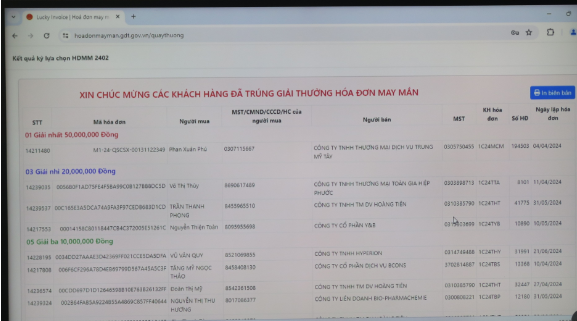

List of 14 people with winning invoices in the Lucky Invoice Program, Quarter II/2024

Specifically, Mr. Phan Xuan Phu (MST 0307115667) won the first prize, worth 50 million VND; 3 second prizes worth 20 million VND each include individuals: Vo Thi Thuy (MST 8690617489), Tran Thanh Phong (MST 8455965510), Nguyen Thien Toan (MST 8095955698).

5 third prizes, worth 10 million VND/prize, went to Mr. Vu Van Quy (MST 8521069855), Chu Thanh Tung (MST 8188942878) and Ms. Tang My Ngoc Thao (MST 8458408130), Doan Thi My (MST 8542361508), Nguyen Thi Thu Huong (MST 8017086377).

In addition, the Ho Chi Minh City Tax Department also identified 5 people winning consolation prizes, worth 5 million VND/prize.

Mr. Nguyen Tien Dung, Deputy Director of the Ho Chi Minh City Tax Department, said that the implementation of electronic invoices (E-invoices) in general and E-invoices with codes from cash registers in particular, has achieved positive results in digitalizing tax management, creating transparency, equality, improving the business environment and convenience for taxpayers.

As of August 11, in Ho Chi Minh City, there were more than 8,794 businesses and business households that had registered to use electronic invoices generated from cash registers, with the number of electronic invoices generated from cash registers being more than 298 million. At the same time, the Ho Chi Minh City Tax Department continues to coordinate with relevant agencies to closely inspect and monitor the issuance of invoices by gas and oil units and gold shops to ensure tax transparency and equality.

"The Lucky Invoice Program is implemented by the tax authority periodically every quarter. The results of this drawing have increased the number of people with lucky invoices to 129, with a total prize value of nearly 1.4 billion VND" - Mr. Dung added.

According to Mr. Nguyen Quoc Bao, Deputy Head of Inspection - Complaints and Denunciations Department No. 2 (Ho Chi Minh City Inspectorate), the Lucky Invoice Program organized by the Ho Chi Minh City Tax Department is objective, protects the rights of consumers; encourages sellers to connect data to tax authorities. Thereby, contributing to creating transparency in goods transactions and improving the efficiency of tax authorities' management, ensuring revenue for the budget.

Source: https://nld.com.vn/14-nguoi-o-tp-hcm-trung-thuong-185-trieu-dong-xo-so-hoa-don-196240822161501767.htm

![[Photo] Overcoming all difficulties, speeding up construction progress of Hoa Binh Hydropower Plant Expansion Project](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/12/bff04b551e98484c84d74c8faa3526e0)

![[Photo] Closing of the 11th Conference of the 13th Central Committee of the Communist Party of Vietnam](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/12/114b57fe6e9b4814a5ddfacf6dfe5b7f)

Comment (0)