USD exchange rate today (June 23): Early morning of June 23, the State Bank announced the central exchange rate of the Vietnamese Dong to the USD increased by 5 VND, currently at 23,732 VND.

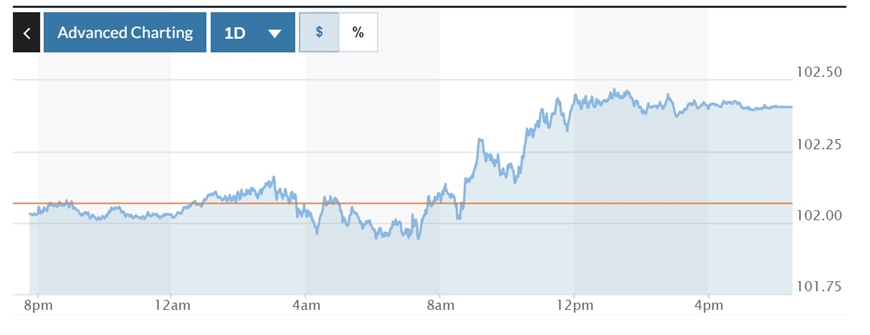

Meanwhile, in the US market, the US Dollar Index (DXY) measuring the greenback's fluctuations against six major currencies (EUR, JPY, GBP, CAD, SEK, CHF) increased by 0.40%, reaching 102.40.

USD exchange rate in the world today

The US dollar rose again in the last trading session, when US Federal Reserve Chairman Jerome Powell said that it may be necessary to raise interest rates further to curb inflation.

|

| DXY Index volatility chart over the past 24 hours. Photo: Marketwatch. |

Last week, the Fed kept its benchmark interest rate steady at 5% to 5.25%, but most policymakers expect rates to rise by at least another 50 basis points by the end of the year.

In testimony before the US Congress on June 22, Mr. Powell said that the prospect of raising interest rates by another 25 basis points was “an educated guess” about the direction of the central bank if the economy continued on its current path.

In addition, Chairman Powell once again emphasized that the US central bank has not yet ended its monetary policy tightening cycle.

Additionally, Fed Governor Michelle Bowman, at an event in Cleveland, said that “additional rate hikes” will be needed to control inflation.

“Investors need to recognize the fact that central banks around the world will continue to actively fight inflation,” said Oliver Pursche, senior vice president and adviser at Wealthspire Advisors in Westport, Connecticut.

US Treasury yields rose as investors focused on hawkish comments from Chairman Powell.

In another development, the Bank of England (BoE) has delivered a larger-than-expected interest rate hike.

Specifically, the BoE announced a 50 basis point increase, raising interest rates to 5%. Previously, investors expected the BoE's bank rate to peak at 6% by the end of this year. In contrast, according to a Reuters poll, economists predicted the highest interest rate would be 5%.

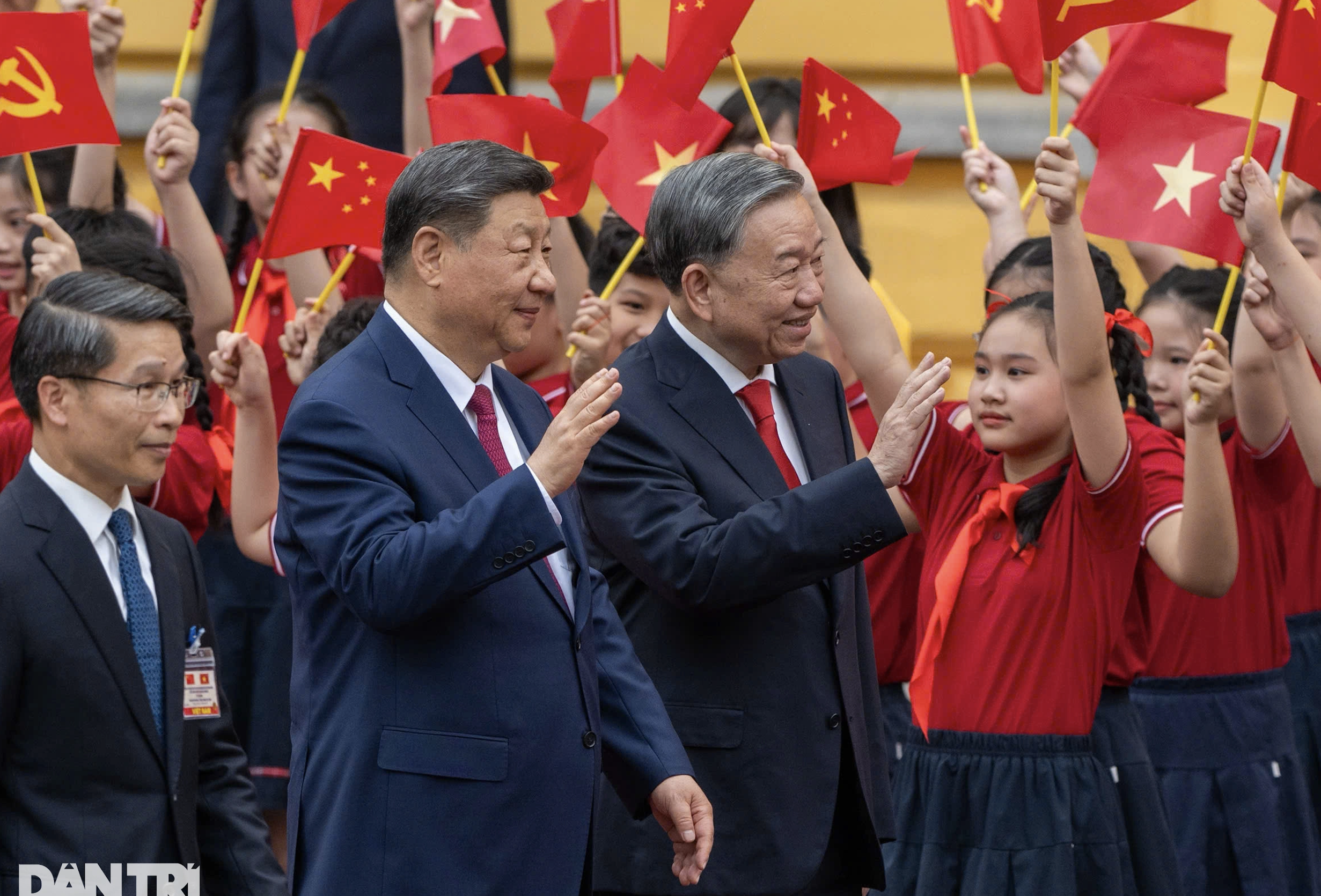

|

| USD exchange rate today (June 23): USD recovers. Illustration photo: Reuters. |

Domestic USD exchange rate today

In the domestic market, at the end of the trading session on June 22, the State Bank announced the central exchange rate of the Vietnamese Dong to the USD increased by 5 VND, currently at: 23,732 VND.

* The reference exchange rate at the State Bank's transaction office increased slightly, currently at: 23,400 VND - 24,868 VND.

USD exchange rates at commercial banks are as follows:

USD exchange rate | Buy | Sell |

Vietcombank | 23,340 VND | 23,680 VND |

Vietinbank | 23,318 VND | 23,738 VND |

BIDV | 23,363 VND | 23,663 VND |

* The Euro exchange rate at the State Bank's buying and selling exchange center increased slightly to: 24,777 VND - 27,386 VND.

Euro exchange rates at commercial banks are as follows:

Euro exchange rate | Buy | Sell |

Vietcombank | 25,416 VND | 26,571 VND |

Vietinbank | 24,922 VND | 26,212 VND |

BIDV | 25,411 VND | 26,551 VND |

MINH ANH

Source

![[Photo] Prime Minister Pham Minh Chinh receives Chairman of Commercial Aircraft Corporation of China (COMAC)](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/14/93ca0d1f537f48d3a8b2c9fe3c1e63ea)

Comment (0)