Collateral value is 3 times greater than outstanding debt

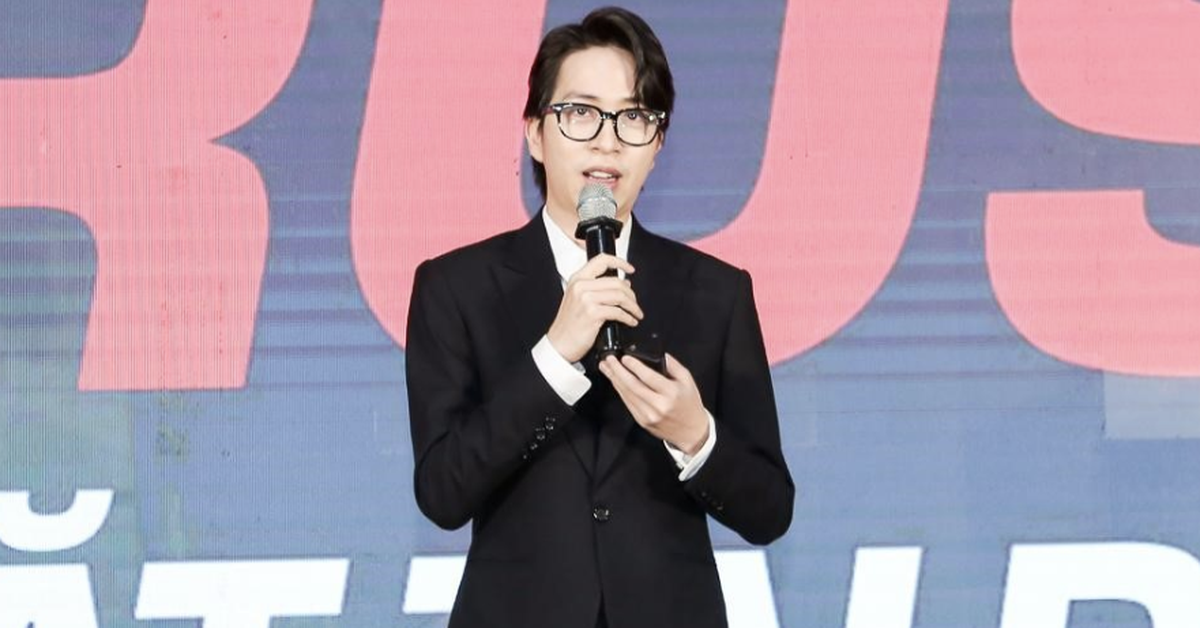

At the Military Commercial Joint Stock Bank's investor conference on the afternoon of August 5, Mr. Luu Trung Thai, Chairman of the Board of Directors, answered investors' concerns about the debts of several large enterprises such as Novaland, Trung Nam Group, Sun Group, Vingroup as well as the provisioning for debts of this group.

Regarding Trung Nam Group, a company known as an investor in large renewable energy projects, MB’s chairman said that the outstanding debt of Trung Nam Group’s customer group has decreased by VND2,000 billion this year. All three independent projects of Trung Nam funded by MB are operating well and are not classified as bad debt by the bank.

“We only focus on lending to solar power projects. These projects are operating on schedule and have good electricity prices, so they can ensure cash flow to repay the debt. This group of projects is operating well and has the ability to repay the debt to MB in the near future,” said Mr. Luu Trung Thai.

Regarding the debt of the Nova Group's customer group, Mr. Thai informed that the outstanding debt has decreased by about 1,500 billion VND from 2023 to present. The debt of the Nova group is not in the situation that investors are worried about because MB only lends to 3 projects that are progressing well: Novaland Phan Thiet, Aqua City Dong Nai, and Nova Ho Tram project in Vung Tau.

“The Novaland Phan Thiet project has shown quite positive signs and has no legal problems, it is just in the process of land valuation according to the new Land Law. The remaining two projects, Aqua City in Dong Nai and a project in Vung Tau, also have full documents, both are in the process of selling. In which, the Aqua City project is monitored and updated regularly by MB to complete legal procedures. This process is being implemented well and is one of the projects chosen by the Government as a point to remove difficulties for real estate projects,” Mr. Thai expressed.

MB's Chairman affirmed that he "sees no problem" with Nova's debt repayment cash flow this year, and expects that the two projects in Phan Thiet and Dong Nai will complete their business plans in 2025.

Regarding Sun Group customers, Mr. Luu Trung Thai affirmed that there are "no difficulties" in terms of collateral or cash flow to repay customers' debts.

Currently, MB's outstanding loans to Sun Group mainly focus on tourism projects such as Sun World Fansipan Legend or Sun World Ba Den Mountain project. These are projects that are being exploited and have a stable customer base and steady cash flow.

In addition, some real estate projects of Sun Group are also funded by MB but the credit scale is small. The bank balances these two sources harmoniously so that customers can get through the difficult period of the real estate market.

“With Sun Group customers, we can completely control the quality (credit - PV)”, the chairman affirmed.

With outstanding loans from Vingroup customers, MB only prioritizes disbursement for projects with full legal documents and final products. Moreover, Vingroup's sales speed is also very fast, so the bank still controls these loans very well.

“The common point for the group of 4 large corporate customers mentioned above is that the value of collateral is always 3 times larger than the size of the outstanding loan balance. Therefore, we strictly control each project, as well as pay constant attention,” Mr. Thai informed investors.

Reached 28 million customers, bad debt below 2%

By the end of June, MB's credit increased quite well at 9.4% and increased evenly in all segments. Notably, bad debt returned to below 2% and was controlled at 1.64% (consolidated) and 1.42% (individual).

Ms. Pham Thi Trung Ha, Deputy General Director of MB, said that although the economy has shown signs of improvement, the bank assessed that the cash flow of individual customers has not yet recovered to the level of previous years. Therefore, the bank assessed that bad debt of individual customers still has the potential to increase.

Regarding the asset quality of Mcredit Finance Company, Mr. Luu Trung Thai said that this year the bad debt of this finance company is about more than 8%.

Mcredit’s business model is somewhere between installment lending and cash lending. MB is improving this model and hopes that Mcredit’s performance will improve by the end of this year.

Mr. Phan Phuong Anh - General Director of MBS said that the number of MB customers is reaching the top 1 in the market, total assets and outstanding loan market share are in the top 4. MB is among the banks with outstanding credit growth rate in the first 6 months of 2024. Ms. Nguyen Thi Thanh Nga - MB's Chief Financial Officer said that pre-tax profit in the first half of the year reached VND13,428 billion, up 5.4% over the same period in 2023, even though provision costs increased in the first half of the year. MB's card operations also recorded outstanding results, currently leading the market in the number of MB cards. Spending revenue increased sharply. |

Source: https://vietnamnet.vn/chu-tich-mb-trai-long-ve-no-cua-novaland-sun-group-vingroup-trung-nam-2308963.html

![[Photo] Schools and students approach digital transformation, building smart schools](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/29/9ede9f0df2d342bdbf555d36e753854f)

![[Photo] Unique Ao Dai Parade forming a map of Vietnam with more than 1,000 women participating](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/29/fbd695fa9d5f43b89800439215ad7c69)

![[Photo] Training the spirit of a Navy soldier](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/29/51457838358049fb8676fe7122a92bfa)

![[Photo] Flower cars and flower boats compete to show off their colors, celebrating the 50th anniversary of Da Nang Liberation Day](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/28/086d6ece3f244f019ca50bf7cd02753b)

Comment (0)