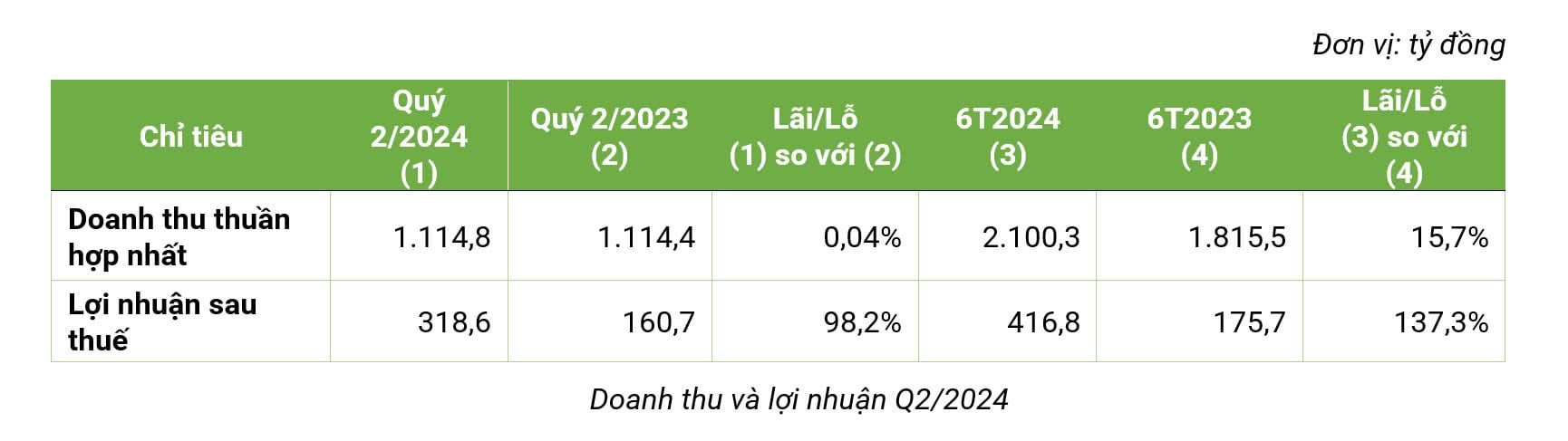

According to the recently released financial report for the second quarter of 2024, Bamboo Capital recorded VND 1,114.8 billion in net revenue, up only 0.04% over the same period in 2023. In the first 6 months of 2024, Bamboo Capital's consolidated net revenue reached VND 2,100.3 billion, up 15.7% over the same period. The revenue structure was mainly contributed by the following segments: renewable energy (VND 689.8 billion) - accounting for 32.8%; infrastructure construction (VND 560.7 billion) - accounting for 26.7%; financial services (VND 366.0 billion) - accounting for 17.4% of Bamboo Capital's total revenue.

Bamboo Capital's after-tax profit in the first 6 months of the year reached VND 416.8 billion, up 137.3% over the same period in 2023. Financial expenses decreased sharply by VND 413.0 billion, equivalent to a decrease of 32.1% compared to the second quarter of the previous year. In addition to the growth in revenue, the main reason for Bamboo Capital's profit breakthrough was thanks to the effective management of financial expenses from BCG Energy. BCG Energy proactively repurchased all 2 separate bond lots worth VND 2,500 billion in advance, helping to reduce the great pressure on interest rates and collateral management costs of this bond lot.

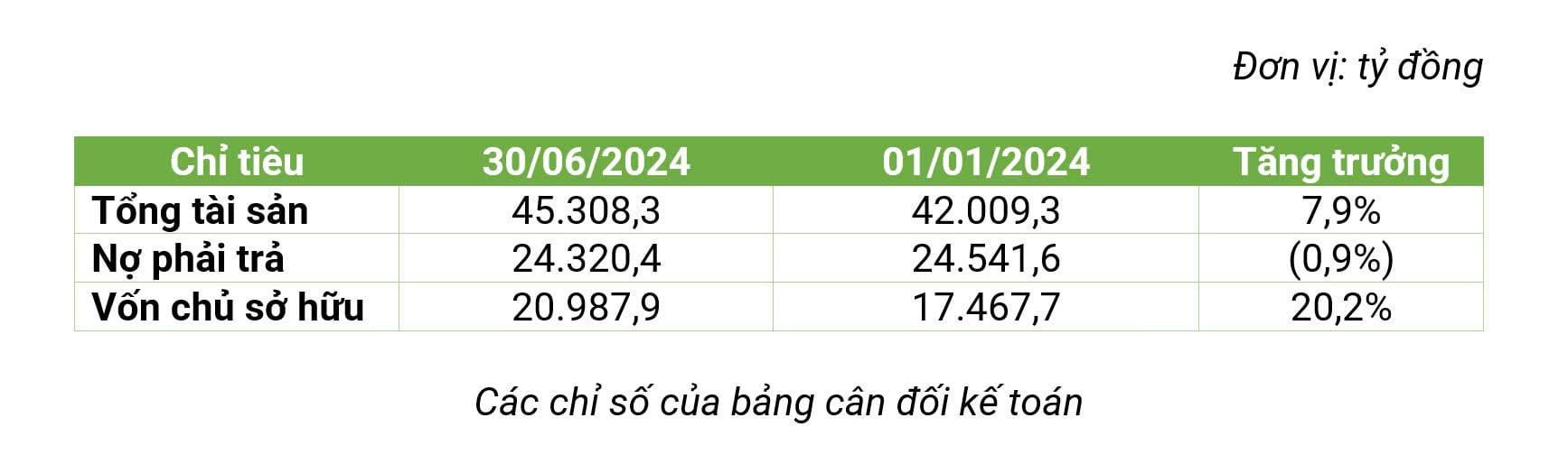

Bamboo Capital's total assets as of June 30, 2024 reached VND 45,308.3 billion, an increase of 7.9% compared to the beginning of 2024 due to the merger of Tipharco Pharmaceutical Joint Stock Company (HNX: DTG) into the Bamboo Capital ecosystem.

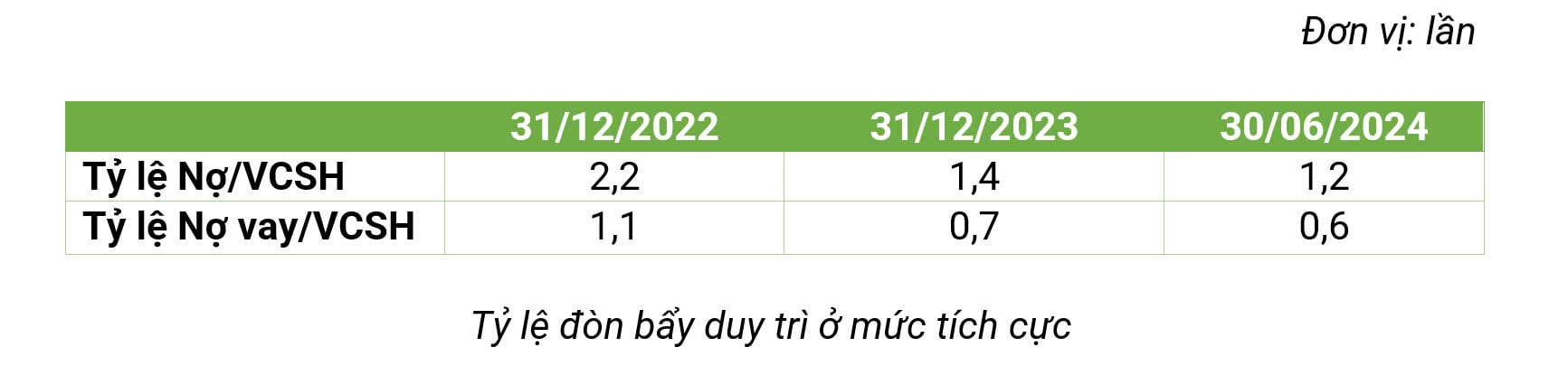

Notably, Bamboo Capital's equity as of June 30, 2024 was recorded at VND 20,987.9 billion, an increase of 20.2% compared to the beginning of the year thanks to the completion of Bamboo Capital's capital increase to VND 8,002 billion from the public offering of shares in the second quarter of 2024. Bamboo Capital's financial leverage ratio continued to decrease to a safe level.

Thanks to proactively increasing charter capital, the debt-to-equity ratio decreased significantly from 2.2 times at the end of 2022 to 1.2 times at June 30, 2024. In addition, Bamboo Capital's debt-to-equity ratio also decreased to 0.6 times. Investing heavily in capital-intensive industries such as renewable energy and real estate, achieving the above leverage ratios shows Bamboo Capital's great efforts to bring the debt balance to an ideal level, lower than that of businesses in the same industry.

In the first half of 2024, Bamboo Capital will continue to limit external investment activities and focus on investing in core business segments. In the cash flow statement, net cash flow from financial activities changed from negative VND 1,073.9 billion to positive VND 2,466.8 billion at the end of the second quarter of 2024 thanks to revenue from the public offering of shares. Bamboo Capital is actively adding capital to serve production and business activities, while maintaining liquidity at a safe level.

With the above business results, at the end of the second quarter of 2024, Bamboo Capital completed 34.4% of the revenue plan and 43.8% of the after-tax profit plan submitted at the 2024 General Meeting of Shareholders.

In the real estate sector, taking advantage of the time when the real estate market shows signs of recovery, BCG Land plans to hand over and operate the entire condotel block of the Malibu Hoi An project, speed up the progress of projects: King Crown Infinity, Hoian d'Or and the rest of Malibu Hoi An to soon hand over products to customers. It is expected that in the third quarter of 2024, BCG Land will organize the opening sale of the King Crown Infinity project.

Bamboo Capital's energy sector has received a lot of good news. The subsidiary in charge of this sector, BCG Energy, has just announced its consolidated financial report for the first 6 months of 2024 with impressive business growth results. Net revenue reached 689.8 billion VND, up 22%; profit after tax also increased sharply, reaching 290.7 billion VND, 33 times higher than the same period last year. On July 31, BCG Energy officially traded 730 million shares on UPCoM, stock code is BGE and reference price is 15,600 VND/share.

In addition, BCG Energy is urgently implementing the Dong Thanh 1 (80 MW capacity), Dong Thanh 2 (120 MW capacity) wind power projects in Tra Vinh province and Khai Long 1 (100 MW capacity) wind power projects in Ca Mau. These projects are expected to be operational in 2025 and will help increase BCG Energy's total power generation capacity by more than 50%. BCG Energy has also just started construction of the Tam Sinh Nghia waste-to-energy plant in Cu Chi, Ho Chi Minh City.

(Source: Bamboo Capital)

Source: https://vietnamnet.vn/bamboo-capital-loi-nhuan-quy-ii-tang-truong-gap-doi-nang-luong-dong-gop-lon-2307302.html

Comment (0)