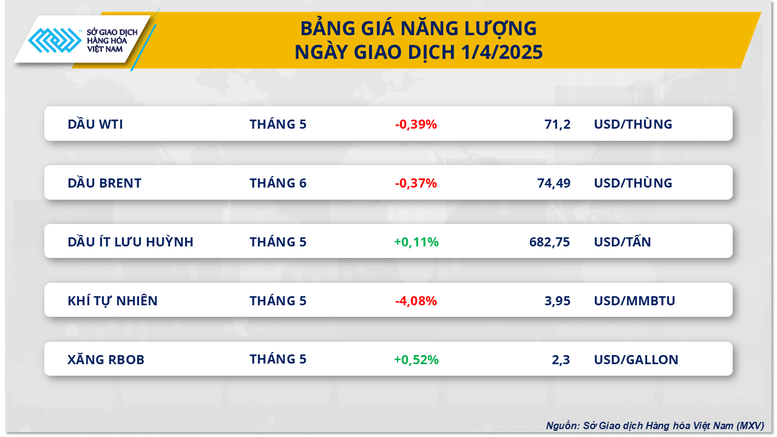

According to MXV, selling pressure dominated the energy market in yesterday's trading session. Oil prices fell in the first trading session of April as previous supply concerns were eased by OPEC+'s plan to increase production, while the market faced new pressure from the weakening global oil demand outlook.

After reaching a one-month high, at the end of the session on April 1, Brent crude oil for June delivery fell 0.37% to $74.49/barrel, while WTI crude oil fell 0.39% to close at $71.2/barrel.

Global oil supplies have eased as OPEC+’s production increase plan officially took effect on April 1. According to the plan announced in early March, production will increase by about 138,000 barrels per day this month. In addition, the market also expects OPEC+ to continue raising production in May, with a proposal to increase by 135,000 barrels per day expected to be considered at the OPEC+ Ministerial Meeting this week.

Two other factors are also raising the prospect of a supply glut. First, a report from the American Petroleum Institute (API) showed that US commercial crude oil inventories rose sharply by 6.04 million barrels in the week ending March 28, reversing a sharp decline of 4.6 million barrels the previous week. Second, Kazakhstan’s crude oil production continued to set a new record of 2.17 million barrels per day in March, far exceeding the OPEC+ quota of 1.47 million barrels per day. This is putting Kazakhstan under pressure from other OPEC+ members to cut excess production.

However, the market still faces greater risks from demand. New tariff policies expected to be announced by the Trump administration on April 2 are escalating global trade tensions. Strong reactions from major US trading partners could lead to a slowdown in global economic growth, thereby causing oil demand to plummet, surpassing previous concerns about supply shortages.

In addition, short-term upward pressure on prices remains due to US sanctions targeting crude oil exports from Iran and Venezuela. Secondary tariffs on countries importing oil from Venezuela will take effect on April 2, increasing the risk of a regional supply shortage.

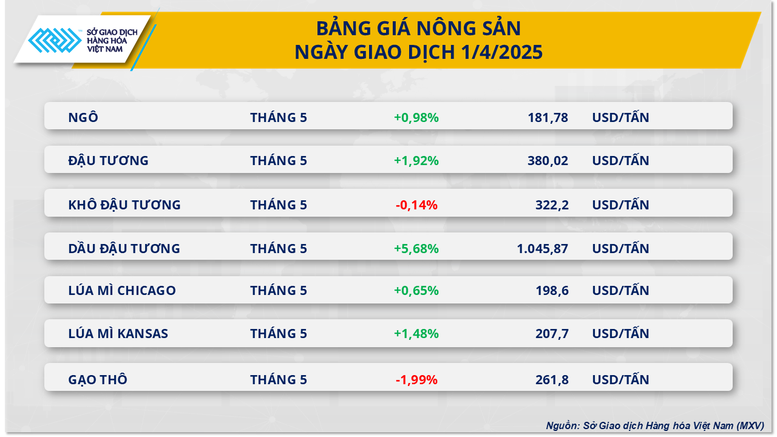

At the end of yesterday's trading session, green dominated the agricultural market. Closing, soybean prices increased sharply by nearly 2% to 380 USD/ton, reflecting a strong recovery thanks to a series of positive information from the market.

Source: https://baochinhphu.vn/gia-hang-hoa-the-gioi-tiep-tuc-bien-dong-truoc-ngay-my-ra-thue-doi-ung-102250402100913184.htm

![[Photo] Prime Ministers of Vietnam and Thailand visit the Exhibition of traditional handicraft products](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/15/6cfcd1c23b3e4a238b7fcf93c91a65dd)

Comment (0)