Investors traded cautiously in the last trading session of 2024.

Cash flow "holiday", VN-Index decreased more than 5 points in the last session of 2024

Investors traded cautiously in the last trading session of 2024.

State-owned banking stocks fall sharply

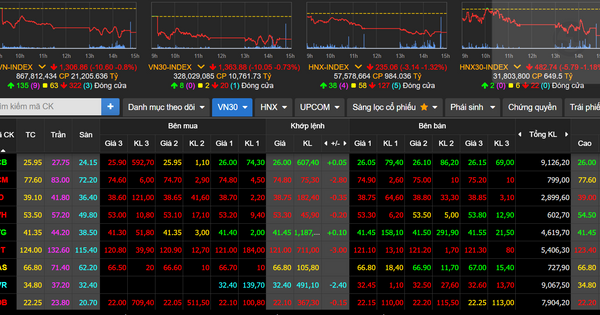

The VN-Index closed the session on December 30 at 1,272.02 points, down 0.24%, trading volume down 23% and equal to 80% of the average. Entering the last trading session of 2024, the market was gloomy with low liquidity, the indices were almost flat. Investors' caution caused the market to lack growth drivers. Increasing selling pressure gradually pushed the stock market down. However, because the selling pressure was not too strong, the VN-Index only decreased slightly. The decrease in liquidity showed a lack of new demand.

Trading in the afternoon session was negative as red completely dominated the electronic board. However, liquidity remained at a very low level, the selling pressure was not too sudden, so the decrease of the indices was only modest. However, VN-Index still closed at the lowest point of the session.

At the end of the trading session, VN-Index stood at 1,266.78 points, down 5.24 points (-0.41%) to 1,266.78 points. HNX-Index decreased 0.71 points (-0.31%) to 227.43 points. UPCoM-Index increased 0.06 points (0.06%) to 95.06 points. At the end of the year, VN-Index increased 12.11% compared to the end of 2023. Meanwhile, HNX-Index decreased 1.56%.

The entire market recorded 346 stocks increasing, while 376 stocks decreased and 838 stocks remained unchanged/no trading. The number of stocks increasing to the ceiling was 31 and there were 20 stocks decreasing to the floor.

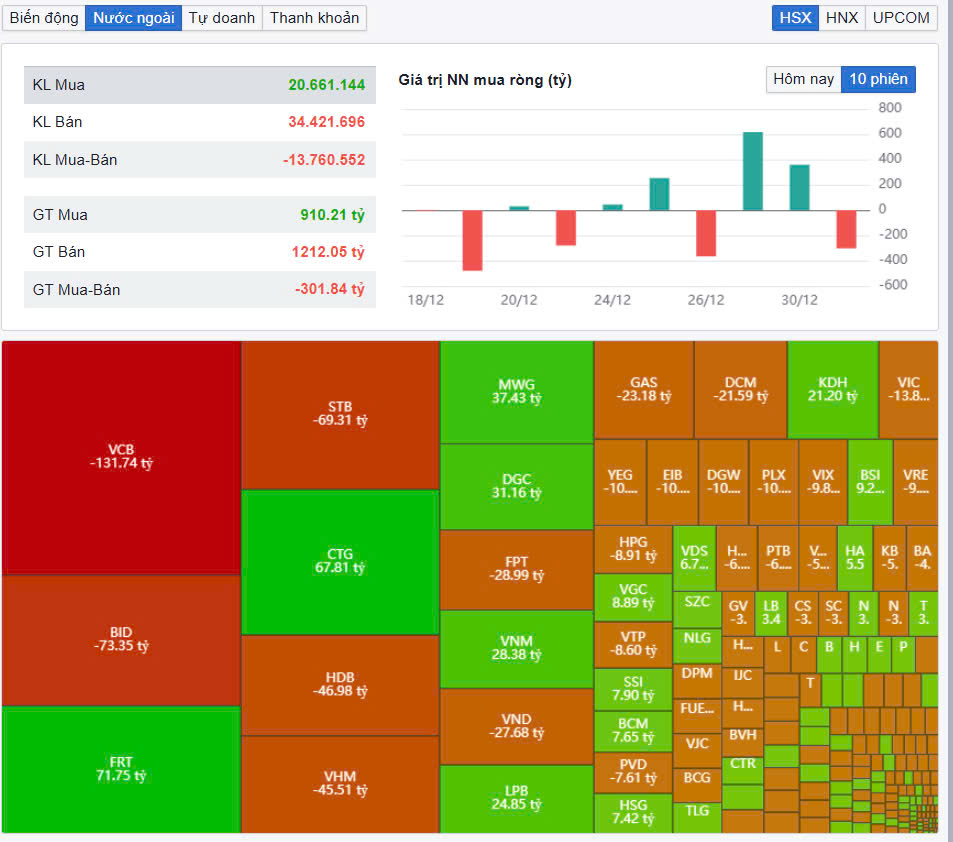

Although the market fluctuated narrowly, there were still some notable names such as HDB, STB, YEG... In which, the two stocks HDB and STB in the ATC session yesterday suddenly had good foreign demand and pushed the price up sharply. The developments in today's session for these two stocks were completely opposite. Both HDB and STB were sold heavily from the beginning of the session and foreign investors also "dumped" a large amount of goods at the end of the session. HDB closed the session down 4.3% and matched 9.2 million units, foreign investors net sold more than 1.8 million units. STB also decreased 2.5% and matched 9.4 million units, foreign investors net sold 1.9 million units.

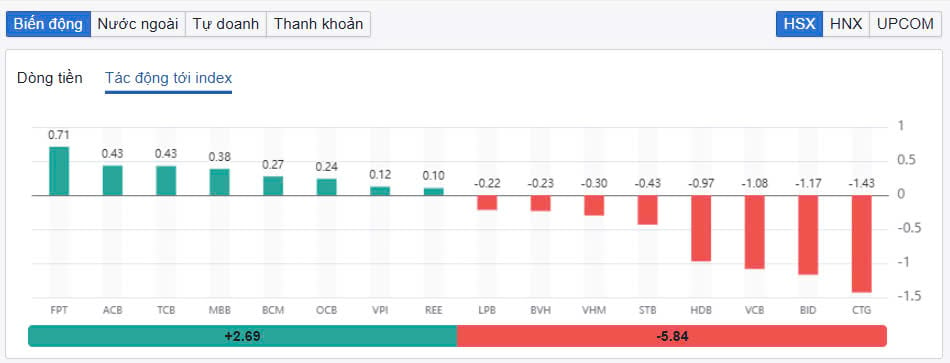

Besides HDB and STB, codes such as CTG, BID, VCB... also decreased quite strongly in today's session. CTG decreased by 2.8%. BID increased quite well during most of today's session, but was sold off heavily at the end of the session and decreased by 1.8%. CTG was the code that had the worst impact on VN-Index when it took away 1.43 points. BID and VCB took away 1.17 points and 1.08 points, respectively.

On the other hand, FPT, ACB, TCB, MBB…. are stocks that increased well in today’s session and contributed greatly to supporting the VN-Index. FPT increased by 1.33% and contributed 0.71 points. ACB increased by 1.57% and contributed 0.43 points. TCB also contributed 0.43 points when it increased by 1.02%.

|

| Shares of three state-owned banks are the locomotives pulling the market down. |

In the small-cap group, the recovery of YEG stock yesterday is likely just a “bull trap”. This stock quickly hit the floor early and gradually lost liquidity.

In addition, many small and mid-cap stocks were in the red and negatively affected the general market sentiment. In the chemical fertilizer group, only DGC and BFC remained green. Meanwhile, DCM fell 1.8%, DPM fell 1.3%, CSV fell 0.9%.

The public investment group also recorded overwhelming red. KSB decreased by 2.4%, VCG decreased by 1.6%, DHA decreased by 1.5%, PLC decreased by 1.3%.

The total trading volume on HoSE reached nearly 481 million shares, equivalent to a trading value of VND11,560 billion, equivalent to yesterday. The negotiated trading value was nearly VND2,000 billion. The trading value on HNX and UPCoM reached VND639 billion and VND674 billion, respectively.

FPT is the strongest traded code today with nearly 550 billion VND. STB and MBB traded 348 billion VND and 281 billion VND respectively.

|

| Foreign investors net sold again, focusing mostly on Vietcombank shares. |

Foreign investors net sold again VND269 billion in the whole market. VCB was the most net sold with VND132 billion. BID and STB were net sold with VND73 billion and VND69 billion respectively. In the opposite direction, FRT was the most net bought with VND72 billion. CTG was behind with a net buying value of VND68 billion. MCH was also net bought with VND62 billion.

Source: https://baodautu.vn/dong-tien-nghi-tet-vn-index-giam-hon-5-diem-trong-phien-cuoi-cung-cua-nam-2024-d237462.html

![[Photo] 2nd Conference of the Party Executive Committee of Central Party Agencies](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/31/8f85b88962b34701ac511682b09b1e0d)

![[Photo] Prime Minister Pham Minh Chinh receives delegation of leaders of US universities](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/31/8be7f6be90624512b385fd1690124eaa)

![[Photo] Ministry of Defense sees off relief forces to the airport to Myanmar for mission](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/30/245629fab9d644fd909ecd67f1749123)

![[REVIEW OCOP] An Lanh Huong Vet Yen Cat](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/27/c25032328e9a47be9991d5be7c0cad8c)

Comment (0)