Mr. Mai Son, Deputy Director of the Tax Department - Photo: VGP/HT

The Tax Department (Ministry of Finance) said: In order to support an additional channel for convenient tax payment for households and individuals doing e-commerce business, from December 19, 2024, the tax authority will operate the "Electronic information portal for households and individuals doing business to register, declare, and pay taxes from e-commerce and business on digital platforms".

As a result, by 10:00 a.m. on March 19, 2025, the E-commerce Portal supported more than 55,000 households and business individuals to register for tax, declare tax, and pay tax on the HKD E-commerce Portal with the amount paid to the State budget of nearly 410 billion VND. Of which, the 5 provinces and cities with the highest amount of direct tax payment on the portal are: Hanoi (261 billion VND), Ho Chi Minh City (71 billion VND), Nam Dinh (7.1 billion VND), Bac Ninh (5.4 billion VND).

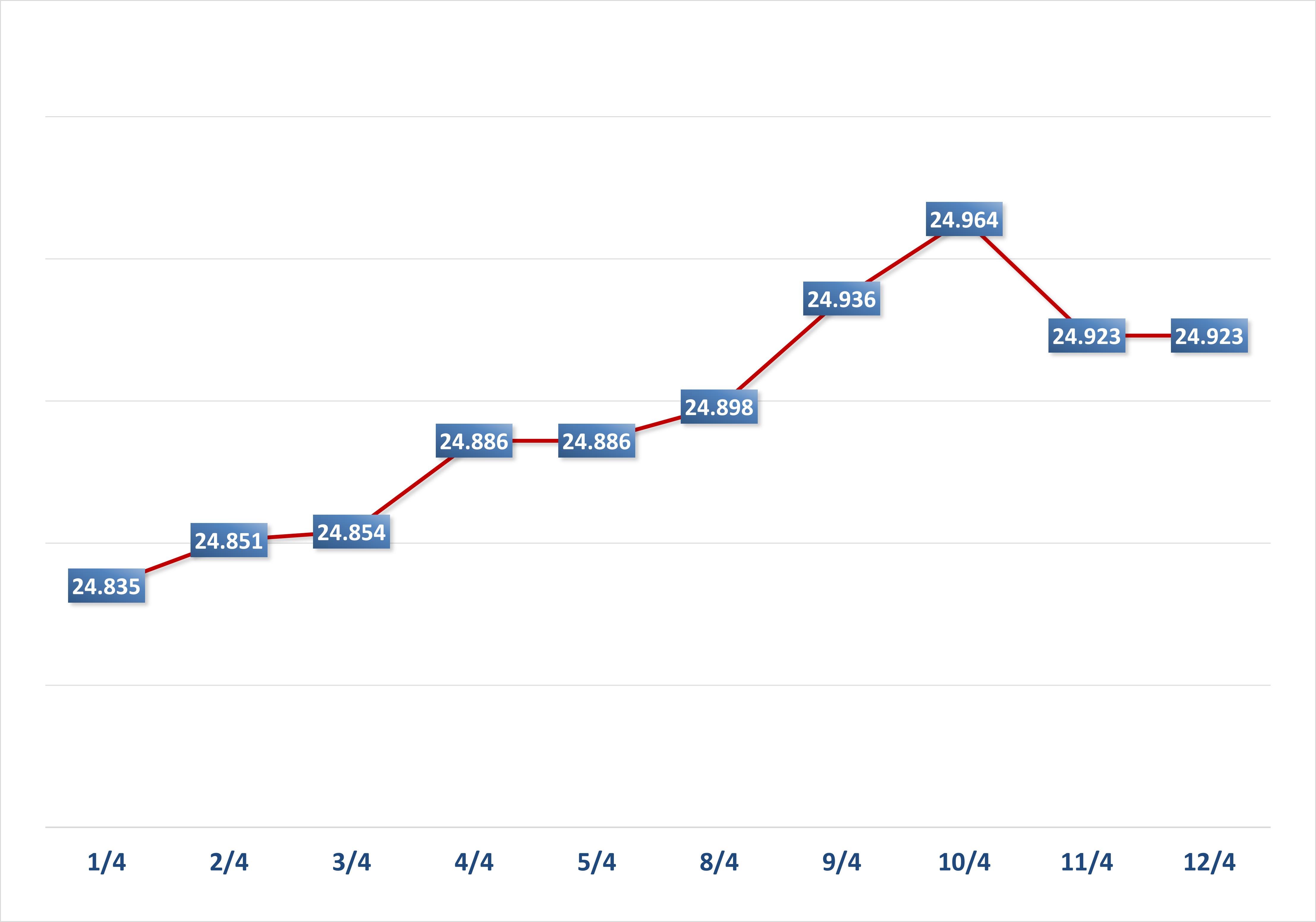

Since the implementation of the Foreign Supplier Portal (FCP), 135 FCPs have declared and paid taxes with a total tax amount of nearly VND 23 trillion.

In addition, implementing the provisions of Law No. 48/2024/QH14 on VAT; Law on Tax Administration (amended and supplemented by Law No. 56/2024/QH14 amending many Laws), to support organizations managing domestic and foreign e-commerce platforms that are subject to deduction and payment of taxes on behalf of others to deduct and pay taxes on behalf of others in accordance with the provisions of tax law; currently, the Tax Department is developing professional guidance documents for e-commerce activities.

At the same time, the Tax Department has also fully prepared the infrastructure to receive taxpayers who are organizations managing e-commerce platforms and digital platforms under the direct management of the Tax Department (E-commerce Tax Department), as well as tax declaration forms prescribed in the draft Decree regulating tax management for business activities on e-commerce platforms and digital platforms so that taxpayers subject to the Decree can implement it as soon as the Decree takes effect.

Sharing about tax management for e-commerce business activities at a recent press conference of the Ministry of Finance, Mr. Mai Son, Deputy Director of the Tax Department, said that according to the law, from April 1, e-commerce platforms must pay taxes on behalf of individuals doing business on the platform.

In the process of developing these regulations, the Tax Department has organized many working sessions with e-commerce associations and online trading floors. The goal is to facilitate businesses and individuals to fulfill their tax obligations, while saving costs for society. Allowing businesses to pay taxes on behalf of individuals with cash flow on the trading floor is considered a positive solution, not only helping to reduce costs but also ensuring transparency in tax management.

Tax authorities said that businesses will need to comply with legal regulations related to tax obligations. Currently, individuals doing e-commerce business, including those doing business on trading floors, can conveniently fulfill their tax obligations through the E-commerce Portal for individuals. Tax authorities have received and controlled a lot of information about revenue from e-commerce floors in Hanoi, Ho Chi Minh City and other localities.

The Tax Department representative also said: This agency has shared data with the Ministry of Industry and Trade to obtain accurate information on revenue from e-commerce, which helps tax agencies better manage online business activities. In addition, the tax agency is also closely coordinating with relevant local agencies to support and better manage the implementation of tax obligations of individuals doing e-commerce business. This is to ensure that taxpayers can easily fulfill their obligations, while minimizing risks in the tax management process.

"With these new orientations, the authorities are striving to build an effective and transparent tax management system for e-commerce activities, creating favorable conditions for the development of this sector in the future. Along with that, the implementation of regulations according to international practices will be focused on to ensure consistency and efficiency in tax management for the e-commerce sector," said a representative of the Tax Department.

Mr. Minh

Source: https://baochinhphu.vn/3-thang-thue-thuong-mai-dien-tu-tang-19-so-voi-cung-ky-102250405112123174.htm

![[Photo] Overcoming all difficulties, speeding up construction progress of Hoa Binh Hydropower Plant Expansion Project](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/12/bff04b551e98484c84d74c8faa3526e0)

![[Photo] Closing of the 11th Conference of the 13th Central Committee of the Communist Party of Vietnam](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/12/114b57fe6e9b4814a5ddfacf6dfe5b7f)

Comment (0)