Many opinions are concerned about the risk of goods from other countries evading origin, impersonating Vietnamese goods to export to the US to enjoy low tax rates after President-elect Donald Trump officially returns to the White House in early 2025. However, according to experts and businesses, the trade war in the "Trump 2.0" era, if it exists, will increase opportunities for Vietnamese goods.

Trade war restart?

US President-elect Donald Trump recently announced that he may impose a 100% import tax on goods from BRICS members, including China, if the group "threatens the USD's position". Previously, Mr. Trump also threatened to impose a 25% import tax on all goods from Mexico and Canada and an additional 10% tax on goods from China on the first day of his inauguration. During the election campaign, this leader also proposed a 10% import tax on all products entering the US, while China alone could be subject to a 60-100% tax.

In fact, during his previous administration (2017-2021), Mr. Trump increased import tariffs to 25% on $350 billion worth of goods from China, starting with solar panels and washing machines in 2018. Then, steel and aluminum products exported to the US were also subject to additional tariffs, including those from allied countries. This year, the US continued to increase import tariffs on electric vehicles by 100%, solar panels by 50%, electric vehicle batteries by 25%, computer chips and medical products by 25%; and it is expected that by 2025, tariffs on semiconductors from China will increase to 50%.

Electronic products are among the billion-dollar export items to the US.

PHOTO: Pham Hung

Of course, China could not sit still and "responded" by increasing import tariffs on US soybeans and aircraft entering the country. In particular, last year, China launched a semiconductor war with the world's No. 1 economy by announcing that it would block public procurement contracts for Micron Corporation (USA) - a memory chip manufacturer - because it failed to pass the security assessment process, followed by a security assessment requirement for Intel products circulating in China. Notably, a quarter of the group's total revenue comes from the world's second largest economy. At the same time, from mid-2023, China began to tighten control over rare earth exports, restricting the export of 8 types of gallium and 6 types of germanium for national security reasons. These are metals commonly used in chip production.

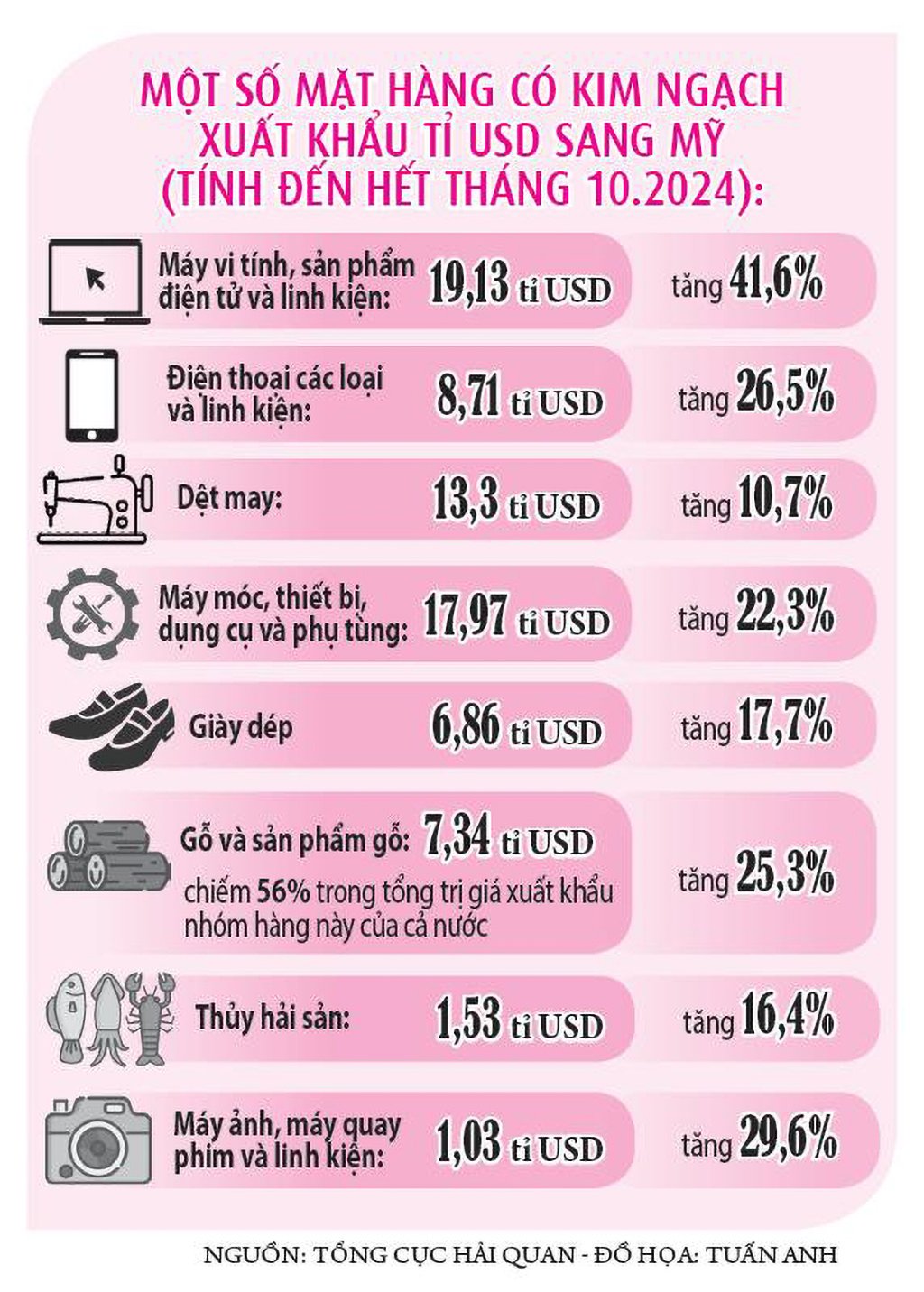

GRAPHICS: TUAN ANH

The first US-China trade war resulted in tariffs on about $550 billion of Chinese goods and $185 billion of US goods before ending with a trade deal in 2020. Now, on December 3, China officially announced a ban on the export of some rare earth minerals to the US, marking a new escalation in the technology war between the two sides. The move shows that China is willing to use the supply chain to exert pressure, especially by blocking the export of important materials for weapons and semiconductor production to the US.

Economist, Associate Professor, Dr. Nguyen Thuong Lang commented: Data shows that the impact of tariffs during Donald Trump's first term was almost unclear on the US economy. However, import tariffs are the leader's favorite tool and the situation may be different in his second term. With experience and preparation, the new round of tariffs can be implemented quickly, decisively and have a stronger impact on Chinese goods.

In the previous term, the US President spent nearly half a year to consolidate and arrange the personnel apparatus. Now, although not officially, he has arranged most of the key personnel, built a sharp staff. Moreover, at the present time, his political capacity and awareness of partners are also deeper and clearer after Mr. Trump had time to research and learn. Therefore, the imposition of tariffs on goods from other countries as declared by the President-elect is likely to happen. This time, the group of goods related to semiconductors, chips, energy batteries, etc. may be prioritized for promotion.

"However, it is important to note that the new US administration will consider how the tariffs will affect its citizens. With high import taxes, Americans will have to buy more expensive goods. Currently, goods produced in the US are always more expensive than imported goods before the tariffs are imposed. A recent study by the Peterson Institute for Economics shows that President-elect Trump's import tariffs will cost each American family an additional $2,600 per year," Associate Professor, Dr. Nguyen Thuong Lang analyzed.

Risk of Vietnamese goods being affected?

According to experts, the risk of a repeat of the trade war is predicted to damage the supply chain and increase global production costs. In particular, economies in the Asia-Pacific region will be affected because they are major trading partners of both the US and China. Associate Professor, Dr. Nguyen Thuong Lang analyzed: Vietnam is one of the countries with a large trade surplus with the US.

Specifically, the US accounts for 30% of Vietnam's total export turnover, an estimated increase of nearly 25% compared to last year. Vietnamese goods exported to the US have also been "scrutinized" a lot recently due to the large trade deficit. If the US pursues a policy of protecting domestic production in the near future, it may impose higher tariffs on goods from Vietnam. It is even more important to note that when Vietnamese goods to the US increase, imported goods from China to Vietnam also increase sharply because we buy raw materials for export production.

"The US has filed anti-dumping lawsuits against many imported goods from Vietnam. If the US-Vietnam trade balance is too large, the risk of being subject to trade defense and anti-dumping taxes is very high. In general, Vietnam will be affected by the US's policy of imposing import taxes on goods from China. In particular, popular high-export products such as seafood, textiles, wooden furniture, etc. will be affected if not careful," this expert warned.

If a second trade war occurs, it will create opportunities for many key Vietnamese exports to the US and China.

PHOTO: Dao Ngoc Thach

Speaking to Thanh Nien, Ms. Le Hang, Communications Director of the Vietnam Association of Seafood Exporters and Producers (VASEP), also commented: If a trade war breaks out in the near future, it could lead to a short-term increase in seafood imports into Vietnam as companies from other countries seek to avoid future tariffs. This is a predictable scenario. The possibility that companies from China seek to sell to the US or other countries before the tariff increase could lead to congestion and delays at major US ports. On the other hand, there could be a shift of Chinese seafood companies to other countries, including Vietnam, creating more challenges than opportunities such as more intense competition for raw materials, and the reputation of Vietnamese products could be affected.

Mr. Nguyen Chanh Phuong, Vice President of the Ho Chi Minh City Handicraft and Wood Processing Association, admitted: "The fact that Chinese goods evaded taxes through Vietnam in the past may have appeared in many forms. Among them, we have seen a wave of FDI investment from China, either buying and selling, acquiring domestic enterprises, or standing behind to operate. China is currently very strong in processing technology, mastering the supply chain as well as building a complete e-commerce system. So in the short term, we can see both favorable and challenging situations. But in the long term, it may be very complicated to manage investment capital flows and shift supply chains in the tax war between the two largest markets in the world."

However, the latest report from the Multilateral Trade Department (Ministry of Industry and Trade) stated that there is little scientific evidence that Chinese goods are diverted through third countries (including Vietnam) to avoid high import taxes into the US market. During the previous term, the Trump administration imposed high taxes on a range of products, targeting more than 60% of Chinese goods, related to intellectual property rights. The data extended to 2023 also noted goods from Mexico and Vietnam. "But the signs are not large enough to show a major trend. For example, for Vietnam, the value of imported goods from China and the value of exported goods to the US have increased at a relatively similar rate for all goods, not just those that the US "screens", the Multilateral Trade Department said.

Opportunities for greater exports and FDI attraction

On the other hand, experts and businesses also believe that "there is always opportunity in danger". Mr. Nguyen Chanh Phuong said: "Export orders of businesses are favorable, many companies have orders for production until mid-2025. Notably, the US market, which contributes more than 55% of the total turnover of the industry, is clearly recovering. With the policy of imposing high taxes on goods from China, it is likely that exports of Vietnamese wooden furniture to this market will increase in the near future".

Similarly, Mr. Vu Duc Giang, Chairman of the Vietnam Textile and Apparel Association, analyzed: "The US is a major export partner of the Vietnamese textile and garment industry with a turnover of over 10 billion USD/year, accounting for 40%. On the other hand, Vietnam is also importing about 38-39 agricultural products from the US. Of which, the Vietnamese textile and garment industry is importing and is the largest customer of the US cotton industry, serving spinning factories. With such a close relationship, Vietnamese textile and garment enterprises are confident in quickly responding to policy requirements of other countries, including changes in US policy".

Textile and garment exports to the US are expected to remain positive under the new administration.

Photo: Ngoc Thang

Regarding seafood products, Ms. Le Hang also shares the same opinion. According to her, when the trade war escalates, the global supply chain may be disrupted, creating an opportunity for Vietnam to become a reliable alternative source for countries that want to avoid high tariffs from the US, especially for seafood products. Therefore, Vietnam can be chosen as an alternative supplier in the global supply chain. Specifically, the fact that Chinese seafood products become more expensive due to high tariffs may reduce the supply from this country, helping Vietnam increase its export market share to the US, especially for key products such as shrimp, pangasius and tuna.

"If the US and China have a trade conflict and China reduces seafood imports from the US, while it is the world's largest seafood consumer market, this will be an opportunity for Vietnam in the high-end segment such as lobster, crab, fresh seafood...", Ms. Le Hang commented.

Regarding investment, according to economist, Professor Ha Ton Vinh, if a second trade war does occur, Vietnam will have more advantages than disadvantages. The reason is that Vietnam is a country that has just signed a comprehensive cooperation agreement with the US, and is having a drastic strategy to develop the semiconductor industry - a field that the US is in great need of.

"China once applied a monetary policy in 2018-2019, allowing the yuan to depreciate against the USD when goods to the US were subject to tariffs. A cheaper currency makes Chinese exports cheaper for overseas buyers, thereby helping to reduce the damage caused by tariffs. China's strategic devaluation may have helped its exports not be much hurt by US tariffs. This time, China may apply that policy again, along with some other countermeasures related to rare earths and semiconductors. For Vietnam, high value-added industries, advanced technology, semiconductors, chips, etc. are the industries we are aiming for in the future. These industries are very much needed by Americans for economic development. Therefore, the escalating US-China trade tensions may help Vietnam attract more foreign direct investment (FDI). China is increasing investment in Vietnam, but the situation shows that attracting FDI from other US allied markets like South Korea, Taiwan and Japan also have an increasing trend.

Thanhnien.vn

Source: https://thanhnien.vn/co-hoi-va-thach-thuc-cho-hang-viet-thoi-ky-trump-20-18524120423051012.htm

![[Photo] Overcoming all difficulties, speeding up construction progress of Hoa Binh Hydropower Plant Expansion Project](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/12/bff04b551e98484c84d74c8faa3526e0)

![[Photo] Closing of the 11th Conference of the 13th Central Committee of the Communist Party of Vietnam](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/12/114b57fe6e9b4814a5ddfacf6dfe5b7f)

Comment (0)