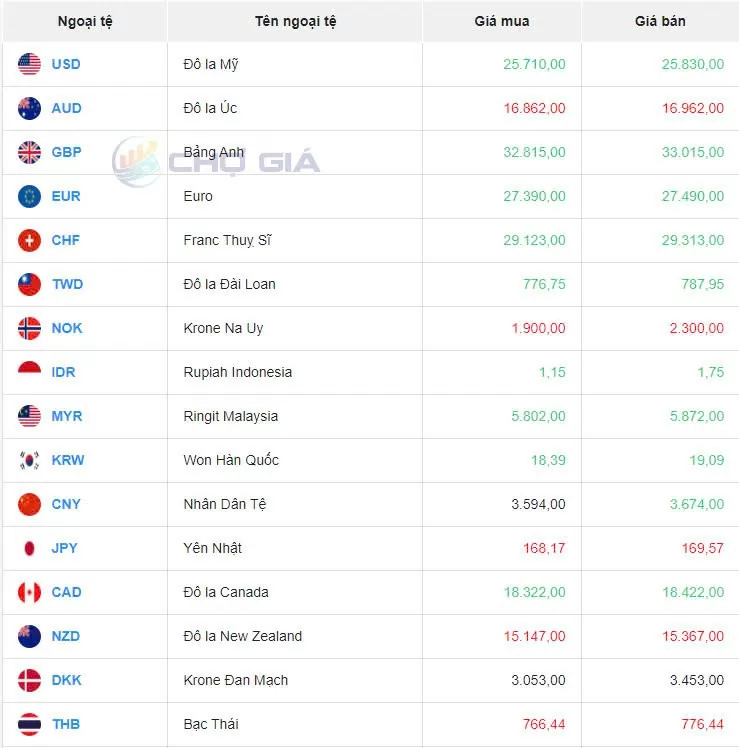

In the "black market", the black market USD exchange rate as of 5:00 a.m. on October 24, 2024 is as follows:

|

| Black market on October 24, 2024. Photo: Chogia.vn |

USD exchange rate today October 24, 2024 on the world market

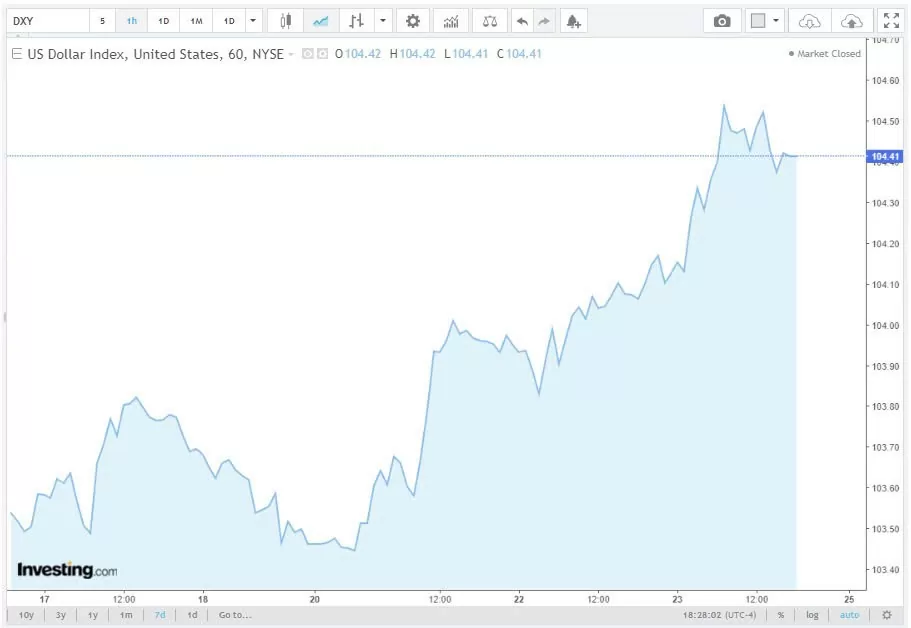

The Dollar Index (DXY), which measures the USD against six major currencies (EUR, JPY, GBP, CAD, SEK, CHF), stopped at 104.41 points, up 0.85 points compared to the transaction on October 23, 2024.

|

| DXY index developments in recent times. |

The dollar rose above 153 against the yen for the first time in nearly three months on Thursday, buoyed by U.S. economic strength and expectations of a divergence in the pace of interest rate cuts by major global central banks.

The greenback is on track for its 16th gain in 18 sessions and fourth straight weekly gain as a slew of positive economic data has dampened expectations about the size and pace of Federal Reserve rate cuts, pushing U.S. Treasury yields higher.

The yield on the benchmark 10-year US Treasury note rose 3.4 basis points (bps) to 4.24%, after hitting a three-month high of 4.26%. After falling for five straight months, the 10-year yield has risen about 40 basis points in October. Investors are also positioning ahead of the US presidential election on November 5.

" We've moved from phase one to phase two, if you like, phase one was a recovery that was going to be dependent on the US economy, the strong data we've had over the last month or so... and this second phase could be dependent on politics," said George Vessey, chief FX strategist at Convera in London. " But the stronger dollar trend in the short term could be driven more by Trump's risk-off move than the interest rate story, which may be overblown, but even so, we're still seeing yields continue to move higher ."

The dollar index, which measures the greenback against a basket of currencies, rose 0.32% to 104.43, after rising to 104.57, its highest since July 30. The euro fell 0.18% to $1.0778 after falling to $1.076, its lowest since July 3. The pound fell 0.49% to $1.2919.

Recent comments from Fed officials suggest the central bank will take a gradual approach to rate cuts.

The central bank's "Beige Book" released Wednesday showed economic activity was largely unchanged from September to early October while companies saw a pick-up in hiring, continuing a recent trend that reinforced expectations the Fed will deliver a smaller 25 basis point cut at its November meeting.

According to the CME FedWatch Tool, the market is pricing in an 88.9% chance of a 25 basis point cut at its November meeting, with an 11.1% chance of the central bank leaving rates unchanged., open new tab . The market had fully priced in at least a 25 basis point cut a month ago, with a 53% chance of a 50 basis point cut.

The upcoming US presidential election also continues to drive currency volatility, as market expectations in recent days have grown for a victory by Republican presidential candidate and former President Donald Trump, which could lead to inflationary policies such as tariffs.

The Bank of Canada cut its key benchmark interest rate by 50 basis points to 3.75% on Wednesday, as widely expected, its first larger-than-usual move in more than four years and hailing signs the country is returning to a period of low inflation. The Canadian dollar weakened 0.14% against the greenback to 1.38 per dollar.

European Central Bank (ECB) President Christine Lagarde said the central bank will need to be cautious in deciding further interest rate cuts and will rely on upcoming data.

In addition, ECB chief economist Philip Lane said the recent relatively weak data on the eurozone economy has raised questions about the bloc's outlook, but the European Central Bank still expects a recovery to take place.

Against the Japanese yen, the dollar rose 0.99% to 152.56, on track for its biggest daily percentage gain since Oct. 4, after rising to 153.18, its highest since July 31, when the Bank of Japan raised interest rates to their highest since 2007.

Japan is set to hold a general election on October 27. Recent opinion polls suggest the ruling Liberal Democratic Party could lose its majority to coalition partner Komeito.

The risk of forming a minority coalition government has raised the prospect of political instability that complicates the Bank of Japan's efforts to reduce its reliance on monetary stimulus.

|

| USD exchange rate today October 24, 2024. Illustration photo |

Refer to the popular addresses for Foreign Currency Exchange - Buying and Selling USD in Hanoi: 1. Quoc Trinh Ha Trung Gold Shop - No. 27 Ha Trung, Hang Bong, Hoan Kiem District, Hanoi 2. Gold and Silver Fine Arts - No. 31 Ha Trung, Hang Bong, Hoan Kiem District, Hanoi 3. Minh Chien Gold and Silver Store - No. 119 Cau Giay, Cau Giay District, Hanoi 4. Thinh Quang Gold and Silver Company - No. 43 Ha Trung, Hang Bong, Hoan Kiem District, Hanoi 5. Toan Thuy Store - No. 455 Nguyen Trai, Thanh Xuan, Hanoi and No. 6 Nguyen Tuan, Thanh Xuan District, Hanoi 6. Bao Tin Minh Chau Gold, Silver and Gemstones - No. 19 Tran Nhan Tong, Hai Ba Trung District, Hanoi 7. Chinh Quang Store - No. 30 Ha Trung, Hang Bong, Hoan Kiem District, Hanoi 8. Kim Linh 3 Store - No. 47 Ha Trung, Hang Bong, Hoan Kiem District, Hanoi 9. Huy Khoi Store - No. 19 Ha Trung, Hang Bong, Hoan Kiem District, Hanoi 10. System of transaction offices at banks such as: Sacombank, VietinBank, Vietcombank, SHB Refer to the popular addresses for Foreign Currency Exchange - Buying and Selling USD in Ho Chi Minh City: 1. Minh Thu Currency Exchange - 22 Nguyen Thai Binh, District 1, HCMC 2. Kim Mai Gold Shop - 84 Cong Quynh, District 1, HCMC 3. Kim Chau Gold Shop - 784 Dien Bien Phu, Ward 10, District 10. Ho Chi Minh City 4. Saigon Jewelry Center - 40-42 Phan Boi Chau, District 1, HCMC 5. Kim Hung foreign currency exchange agency - No. 209 Pham Van Hai, Binh Chanh, Ho Chi Minh City 6. DOJI Jewelry Store - Diamond Plaza Le Duan, 34 Le Duan, Ben Nghe, District 1, HCMC 7. Kim Tam Hai Shop - No. 27 Truong Chinh, Tan Thoi Nhat Ward, District 12, HCMC 8. Bich Thuy Gold Shop - No. 39 Pham Van Hai Market, Ward 3, Tan Binh District, HCMC 9. Ha Tam Gold Shop - No. 2 Nguyen An Ninh, Ben Thanh Ward, District 1, HCMC 10. System of transaction offices at banks in Ho Chi Minh City such as: Sacombank, VietinBank, Vietcombank, SHB, Eximbank |

Source: https://congthuong.vn/ty-gia-usd-hom-nay-24102024-dong-usd-tiep-tuc-tang-gia-354356.html

Comment (0)