By the end of 2023, the country will have more than 182 million personal payment accounts, equivalent to 87.08% of adults having a bank account. Many banks have processed over 95% of transactions on digital channels; the rate of customers making non-cash payments via electronic channels is about 50%.

The number of payment transactions via mobile devices and QR codes is also growing rapidly. Currently, there are 85 payment service providers implementing payment services via the internet and 52 organizations implementing via Mobile.

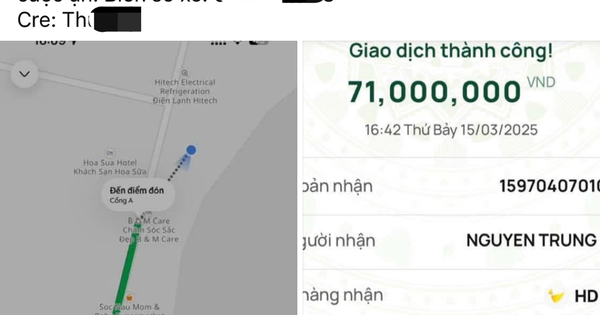

Statistics show that in the first 4 months of 2024, cashless payments reached about 4.9 billion transactions with a total value of more than VND 87 million billion (up 57% in quantity and 33% in value). Of which, transactions via the internet and mobile channels both increased sharply, especially payments via QR code method reached nearly 101.2 million transactions with a value of more than VND 126,800 billion (up 167% in quantity and more than 424% in value).

However, with the development of payment technology, cybercrime tends to increase with increasingly sophisticated, complex and unpredictable tricks. Many customers have been deceived and actively transferred money to accounts as instructed by criminals. These amounts of money are then transferred to other accounts (in the fraud network). Therefore, it is very difficult to help victims recover the lost money.

In that context, the State Bank has actively coordinated with the Ministry of Public Security and relevant agencies to deploy many measures to help prevent and minimize the risks of fraud, scams and loss of security and safety of payments. Among them, it is necessary to mention Decision No. 2345/QD-NHNN on implementing safety and security solutions in online payments and bank card payments (effective from July 1, 2024). Accordingly, this decision requires that individual electronic transactions with a value of over VND 10 million or a total payment value of over VND 20 million per day must apply one of the biometric authentication measures.

The essence of Decision No. 2345 is to check the information of the account opener to match the information on the ID card issued by the Ministry of Public Security, eliminating fake, unregistered, and illegal accounts. Thus, credit institutions will accurately identify and verify customers during the payment transaction process, contributing to preventing and minimizing crimes of renting, borrowing, buying, selling payment accounts, cards, e-wallets, etc. for illegal purposes.

Account owners register for biometric authentication at the bank. Photo: BINH AN

Currently, if a user's payment account information is unfortunately stolen, criminals can take over the phone. However, with the new regulation in Decision No. 2345, when transferring money, facial authentication must be performed. If it does not match the original profile, criminals cannot take the money. At the same time, when appropriating customer account information, criminals often install it on another device to carry out the appropriation. However, from July 1, banks require biometric authentication, criminals will not be able to install it on another device to take over money.

According to the State Bank of Vietnam, transactions over VND10 million only account for about 11% of total transactions. The number of people with transactions over VND20 million/day is also less than 1%. Therefore, biometric authentication does not greatly affect users' payment transactions but still contributes to minimizing fraud.

Statistics show that by the end of 2023, the Ministry of Public Security has issued more than 84.7 million chip-embedded ID cards and 70.2 million VNeID accounts, ensuring that "correct, sufficient, clean, and live" data has been connected and integrated with a number of other reliable data sources (social insurance, public services, etc.). This is an important source of input data, not only helping to identify and verify customers accurately, but also helping payment intermediaries have more information and input data to serve the analysis and evaluation of customers; design and provide products and services suitable to customers' needs.

Mr. TRAN CONG QUYNH LAN , Deputy General Director of VietinBank :

Continuously update security technology

The goal of Decision No. 2345 is to purge accounts that are not in the owner's name. This helps to clarify the cash flow and helps prevent fraud. In fact, in many situations, the victim is deceived and actively transfers money to the scammer. But the scammer's account is not the owner's (possibly due to previous forged documents), making it difficult to track down the scammer. Now, according to the new regulations, all account owners must authenticate and re-identify, and accounts that are not in the owner's name will not be able to transfer money over 10 million VND... At that time, the misappropriated money will be retained, creating conditions for the authorities to recover.

There are also opinions that biometrics can be deepfaked (a sophisticated fraud method that fakes customer images and videos), but when the first authentication includes NFC (reading information from the chip card on the CCCD) linked with data from the Ministry of Public Security and biometrics, it shows that this solution is still the safest and most feasible. In fact, there is no radical solution because bad guys constantly change their fraud methods and credit institutions must also constantly upgrade. Technology must always improve and currently the solutions in Decision No. 2345 will contribute to limiting online fraud crimes.

. Associate Professor, Dr. TRAN HUNG SON , Director of the Institute for Banking Technology Development Research (VNU-HCM):

AI application to detect fraud

The rate of damage caused by digital fraud in Vietnam is up to 3.6% of GDP, higher than the global average (1.1%) and surpassing countries such as Brazil or Thailand (both 3.2%). Common forms of fraud in digital payments in Vietnam include cyber attacks (malware, phishing, man-in-the-middle attacks), impersonation, social engineering fraud, refund policy abuse, first-party fraud... The rate of confirmed fraud in the Southeast Asia region increased by 5 percentage points last year to 54%.

To deal with the increasing fraud, banks and businesses need to deploy many solutions synchronously, in which the application of artificial intelligence (AI) and machine learning technology to detect fraud is an effective risk prevention method. Through smart algorithms, the AI system can continuously analyze transaction behavior, identify abnormal signs and promptly warn the operating unit as well as customers. By continuously "learning" from data, AI is becoming increasingly intelligent in detecting new forms of fraud.

In addition, payment service providers need to proactively cooperate, share fraud databases, and agree on common processing procedures. Completing the digital identification system will also contribute effectively to fraud prevention in payments.

Ms. DANG TUYET DUNG , Director of Visa Vietnam and Laos:

Investing billions of dollars in security

Visa has invested billions of dollars in AI-based solutions to prevent fraud and increase security awareness. We have also implemented a strategy to replace account information with a unique identifier. This strategy enhances security, allowing users to manage data sharing options across banking applications. The application of transaction encryption technology removes cardholder private information from the payment flow, enhancing security.

Visa is also working with banks and partners to adopt data-based authentication instead of OTP codes for e-commerce transactions. This is a trend in developed markets such as Singapore and Malaysia, which helps increase payment security many times over. The State Bank's regulation on requiring facial authentication for transfers is an important step forward in efforts to prevent fraud and protect customers' assets.

Linh Anh wrote

(*) See Lao Dong Newspaper from issue dated June 25

Source: https://nld.com.vn/chia-khoa-phong-chong-lua-dao-qua-mang-xac-thuc-de-thanh-toan-an-toan-196240626195938811.htm

![[Photo] Visiting Cu Chi Tunnels - a heroic underground feat](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/8/06cb489403514b878768dd7262daba0b)

Comment (0)