Gold price receives positive forecast

After a week of "galloping" thanks to optimistic signals related to interest rate expectations, the gold market is expected to have many unpredictable fluctuations this week when a series of central banks, most importantly the US Federal Reserve (FED), will hold meetings and announce their interest rate decisions.

Currently, the market is leaning towards the possibility that the FED will cut interest rates by 25 basis points.

According to Mr. Heng Koon How - Head of Market Strategy, Global Market and Economic Research, UOB Group, since continuously breaking above 2,000 USD/ounce at the end of 2023, gold has shown no signs of cooling down and is expected to increase in the coming time.

Geopolitical instability drives gold buying as a “safe haven”.

Growing uncertainty in the global geopolitical landscape with two ongoing conflicts in Europe and the Middle East has supported safe-haven buying of gold.

In addition, the increase in gold reserves purchased by emerging market (EM) and Asian central banks is also a positive factor supporting gold prices. In particular, China has attracted the world's attention with its strong allocation to gold.

According to an update from the World Gold Council (WGC), as of May 2024, China’s official gold holdings had increased to around 2,300 tonnes, or approximately 5% of its total reserves. This is an increase of around 20% compared to 1,900 tonnes just two years ago in 2022.

The latest Kitco News weekly gold survey shows that industry professionals and retail investors are both bullish on gold’s upside potential, but remain skeptical and more cautious than in recent weeks.

Thirteen analysts participated in the Kitco News gold survey this week. The majority of experts remain bullish on gold. Eight experts expect gold prices to rise this week.

While three other analysts believe gold will trade lower this week, the remaining two experts predict the precious metal will trade sideways.

Meanwhile, 189 votes were cast in Kitco's online poll, with 107 traders expecting gold prices to rise this week.

While 47 people expect the precious metal to fall. The remaining 35 respondents predict gold prices to move sideways this week.

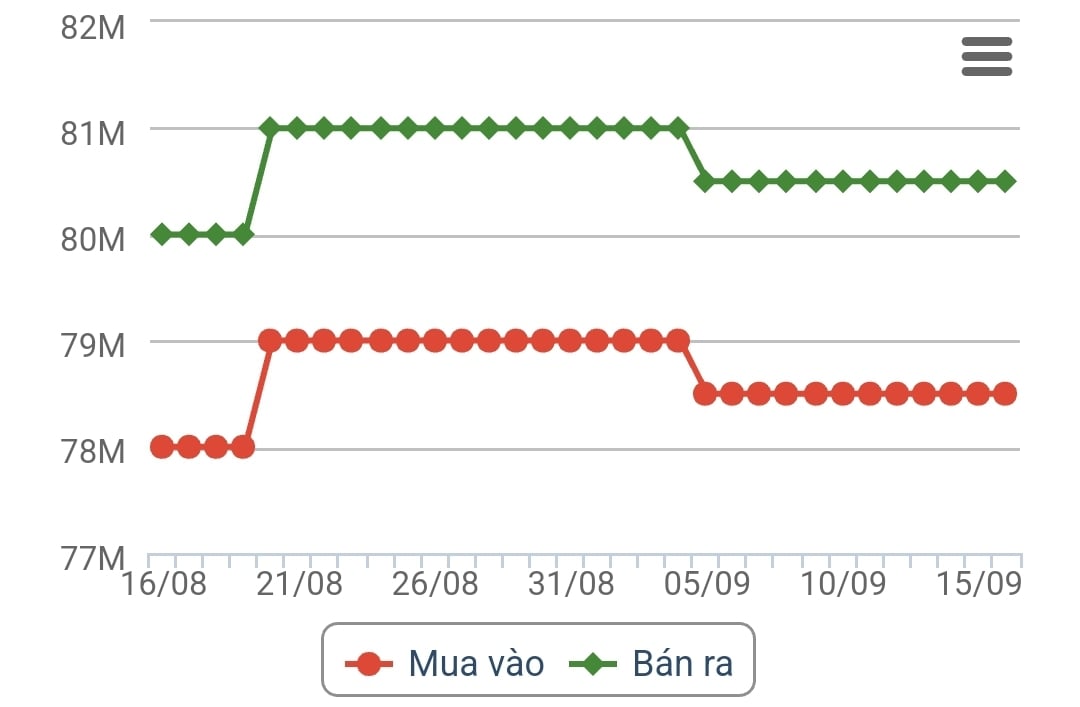

Gold price update

Recorded at 8:00 a.m. on September 16, SJC gold price was listed by DOJI Group at 78.5 - 80.5 million VND/tael (buy - sell).

The difference between buying and selling price of SJC gold at DOJI Group is at 2 million VND/tael.

Meanwhile, Saigon Jewelry Company SJC listed the price of SJC gold at 78.5 - 80.5 VND/tael (buy - sell).

The difference between buying and selling price of SJC gold at Saigon Jewelry Company is at 2 million VND/tael.

The price of 9999 Hung Thinh Vuong round gold ring at DOJI is listed at 77.9-79.1 million VND/tael (buy - sell); unchanged.

Bao Tin Minh Chau listed the price of gold rings at 77.88-79.08 million VND/tael (buy - sell), unchanged.

As of 8:30 a.m. on September 16, the world gold price listed on Kitco was at 2,581.5 USD/ounce.

Source: https://laodong.vn/tien-te-dau-tu/chuyen-gia-du-bao-ve-gia-vang-tuan-nay-1394379.ldo

![[Photo] The 9th Vietnam-China Border Defense Friendship Exchange](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/16/10e73e2e0b344c0888ad6df3909b8cca)

![[Photo] President Luong Cuong meets 100 typical examples of the Deeds of Kindness Program](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/16/ce8300edfa7e4afbb3d6da8f2172d580)

![[Photo] Opening of the Exhibition on Green Growth](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/16/253372a4bb6e4138b6f308bc5c63fd51)

![[Photo] Prime Minister Pham Minh Chinh receives Cambodian Deputy Prime Minister Neth Savoeun](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/16/e3dc78ec4b844a7385f6984f1df10e7b)

![[Photo] General Secretary To Lam gave a speech at the National Conference to disseminate the Resolution of the 11th Central Conference, 13th tenure.](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/16/04e0587ea84b43588d2c96614d672a9c)

![[Photo] The capital of Binh Phuoc province enters the political season](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/16/c91c1540a5744f1a80970655929f4596)

Comment (0)