Vietnam International Commercial Joint Stock Bank (VIB) has just released a document announcing the results of its early bond buyback. Accordingly, on August 25 and 26, the bank conducted early buybacks of two bonds VIBL2125013 and VIBL2125014.

Of which, bond lot VIBL2125013 has a total value of 600 billion VND, issued on August 25, 2021, with a term of 4 years, expected to mature in 2025.

Bond lot VIBL2125014 has a total face value of 400 billion VND, issued on August 26, 2021, with a term of 4 years, also expected to mature in 2025. The interest rate for the two bond lots is 3.8%/year.

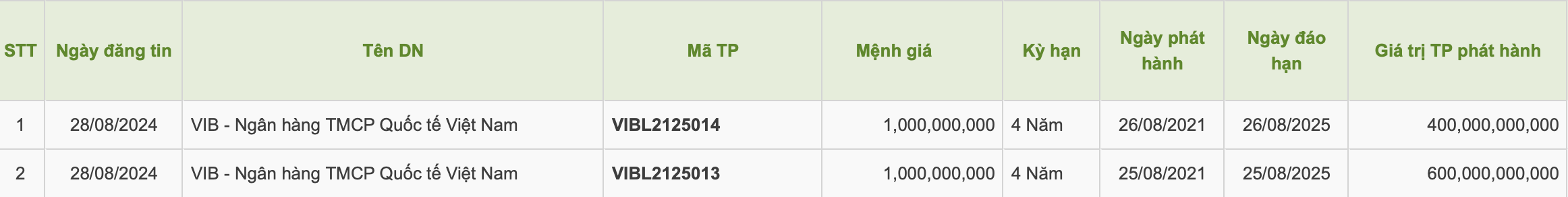

Information on bonds being bought back.

According to the issuance information, the bondholder of the two bond lots is a domestic securities company. These are all non-convertible bonds, not secured by assets, not accompanied by warrants and not secondary debt of the bank.

The purpose of issuance is to increase the bank's operating capital to enhance credit for corporate and individual customers. The bond registration and custody agent is VNDirect Securities Corporation.

Previously, the bank also bought back 3 lots of bonds VIBL2128027, VIBL2225002 and VIBL2225003 with a total value of VND 4,000 billion.

Of which, the bond lot with the largest face value is VIBL2225002, which was bought back by the bank on February 28, 2024. The bond lot is worth VND 2,000 billion, issued on February 28, 2022, with a term of 3 years, expected to mature in 2025.

On the other hand, this bank successfully mobilized 1,000 billion VND of bonds coded VIBL2427002 in the domestic market on August 22, 2024. The bond lot has a term of 3 years, expected to mature on August 22, 2027. The issuance interest rate is 5.2%/year.

Recently, the bank announced the situation of interest and principal payments for the first half of 2024. In the first 6 months of the year, the bank spent nearly 297 billion VND to pay interest and 6,600 billion VND to pay bond principal.

Source: https://www.nguoiduatin.vn/vib-mua-lai-truoc-han-1000-ty-dong-trai-phieu-2042408281145442.htm

![[Photo] Opening of the 44th session of the National Assembly Standing Committee](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/14/03a1687d4f584352a4b7aa6aa0f73792)

![[Photo] General Secretary To Lam chairs the third meeting to review the implementation of Resolution No. 18-NQ/TW](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/14/10f646e55e8e4f3b8c9ae2e35705481d)

![[Photo] Touching images recreated at the program "Resources for Victory"](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/14/99863147ad274f01a9b208519ebc0dd2)

![[Photo] Children's smiles - hope after the earthquake disaster in Myanmar](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/14/9fc59328310d43839c4d369d08421cf3)

Comment (0)