After the "lunch break", the market opened the afternoon session with excitement and decisive increases. The banking group continued to be the main support for the market, in which TPB code of Tien Phong Commercial Joint Stock Bank stood out.

In the early afternoon session, TPB hit the ceiling price of VND16,650/share with a buy surplus of 3.5 million units. This is also the peak of TPB in more than 2 years, since June 2022.

Liquidity also reached a record high with more than 60 million shares changing hands, 5 times higher than the average liquidity in the month when only more than 12 million units/day were recorded and 2.7 times higher than in the week with 22 million units/day.

TPB stock price movement (Source: TradingView).

The increase in TPB shares occurred after the bank closed the list of shareholders receiving stock dividends at a rate of 20% on September 24.

TPB is expected to issue more than 440.3 million shares to pay dividends to existing shareholders. After the issuance, TPBank's charter capital is expected to increase by VND4,403 billion, equivalent to an increase from VND22,016 billion to a maximum of VND26,419 billion.

At the 2024 Annual General Meeting of Shareholders, TPBank decided to pay 2023 dividends at a rate of 25% in cash and shares. The source of payment is taken from undistributed profits after setting aside funds, according to the audited financial statements.

In July 2024, TPBank spent more than VND 1,100 billion to pay cash dividends to shareholders at a rate of 5%, equivalent to shareholders owning 1 share receiving VND 500.

The source of capital for payment is from undistributed profits after setting aside funds as of December 31, 2023 according to the Resolution of the 2024 Annual General Meeting of Shareholders.

Previously, in 2023, the bank spent nearly VND 4,000 billion to pay cash dividends to shareholders at a rate of 15%. At the same time, it distributed bonus shares at a rate of more than 39.19%.

Regarding TPB stock prospects, MB Securities (MBS) believes that the current price is 1.1x compared to BVPS in 2024, 26% lower than the 3-year P/B average (1.5x) and 15% lower than the P/B of banks in the industry in 2024.

According to MBS, TPB is a reasonable investment option with a profit growth rate of 20%/year in the period of 2024-2026 with gradually improving asset quality.

MBS expects NIM to recover in 2025, reaching 4% (+10 bps yoy), thanks to a 35 bps improvement in asset yields, as higher interest rates and increased retail lending demand will result in higher lending yields.

Regarding business performance, in the first 6 months of 2024, TPBank's net interest income increased by 14% to VND 6,664 billion. The bank reported pre-tax net profit of nearly VND 3,733 billion and after-tax profit of nearly VND 2,986 billion, up 20% compared to the first 6 months of 2023.

As of March 31, 2024, TPBank's total assets reached VND 361,555 billion, a slight increase of 1.37% compared to the beginning of the year. Of which, customer loans increased by nearly 4% over the same period last year to nearly VND 210,530 billion.

Regarding loan quality, at the end of March 2024, TPBank's total bad debt was VND 4,399 billion, an increase of 4.7% compared to VND 4,200 billion in the same period last year. As a result, TPBank's bad debt/loan balance ratio increased from 2.05% at the end of 2023 to 2.06%.

Of which, substandard debt (group 3 debt) increased by 7.2% to VND1,779 billion, doubtful debt (group 4 debt) increased by 11% to nearly VND1,582 billion. Only debt with the possibility of losing capital (group 5 debt) decreased slightly compared to the beginning of the year to VND1,038 billion.

Source: https://www.nguoiduatin.vn/co-phieu-tpbank-tim-theo-ngan-hang-cham-dinh-2-nam-204240926144115196.htm

![[Photo] Queen of the Kingdom of Belgium and the wife of President Luong Cuong visit Uncle Ho's Stilt House](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/1/9752eee556e54ac481c172c1130520cd)

![[Photo] Myanmar's capital in disarray after the great earthquake](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/1/7719e43b61ba40f3ac17f5c3c1f03720)

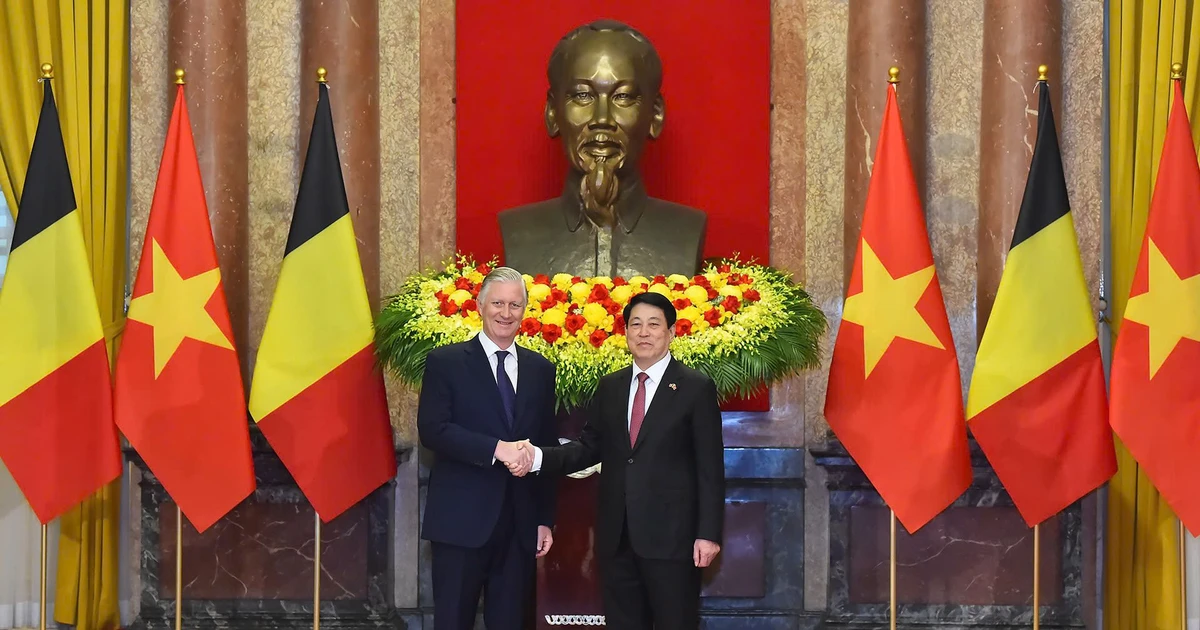

![[Photo] Prime Minister Pham Minh Chinh meets with King Philippe of Belgium](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/1/be2f9ad3b17843b9b8f8dee6f2d227e7)

![[Photo] President Luong Cuong and King Philippe of Belgium visit Thang Long Imperial Citadel](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/1/cb080a6652f84a1291edc3d2ee50f631)

![[Photo] President Luong Cuong and the King of Belgium witness the Vietnam-Belgium document exchange ceremony](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/1/df43237b0d2d4f1997892fe485bd05a2)

Comment (0)