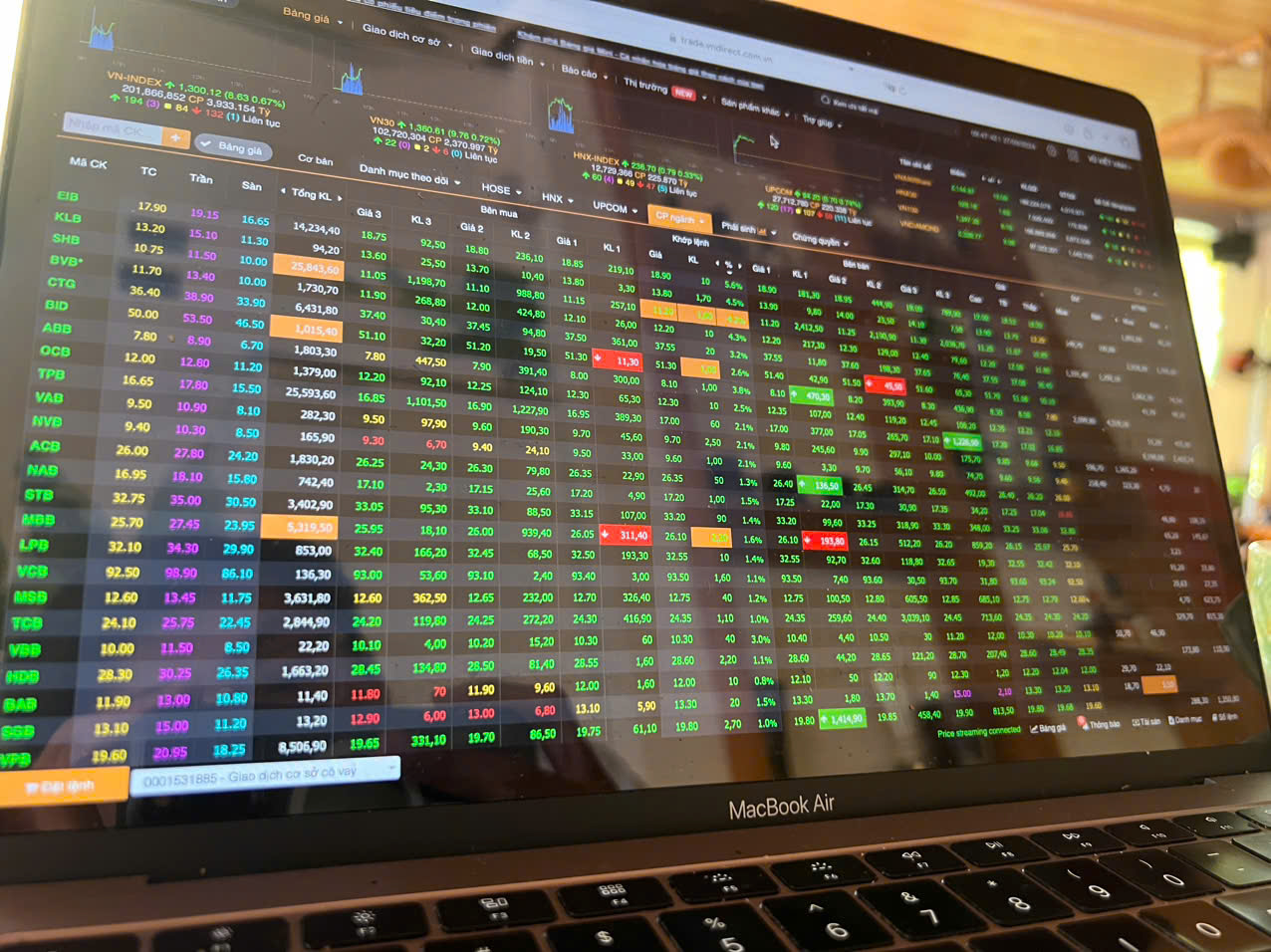

In the first 45 minutes of the trading session on September 27, the consensus of banking stocks pulled the VN-Index to 1,300 points after many unsuccessful attempts to conquer this mark.

At 8:45 a.m., VN-Index increased by 8.5 points to 1,300.08 points when all banking stocks increased in price. Of which, EIB and KLB increased the most by 5.6% and 4.5%; other codes such as SHB, BVB, CTG, BID, ABB all increased by over 3% each; the remaining codes all recorded an increase of over 1%.

Many individual investors are worried about being "left behind" so they pour money into buying this group of stocks, causing the matched value to skyrocket.

VN-Index hit 1,300 points a few minutes after opening the trading session on September 27.

Other industry stocks also recorded quite positive growth such as securities, real estate, iron and steel... helping the number of increasing stocks on the market to dominate compared to decreasing stocks.

Trading value increased significantly compared to the previous session, with HoSE alone reaching nearly 4,000 billion VND.

However, after the VN-Index surpassed 1,300 points, profit-taking pressure appeared, causing the index to not maintain this level and narrow its increase. By around 10 a.m., the increase was only about 5 points, with the VN-Index trading around 1,296 points.

According to Vietcombank Securities Company (VCBS), the market is showing caution as the VN-Index approaches the 1,300 point mark.

The company recommends that investors should not chase high-priced stocks, especially those that are at their peak and showing signs of strong selling. At the same time, stock "players" can hold stocks that attract cash flow in the banking and real estate groups; can take advantage of fluctuations in each session to disburse some stocks in the oil and gas industry, public investment, etc.

Source: https://nld.com.vn/co-phieu-ngan-hang-dong-thuan-keo-vn-index-cham-1300-diem-196240927100310069.htm

![[Photo] Closing of the 11th Conference of the 13th Central Committee of the Communist Party of Vietnam](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/12/114b57fe6e9b4814a5ddfacf6dfe5b7f)

![[Photo] Overcoming all difficulties, speeding up construction progress of Hoa Binh Hydropower Plant Expansion Project](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/12/bff04b551e98484c84d74c8faa3526e0)

Comment (0)