What is a mortgage?

Mortgage loan is a form of loan in which the borrower must have assets to mortgage such as: house and land papers, cars or valuable tangible assets...

When the bank accepts the application and disburses the loan, the property still belongs to the customer, but the bank retains the documents proving ownership.

With mortgage loans, customers will have a long-term loan term, up to 25 years. This helps reduce the debt repayment pressure for borrowers.

Advantages of mortgage loans

The advantage of a mortgage loan is that you can borrow a large amount of money, depending on the value of the collateral (up to 100% of the value of the collateral).

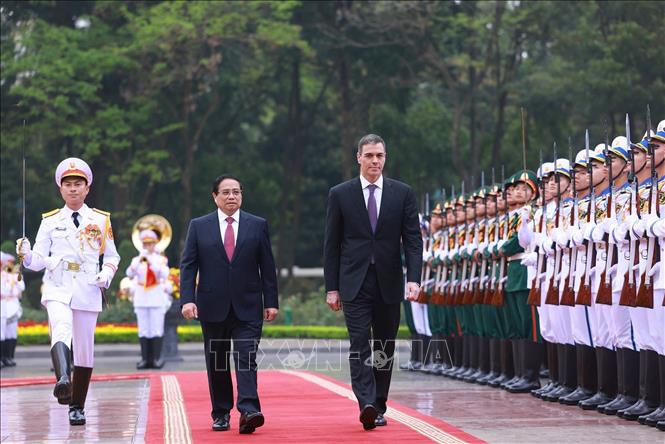

(Illustration)

In addition, this form has a long loan period and flexible repayment methods to help borrowers reduce the burden of debt repayment. Moreover, mortgage interest rates are also lower than unsecured loans.

Disadvantages

Mortgage loans require customers to have assets to mortgage such as real estate, cars, or assets of suitable value. In case of default, customers will lose ownership of the mortgaged assets.

Because mortgage loans are often large, it takes time to appraise the property, leading to a long loan application processing time due to many procedures.

Lagerstroemia (synthesis)

Source

![[Photo] Visiting Cu Chi Tunnels - a heroic underground feat](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/8/06cb489403514b878768dd7262daba0b)

Comment (0)