The US's imposition of a 25% tax on imported aluminum and steel, to a greater or lesser extent, will impact Vietnamese businesses exporting to the US, increasing the tax burden, but also creating pressure for businesses to diversify their export markets.

The US's imposition of a 25% tax on imported aluminum and steel, to a greater or lesser extent, will impact Vietnamese businesses exporting to the US, increasing the tax burden, but also creating pressure for businesses to diversify their export markets.

|

| Aluminum and steel businesses will face more tariff risks in 2025 |

Exports are significantly affected.

US President Donald Trump has just announced a 25% tax on all steel and aluminum imported into the US, the tax will officially take effect from March 4.

Countries that export large amounts of aluminum and steel to the US are facing severe impacts. Even though Vietnam’s aluminum and steel exports are not as large as those of Canada, Mexico, South Korea, and China, it is still not immune to the impact.

"Maintain stable production, ensure quality."

- Deputy Minister of Agriculture and Rural Development Phung Duc Tien

US President Donald Trump has signed executive orders imposing tariffs on Mexico, Canada and China. As the US engages in trade confrontations with a number of countries, it will certainly have an impact on Vietnam’s agricultural, forestry and fishery exports to these markets.

For the agricultural sector, it is necessary to maintain stable production, ensure quality, and maintain prestige with partners. That is an important solution to deal with the risk of a global trade war.

"Continuously update information to have response scenarios."

- Mr. Cao Huu Hieu, General Director of Vietnam Textile and Garment Group (Vinatex)

Faced with US tariff moves on imported goods, with the possibility of expanding the taxable import sector, Vinatex is constantly listening and updating information to have scenarios for production, business and export activities.

In our opinion, it is highly likely that textiles will also be subject to an additional 10% tax.

Statistics from the US Customs show that in 2024, Vietnam will export about 1.462 billion USD of steel and aluminum to the US, of which 983 million USD is steel and steel products (an increase of nearly 159% compared to 2023), 479 million USD is aluminum products (an increase of 9.5% compared to 2023).

The Vietnam Trade Office in the US commented: "The US's application of an additional 25% tax on imported aluminum and steel will negatively affect countries exporting aluminum and steel to the US."

Mr. Do Ngoc Hung, Commercial Counselor, Head of the Vietnam Trade Office in the US, added that Vietnamese steel and aluminum products still have the opportunity to continue exporting when the capacity of US steel and aluminum manufacturers cannot meet the demand immediately. However, the profit margin of enterprises will decrease.

Increased tariffs and difficulties exporting to the US will affect the supply chain as businesses seek to export to other regions. Many steel companies are returning to the domestic market, causing countries to increase protectionism.

It should be added that before the US President increased the import tax on aluminum and steel to 25%, these two Vietnamese products were subject to tax rates of 10% and 25% respectively under Section 232 that the US has applied since 2018 to a number of countries.

Vietnam’s aluminum and steel products are also frequently the subject of trade defense lawsuits in the US. The US has investigated 34 cases of steel products, accounting for more than 50% of the total number of trade defense lawsuits that the US has investigated with Vietnam, and 2 cases of aluminum products.

Mr. Tran Hoang Son, Director of Market Strategy, VPBank Securities Joint Stock Company (VPBankS), said that in 2018, US President Donald Trump also imposed a 25% tax on steel, and Vietnam had to pay this tax. The group of stocks of galvanized steel enterprises was more affected because the export output of this group to the US was large. For example, Ton Dong A's exports to the US accounted for about 35%, Nam Kim accounted for about 25%, and Hoa Sen accounted for about 15%.

Not only does it have a direct impact, tariffs also have a negative impact on purchasing power, exchange rates, and export prospects for many products. When import taxes on many products increase, goods become more expensive, causing American consumption to decrease, immediately affecting export growth of many major trading partners with the US, including Vietnam.

|

Prepare response scenarios

Businesses are concerned that not only steel and aluminum are affected by trade policy adjustments, but many other Vietnamese export products are also at risk from tariffs due to the US's new policy to protect domestic manufacturing.

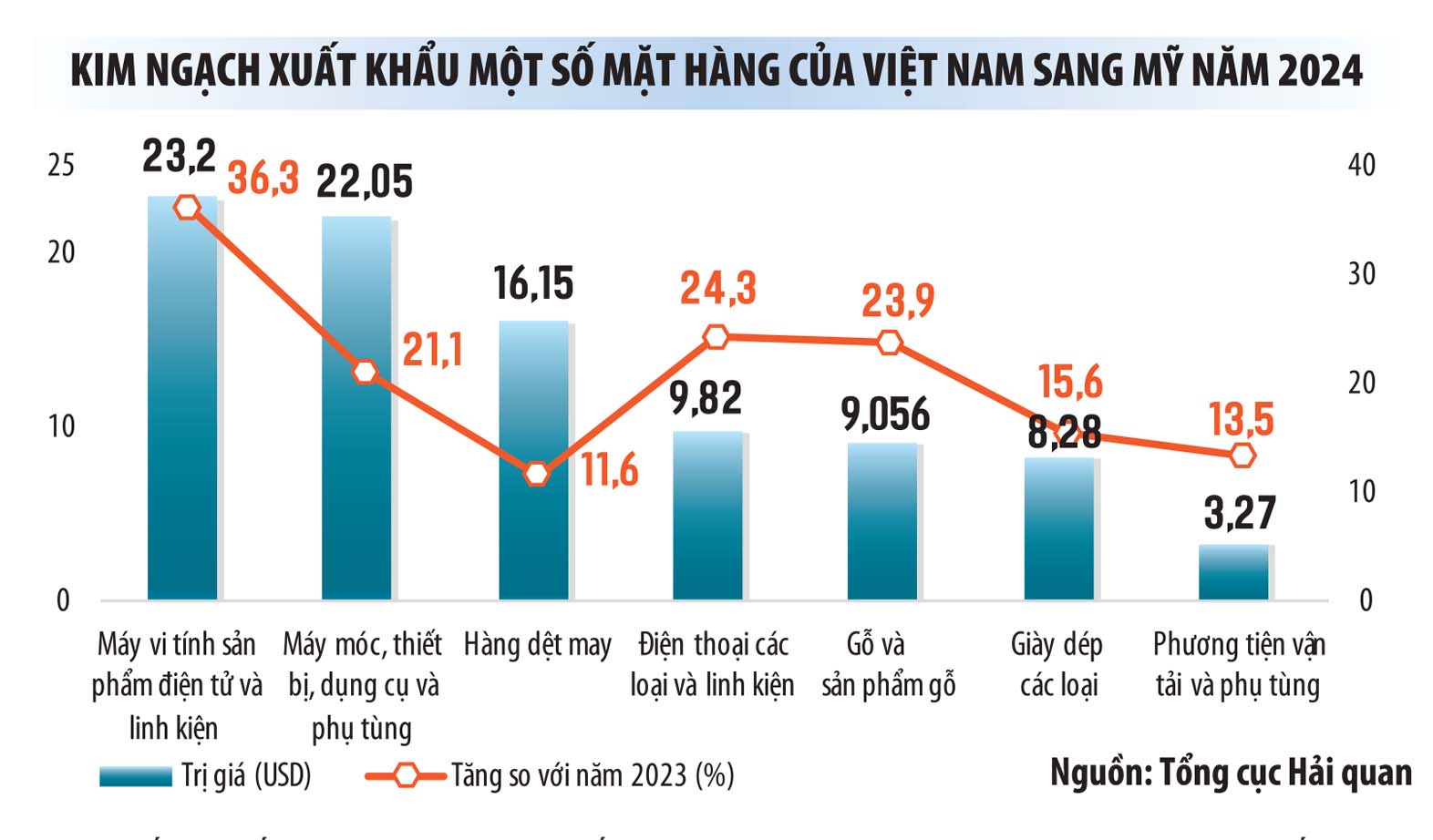

According to experts, there is a high possibility that textiles will also be subject to an additional 10% tax. Textiles are also one of Vietnam's key export industries to the US. In 2024, this industry will bring in 44 billion USD from exports, of which more than 16 billion USD will be exported to the US alone.

In 2025, the US will continue to be Vietnam's largest and most important export market, but exports are facing many tariff risks. This forces Vietnamese businesses to outline plans to respond to the impacts of the potential trade war.

Mr. Pham Luu Hung, Chief Economist of SSI Securities Corporation, analyzed: “President Donald Trump’s tariff policy is said to have a direct impact on trade in many countries around the world. This is fierce competition, not only with big countries, but small countries cannot separate themselves from the game. Therefore, Vietnam needs to change to adapt.”

The Vietnam Trade Office in the US recommends that businesses need to assess the situation to have appropriate business strategies, expand exports to markets that have free trade agreements (FTAs) with Vietnam, and avoid dependence on one market.

Along with that, we must comply with US regulations on origin and always be ready to fully participate in the US investigation agency's explanation process for trade defense cases, when there are currently 34 trade defense lawsuits on steel products and 2 investigations on aluminum.

Faced with escalating global trade tensions, occurring in the Europe-America region, which is an important destination for Vietnamese exports, the Ministry of Industry and Trade has proactively developed scenarios and response plans when global trade tensions escalate.

The Ministry of Industry and Trade said that there are currently three clear trends in world trade. The first is “de-globalization”, or fragmentation in international trade, which has led to the return of tariff tools. The second is market protection through technical measures, trade barriers or trade defense measures. The third is unpredictable policy moves, causing disruption, damage and even disruption of supply and production chains.

In addition, importing countries are also gradually implementing new standards and regulations related to supply chains, raw materials, labor, and the environment that are more stringent for imported products.

“Since the beginning of the year, developments in the international market have clearly reflected the above trends and strongly affected the recovery momentum of the world market, especially the European and American markets, which are key import and export areas of Vietnam,” the Ministry of Industry and Trade assessed.

Responding to the complicated developments of the world market, the Ministry of Industry and Trade has directed foreign market departments and the Vietnamese trade office system abroad to grasp information on market developments, economic, political and policy fluctuations in the region and the world that affect Vietnam's trade, in order to promptly advise the Government to have appropriate policies.

The Ministry also proactively develops scenarios and response plans, firmly adheres to the strategy of diversifying import-export markets, industries and products, and increasing the technology content of products manufactured and processed in Vietnam.

Diversifying export markets as quickly as possible will help industries and businesses minimize risks and impacts. For example, some large-scale steel manufacturing enterprises in Vietnam such as Hoa Phat Group are no longer exporting steel to the US. This enterprise has expanded its exports to more than 10 other markets since the US applied a series of trade defense investigation measures.

Therefore, assessing the impact of the US tax policy on some steel stocks, the strategic report of ACB Securities Company (ACBS) said that the direct impact of the US tariff barrier on Hoa Phat is quite low. The reason is that the export ratio of this enterprise only accounts for 30% of total revenue, of which exports to the US account for about 5-10% of export revenue.

Speaking more about how to avoid trade risks, Mr. Cao Huu Hieu, General Director of Vietnam National Textile and Garment Group (Vinatex) shared that tariffs in the US are just part of the unpredictable trend of the global economy. To minimize the impact, Vinatex enterprises focus on diversifying markets, investing and producing high-end fashion brands, highly technical orders, and high unit prices. With orders to the US, enterprises increase the use of self-produced materials, increasing value content...

Source: https://baodautu.vn/doanh-nghiep-nhom-thep-truoc-rui-ro-ganh-thue-d246182.html

![[Photo] Comrade Khamtay Siphandone - a leader who contributed to fostering Vietnam-Laos relations](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/3/3d83ed2d26e2426fabd41862661dfff2)

![[Photo] Prime Minister Pham Minh Chinh receives Deputy Prime Minister of the Republic of Belarus Anatoly Sivak](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/2/79cdb685820a45868602e2fa576977a0)

![[Photo] General Secretary To Lam receives Russian Ambassador to Vietnam](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/2/b486192404d54058b15165174ea36c4e)

![[Photo] Prime Minister Pham Minh Chinh receives CEO of Standard Chartered Group](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/2/125507ba412d4ebfb091fa7ddb936b3b)

Comment (0)