Major US tech stock indexes fell sharply at the close on September 3 (local time), most notably Nvidia, which lost $279 billion in value. This news led to a sharp decline in similar stocks in Europe and Asia.

Waiting for interest rate cut from Fed

Shares of US-based multinational technology company Nvidia fell 9.5% at the close of trading on September 3 (local time), marking the biggest one-day decline in market capitalization ever for a US company. The “evaporation” of Nvidia’s stock price comes after a wave of sell-offs in technology stocks as investors are skeptical about the prospects for artificial intelligence (AI) development and the ability to recover profits after investing in this field. The new development means Nvidia has lost $279 billion in market capitalization.

Investor skepticism about the return on investments in big tech companies has spread to Wall Street’s most valuable companies in recent weeks. Shares of the iShares Semiconductor Fund fell 7.6%, while Intel, Marvell Technology and Micron all fell at least 8%. Large-cap tech stocks fell broadly, with Apple, Meta Platforms, Amazon, Alphabet and Microsoft (MSFT) all falling.

US stocks had rallied strongly in August as investor concerns about the health of the economy eased and expectations of further interest rate cuts from the Federal Reserve soon mounted. However, the trend reversed in early September, the first session after the US Labor Day holiday (September 2). Fed Chairman Jerome Powell has hinted that a rate cut is coming, possibly as early as the September meeting, but added that US economic data due on September 6 will drive decisions on the pace and extent of rate cuts.

European and Asian stocks fell as well.

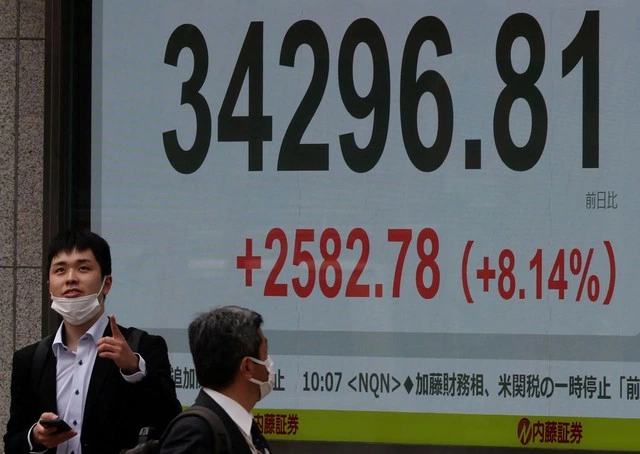

European stocks also fell in early trading on September 4, following the US. The pan-European Stoxx 600 index fell 1.1% in early trading, with all sectors falling. Technology stocks fell 2.5%, while autos and banks fell 1.3%. In Asia, according to the Japan Times, stocks in Japan had their biggest drop in a month. The blue-chip Nikkei 225 stock average fell 4.7%, the biggest drop since the 12% crash on August 5. Japan's overall Topix index lost 3.7%. Technology stocks in South Korea, India, Thailand, and Indonesia all fell on September 4.

The AI-fueled stock rally has ended, and the stock market's performance is raising concerns about a recession, said Tomoichiro Kubota, senior market analyst at Matsui Securities. Concerns about higher borrowing costs in Japan have also resurfaced after Bank of Japan Governor Kazuo Ueda reiterated that the central bank will continue to raise interest rates if the economy and prices perform as expected. Ueda's comments helped the yen maintain a 1% gain against the dollar. Some analysts see the stock market's recent decline as a temporary reaction rather than the start of another crisis.

KHANH MINH compiled

Source: https://www.sggp.org.vn/co-phieu-cong-nghe-toan-cau-giam-manh-post757238.html

![[Photo] "Beauties" participate in the parade rehearsal at Bien Hoa airport](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/11/155502af3384431e918de0e2e585d13a)

![[Photo] Looking back at the impressive moments of the Vietnamese rescue team in Myanmar](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/11/5623ca902a934e19b604c718265249d0)

![[Photo] Summary of parade practice in preparation for the April 30th celebration](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/11/78cfee0f2cc045b387ff1a4362b5950f)

Comment (0)