After a series of consecutive declines, the VN-Index maintained and strongly promoted its growth momentum in today's session with nearly 10 points, returning to the 1,280 point mark.

VN-Index increased most positively in the past 3 weeks

At the end of the session, VN-Index closed at 1,281.9 points, up nearly 10 points (equivalent to 0.78%), marking the strongest increase in the past 3 weeks.

Right after the lunch break, the stock market received strong demand from pillar stocks, especially banks. On the HNX and UPCoM exchanges, the developments also turned positive at the end of the session.

Market liquidity reached over VND18,700 billion, of which, on HOSE alone, cash flow reached over VND17,000 billion. However, in general, the amount of money has not improved much compared to previous sessions.

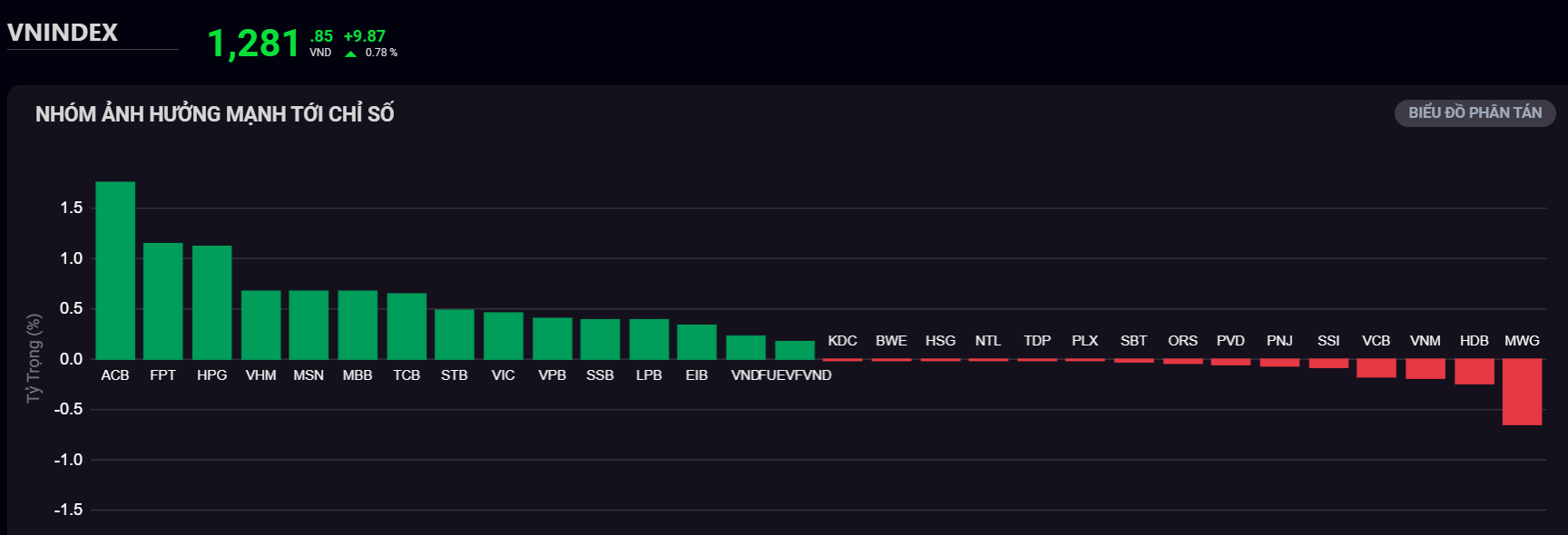

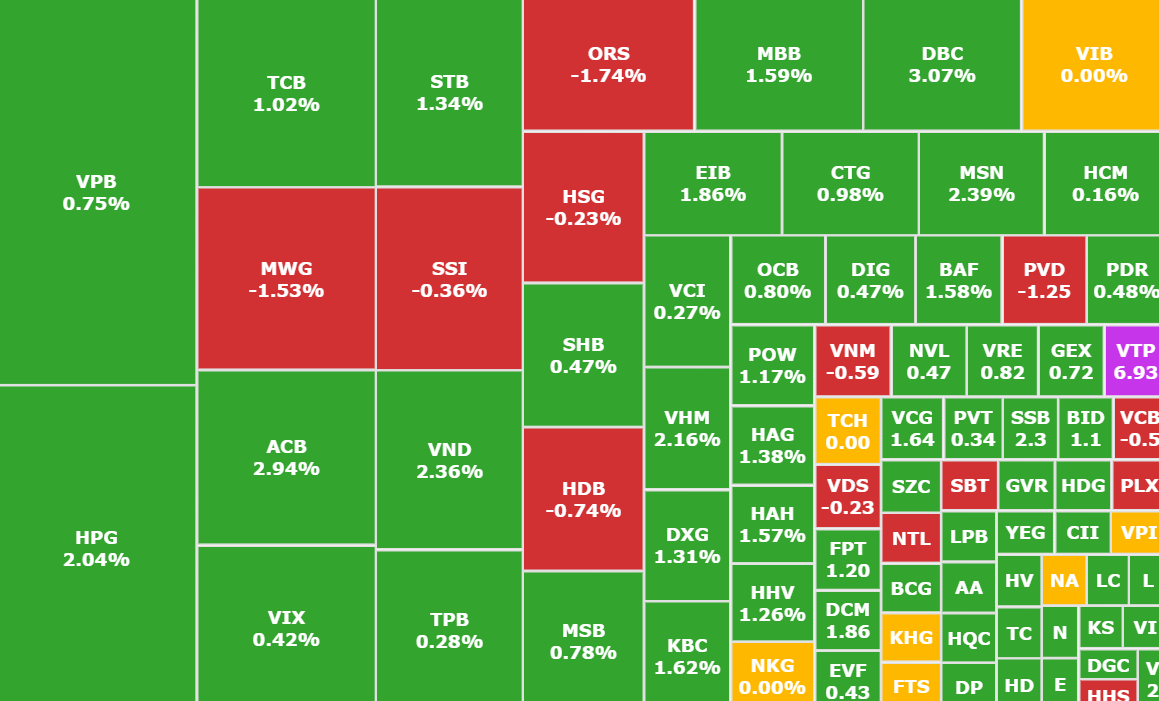

Today's increase in points came largely from banking stocks, "pillar" stocks in the VN30 group leading the market.

Leading the way is ACB (ACB, HOSE) with a strong increase of nearly 3%, followed by FPT (FPT, HOSE), HPG (Hoa Phat Steel, HOSE), the "duo" VHM (Vinhomes, HOSE) - VIC (Vingroup, HOSE), MSN (Masan, HOSE), MBB (MBBank, HOSE),...

Banking stocks and VN30 lead market recovery (Photo: SSI iBoard)

On the contrary, MWG (Mobile World, HOSE) has the most negative impact on the market, in addition to the appearance of HDB (HDBank, HOSE), VNM (Vinamilk, HOSE), VCB (Vietcombank, HOSE),...

While the upward trend is dominant in most industry groups, the state of differentiation appears clearly in the securities and real estate groups.

Foreign investors maintained their fourth consecutive net selling session, but the selling pressure decreased somewhat, nearly 40% compared to the previous session, with a total value of nearly VND250 billion, concentrated in MWG (Mobile World, HOSE) reaching VND194 billion and VPB (VPBank, HOSE) reaching VND284 billion.

On the other hand, strong buying power was recorded at TCB (Techcombank, HOSE) with 197 billion VND and HPG (Hoa Phat Steel, HOSE) reached 237 billion VND.

Notably, today's positive developments come in the context of Vietnam's market not being upgraded. Specifically, FTSE Russell released its October 2024 market ranking report, according to which, Vietnam is still on the watch list for upgrading to secondary emerging market status.

The market increased positively with "green" dominating after the news of not being promoted

Upgrading the market is expected to attract large amounts of money

As a long-time investor, Ms. Lan Chi (35 years old, Thanh Xuan District, Hanoi) said: "According to my observations and experience, the market is going through the most difficult period and is gradually recovering. The recent adjustment period is also an opportunity to collect potential stocks, so even though I have not met the conditions for promotion, I am still quite optimistic about the market. The 1,300 point mark is likely to be surpassed in the near future."

Sharing the same opinion, Ms. Minh Ngoc (33 years old, Cau Giay District, Hanoi) also said: "The nature of the upgrading process has also supported the flow of money into the Vietnamese stock market, so I still have expectations for the market and have traded regularly in the past time."

Regarding the upgrade, FTSE Russell stressed that if Vietnam is to achieve the 2025 target date set by the Vietnamese Prime Minister, it is important to maintain the pace of change. The revised market rules need to be confirmed and widely communicated in the coming period, including: finalizing the necessary roles and responsibilities in the payment model, along with a roadmap and key milestones for implementation.

At the same time, FTSE Russell acknowledges the Vietnamese Government’s continued support for market reforms and appreciates the constructive relationship with the State Securities Commission, other market regulators and the World Bank Group, which is supporting the broader market reform agenda.

The story of upgrading to emerging market status received many expectations from analysts/investors about the prospect of new money flowing into the market.

SSI Research estimates that capital flows from ETFs could reach $1.7 billion, not including capital flows from active funds (FTSE Russell estimates total assets from active funds to be 5 times higher than ETFs). According to this analysis department, stocks such as VNM, VHM, VIC, HPG, VCB, SSI, MSN, VND, DGC, VRE, VCI could attract large cash flows. Vietnam is upgraded to an emerging market.

According to experts, the market is in the accumulation zone, which could be a good opportunity for investors to collect stocks. It is only a matter of time before it surpasses 1,300 points. However, the market needs more consensus in the upward process and more spread in leading stock groups such as Banking or Securities.

Source: https://phunuvietnam.vn/vn-index-tang-gan-10-diem-ve-lai-moc-1280-diem-20241009170338403.htm

![[Photo] Close-up of Vietnam's sniffer dog team searching for earthquake victims in Myanmar](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/1/d4949a0510ba40af93a15359b5450df2)

![[Photo] Relatives of victims of the earthquake in Myanmar were moved and grateful to the rescue team of the Vietnamese Ministry of National Defense.](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/2/aa6a37e9b59543dfb0ddc7f44162a7a7)

![[Photo] Third meeting of the Organizing Subcommittee serving the 14th National Party Congress](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/2/3f342a185e714df58aad8c0fc08e4af2)

Comment (0)