Since the end of 2022, deposit interest rates have been continuously adjusted downward to reduce lending interest rates to support businesses.

At the Government press conference held on the afternoon of July 4, Deputy Governor of the State Bank Dao Minh Tu said that since the beginning of the year, the State Bank has lowered interest rates four times, from 0.5% to 2% for operating interest rates.

Since then, commercial banks with data up to the end of June 2023, the average mobilization interest rate has decreased by 0.7-0.8%; the average lending interest rate has decreased by 1-1.2%.

Not long ago, data released by the State Bank showed that the average lending interest rate in the first 6 months of 2023 reached about 8.9%/year.

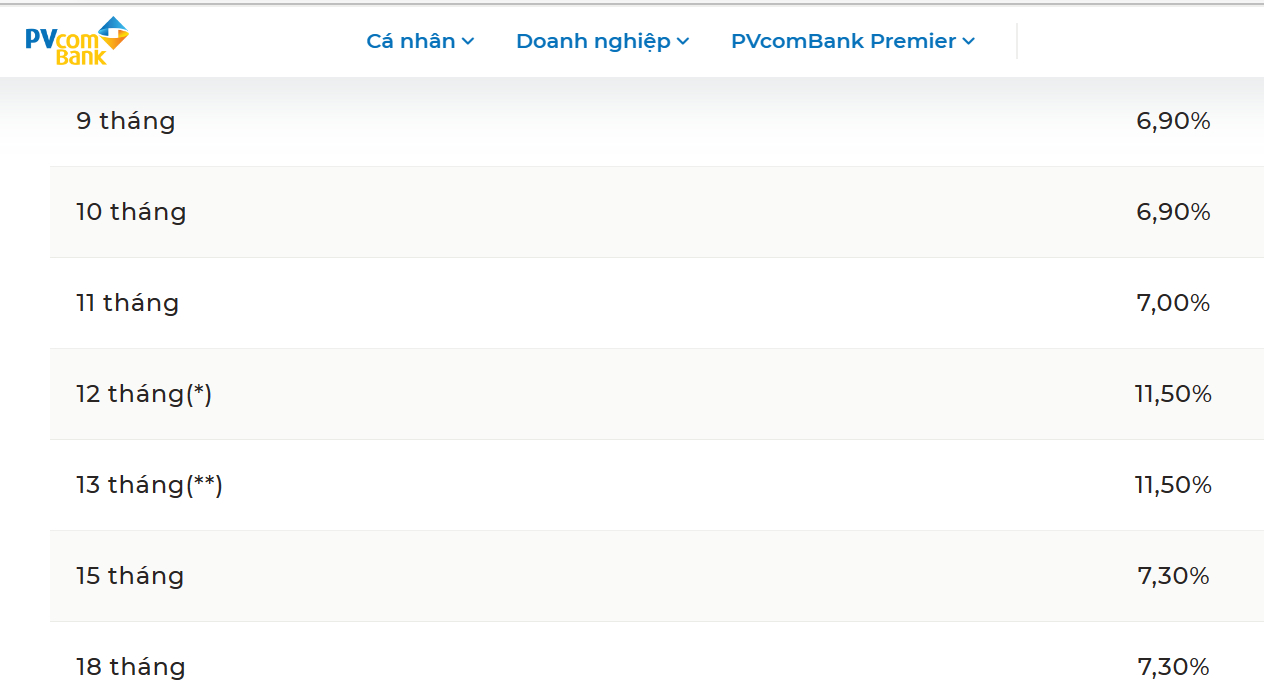

The highest interest rate on the market is currently 11.5%/year at PVComBank. However, only deposits worth over VND2,000 billion can enjoy this benefit. Screenshot

However, currently, the highest mobilization interest rate is still up to 11.5%, which is 1.3 times higher than the average lending interest rate.

Vietnam Public Joint Stock Commercial Bank (PVComBank) has surpassed all to become the bank with the highest deposit interest rate in the entire system. With 12-month and 13-month term contracts, depositors receive outstanding incentives of up to 11.5%/year. For other long terms, the highest rate at PVComBank is only 7.3%/year.

This program of PVComBank only applies to newly opened deposit balances of at least 2,000 billion VND. In case of deposit balances under 2,000 billion VND, the interest rate of 7.20%/year is applied.

An Binh Commercial Joint Stock Bank - ABBank also regularly makes its name on the list of banks with the highest deposit interest rates. The "ceiling" rate of 10.9%/year is applied from July 1, 2023.

The subjects of this program are cases of savings deposits of VND 1,500 billion or more on a 13-month term deposit - interest at the end of the term and must have the approval of the General Director.

The business unit must send information to the Personal Customer Division for review and approval by the General Director before implementation.

As you can see, it is not easy to enjoy this great offer.

While super-rich customers enjoy great benefits, for ordinary customers, the highest interest rate at ABBank is only 7.1%/year, applied to terms of 10 months, 11 months and 12 months.

Ho Chi Minh City Development Joint Stock Commercial Bank – HDBank also has an attractive program for the super-rich. With a deposit of over 300 billion VND, customers at HDBank will enjoy an interest rate of 8.6%/year for a 12-month term and 9.3%/year for a 13-month term. For ordinary customers depositing at the counter, the highest rate is only 7%/year for an 18-month term.

Vietnam Maritime Commercial Joint Stock Bank – MSB has a low interest rate policy. Accordingly, the highest rate when depositing at the counter at MSB is only 7%/year, applicable for terms from 12 months to 36 months. However, if depositing online, customers enjoy a higher rate of 7.4%/year.

Not stopping there, if participating in the “Special Interest Rate” program, depositors will receive up to 7.9%/year. To participate in this program, customers must have a minimum deposit of 5 billion VND and can only open 1 book at a time.

But the most attractive is the interest rate of 9%/year (12-month and 13-month terms). However, this incentive is only for the super-rich when MSB stipulates that the deposit amount must be over 500 billion VND.

Nam A Commercial Joint Stock Bank - NamABank also offers a very attractive option for customers. With deposits of over 500 billion VND and a term of 36 months at NamA Bank, customers will receive an interest rate of 8.5%/year. However, this deposit also needs to be approved by the bank's leadership.

DongA Bank also “broke” the 7%/year mark for a 12-month term. This means that the interest rate at this bank is at a very low level. The only interest rate above 7% is for a 13-month term at 7.1%/year.

However, for 13-month term deposits, interest paid at maturity and deposit value over VND500 billion, DongA Bank applies a margin of up to 1.2%/year. That means the highest rate that customers at DongA Bank have the opportunity to receive will be 8.3%/year.

Orient Commercial Joint Stock Bank – OCB also gives priority to deposits worth over 50 billion VND. The interest rate applied to 6-month electronic deposits is increased by 0.3 percentage points/year to 7.6%/year and 12-month deposits are increased by 0.1 percentage points/year to 7.7%/year.

Source

![[Photo] President Luong Cuong receives Ethiopian Prime Minister Abiy Ahmed Ali](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/16/504685cac833417284c88a786739119c)

![[Photo] North-South Expressway construction component project, Bung - Van Ninh section before opening day](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/17/ad7c27119f3445cd8dce5907647419d1)

![[Photo] Many practical activities of the 9th Vietnam-China border defense friendship exchange](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/16/3016ed3ef51049219574230056ddb741)

![[Photo] Opening of the 4th Summit of the Partnership for Green Growth and the Global Goals](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/16/488550ff07ce4cd9b68a2a9572a6e035)

![[Photo] National Assembly Chairman Tran Thanh Man meets with Ethiopian Prime Minister Abiy Ahmed Ali](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/16/c196dbc1755d46e4ae7b506c5c15be55)

![[Video] Viettel officially puts into operation the largest submarine optical cable line in Vietnam](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/17/f19008c6010c4a538cc422cb791ca0a1)

Comment (0)