Easy capital, immediate availability, and simple procedures are what small traders and businesses need in the final stages of reaching the end of the year.

With ShopCash overdraft loan solution, business households and small traders can easily apply for capital with a pre-granted limit of up to 500 million VND - Photo: BT

ShopCash overdraft loan - 100% unsecured loan from Techcombank with pre-approved limit up to 500 million VND right on Techcombank Mobile Digital Bank is a reasonable solution for customers. Business season has come Entering the 4th quarter, business and trading activities have also entered the "growth season" with many consumer stimulus events such as Black Friday, Christmas, New Year's Day, Lunar New Year.... The macro -economic picture has begun to recover and year-end demand in most fields has increased. This also opens up opportunities for industries, especially for small traders and small businesses. In fact, at this stage, fields such as consumer goods retail, fashion, food services, passenger transport services, goods, tourism services, interior and home decoration, gifts... all achieved the highest sales in the last months of the year. However, to prepare for business opportunities, small traders must quickly develop plans, learn about needs, and even consumer trends to catch up appropriately. "In the field of home decoration for Tet, to prepare for the end of the year, we must start to grasp the needs and trends of customers' tastes. In addition to considering the year of the animal, we also have to "catch the trend" to quickly stock up on items. The more difficult thing is to have abundant capital to import goods, because when demand increases, it will become scarce and prices will increase. Buying high and selling high will make it very difficult to sell" - Ms. Nguyen Anh, owner of a shop in District 5 (HCMC), shared. Sharing the same concern, Mr. Thanh Tuong, owner of a gift shop, said that everyone knows that at the end of the year, we will need to stock up as soon as possible. "However, capital to stock goods for small businesses like me is very difficult. Borrowing from banks does not have collateral, borrowing from outside has very high interest rates, so every year at this time we are very worried. Many times when we see opportunities, we have to give up", Mr. Thanh Tuong complained. That is a common story of small businesses or small traders at the end of the year. At this time, solutions that accompany and solve the right loan needs will contribute to supporting and helping them seize growth opportunities. "Understanding the difficulties and obstacles of small businesses, Techcombank has officially introduced the ShopCash solution - a pre-approved overdraft loan source with a limit of up to 500 million VND exclusively for businesses, easy to use when needed, with preferential interest rates. Only when the right needs and at the right time can we bring positive value to customers" - Techcombank leaders shared. Solving the capital problem for small traders With the ShopCash overdraft loan solution - 100% unsecured loans right on Techcombank Mobile Digital Bank, business households and small traders can easily advance capital with a pre-granted limit of up to 500 million VND. The registration procedure is easy, no collateral required, no activation fee, no documents proving income required. ShopCash allows users to advance money instantly by transferring money or scanning the QR code to pay from the overdraft account for customers to easily do. In particular, the low interest rate from only 326 VND/1 million/day calculated on the actual amount and time of use, from the time of capital withdrawal to debt repayment, will be a great opportunity for small traders to have easy business capital and improve operational efficiency. In addition, to give small traders flexibility in paying for goods, ShopCash does not limit the number of times to advance money within the granted limit, repay the principal at any time, and has no early repayment fee. With the outstanding advantages of ShopCash loan solution at Techcombank, small traders and business households can not only easily expand their capital sources but also take advantage of outstanding incentives on interest rates and simple procedures. This is the credit solution that helps them develop sustainable businesses, while managing their finances more optimally. For advice on registering for the solution, small traders can call the hotline 1800 588 822 or contact Techcombank's personal financial consultant for support. Source: https://tuoitre.vn/giai-bai-toan-von-cho-tieu-thuong-kinh-doanh-cuoi-nam-20241205095550463.htm

![[Photo] Ready for the top competitions of Vietnamese table tennis](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/18/9c547c497c5a4ade8f98c8e7d44f5a41)

![[Photo] Many young people patiently lined up under the hot sun to receive a special supplement from Nhan Dan Newspaper.](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/18/6f19d322f9364f0ebb6fbfe9377842d3)

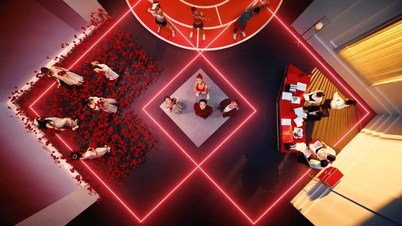

![[Photo] Party and State leaders attend the special art program "You are Ho Chi Minh"](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/18/6895913f94fd4c51aa4564ab14c3f250)

Comment (0)