VinaCapital, Dragon Capital, and VCBF say their "secret" is to carefully select stocks and value them, while always assessing and managing risks appropriately.

In 2023, the stock market had a significant recovery. The uptrend from May to around September helped the VN-Index to approach the 1,250-point mark. However, the strong correction from late September to the end of October became a "crash" for many individual investors and some professional organizations. However, thanks to the recovery in the last two months, the VN-Index closed 2023 with a performance (growth rate in %) of about 12.2%. The market recorded many open-end investment funds with much better performance than the above figure.

Leading the way is Vietcombank Fund Management Company's Growth Stock Investment Fund (VCBF-MGF) with an increase of nearly 32%. This performance helps the fund recover the lost amount in 2022 and bring in additional profits in 2023.

In second place, VinaCapital Market Access Equity Fund (VESAF) has a performance of more than 30.8%. This fund has been established for more than 6 years, investing mainly in listed stocks with small and medium capitalization, stocks with foreign ownership limits, especially stocks that have run out of "room" for foreign investors.

Followed by SSI Sustainable Competitive Advantage Fund (SCA) with an increase of more than 28.4% in 2023. SCA actively invests, focusing on companies with sustainable competitive advantages, large market share, good governance capacity, strong financial situation, ability to operate well in unfavorable market conditions and are attractively valued.

In addition to the three funds mentioned above with performance of over 30%, the market recorded about 10 more open-ended funds with growth rates higher than the VN-Index.

Carefully selecting stocks is a common strategy of funds to have better investment performance than the general market level .

Dragon Capital said it has focused on stocks of good companies with cheap valuations but were "oversold" in 2022 such as stocks, steel, real estate, fertilizers, chemicals and oil and gas... In 2023, these will become industry groups with strong stock price recovery and market leadership.

"We always closely follow macro developments, market fluctuations and businesses to restructure the portfolio to optimize profits as well as balance risk management for the portfolio," Mr. Vo Nguyen Khoa Tuan - Senior Director of Securities at Dragon Capital, added.

Sharing with VnExpress , Ms. Nguyen Hoai Thu - General Director of VinaCapital Securities, said that choosing businesses to invest in and building an optimal portfolio between profit and risk are key factors for this unit's funds to achieve high performance.

"Since 2022, when the stock market has faced many disadvantages, we have bought into companies that can withstand economic difficulties well and break out when the economy recovers," Ms. Thu shared.

When selecting a company, growth is not the only factor, VinaCapital also analyzes the ability to generate future cash flow, debt ratio and long-term business development plan. This team focuses on evaluating the quality of the executive board, who must have strategic vision, be able to bring growth to the business for many consecutive years, and above all, be responsible for the interests of shareholders.

In addition to the intrinsic quality of the business, valuation is also one of the important criteria in VCBF's investment philosophy. After analyzing and gaining in-depth understanding of the business, this fund team will apply many different methods to determine the value to know at what price to buy or sell a stock. In addition, VCBF also determines investment with a long-term vision, avoiding buying and selling stocks at the wrong time by regularly evaluating the companies in the portfolio and comparing them with other investment opportunities.

"Selling stocks at the wrong time, especially when the market is down sharply, is one of the biggest and typical mistakes in investing," said Deputy Investment Director Nguyen Trieu Vinh.

Similarly, VBCF claims to be very patient when buying stocks, typically with MGF - the best performing fund last year. This fund was established at a time when the market peaked and many stocks had high valuations (December 2021), VCBF chose to disburse cautiously over 6 months, taking advantage of the market decline to buy good stocks.

Risk management is also the secret to helping investment funds overcome the strong correction in October 2023. Dragon Capital said that fund experts had realized in advance that the withdrawal of treasury bills could affect the market in the short term. They switched to increasing the cash ratio, taking profits and reducing the proportion of some stocks that had increased a lot such as steel, securities, and chemicals. Similarly, VincaCapital also promptly reduced the proportion of some stocks that had increased rapidly, exceeding the calculated target price before the market fell.

At the same time, the funds all share the view that this is also a good opportunity to "collect goods". VCBF believes that the macro challenges are only short-term and mainly due to impacts from the world macro. Looking at the medium and long term, Vietnam's economic growth potential is still very positive. "October 2023 is one of the good opportunities to buy stocks of high-quality companies at suitable prices", said Mr. Vinh.

Siddhartha

Source link

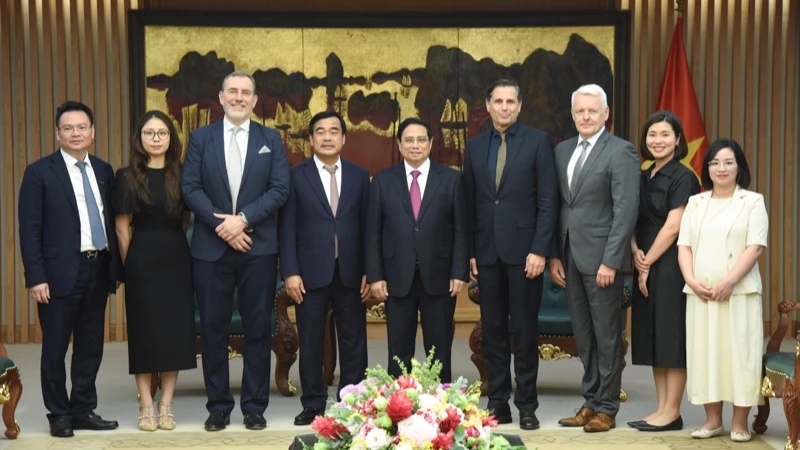

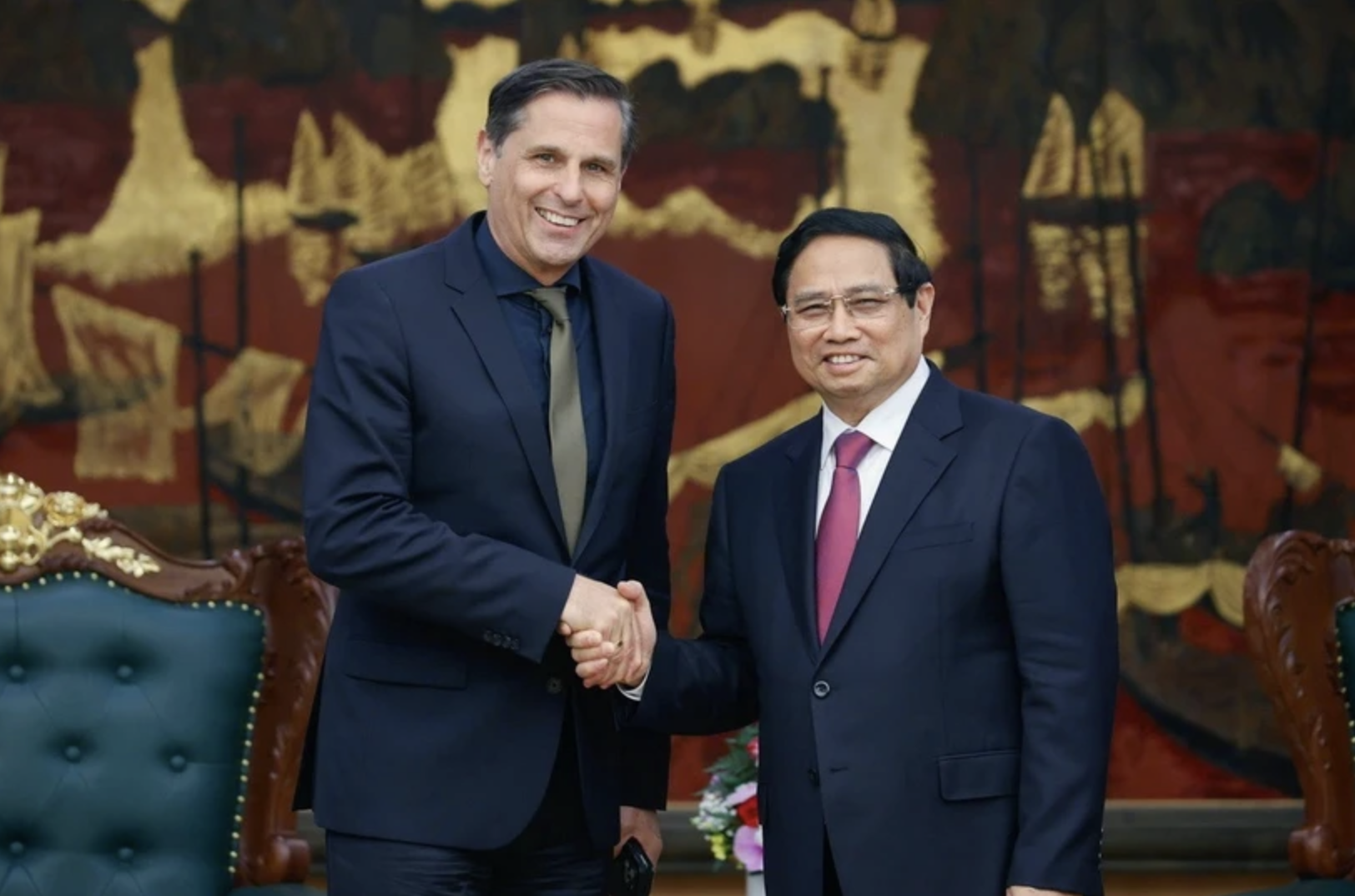

![[Photo] Prime Minister Pham Minh Chinh receives Chairman of Skoda Auto Group](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/27/298bbec539e346d99329a8c63edd31e5)

![[Photo] Admiring orange cotton flowers on the first "Vietnam heritage tree" in Quang Binh](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/28/7476a484f3394c328be4ac8f9c86278f)

Comment (0)