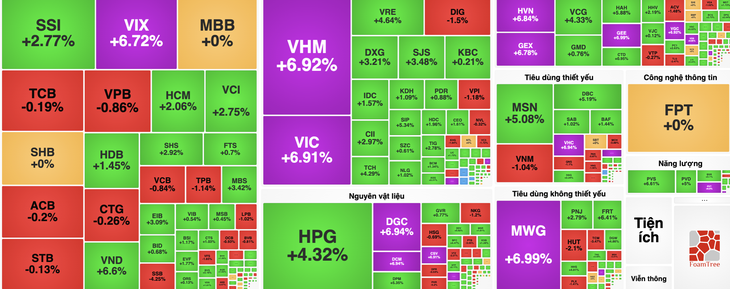

The stock market has recovered, but there is strong differentiation among stock groups.

Vingroup shares pull the stock market

This morning's stock trading session continued to recover slightly, VN-Index only fluctuated above the reference level with market liquidity decreasing sharply compared to the previous session.

The differentiation of stock sectors became more evident when the index approached the resistance zone of 1,230 points. Cash flow strongly "flowed" into the steel, retail, real estate, and chemical groups with many stocks hitting the ceiling.

The most notable of these are Vingroup stocks, as both VIC (+6.91%) and VHM (6.92%) soon turned purple, while VRE also increased by nearly 4.7%.

In the steel group, Hoa Phat's HPG, after two consecutive ceiling prices, still increased by 4.3% in market value. In the retail group, Mobile World's MWG increased by the full margin (+6.99%), and Masan 's MSN also added 5% in market value.

In particular, the group of stocks related to exports or FDI capital flows, after many sessions of strong selling and continuous deep declines, has shown signs of recovery this session.

On the contrary, the banking group is under selling pressure after a strong increase from last week, such as TCB (-0.19%), VPB (-0.86%), TPB (-1.14%), ACB (-0.2%), CTG (-0.26%)...

In the information technology group, FPT had a "struggling" day when selling pressure did not stop, but was still lucky to return to the reference level at the close of the session.

Overall, the market breadth remained positive with 447 stocks increasing in price and 47 hitting the ceiling. Meanwhile, the bears had 314 stocks and 18 hitting the floor.

With the pull of pillar stocks, the credit goes to codes related to Mr. Pham Nhat Vuong, Vin-Index increased by nearly 19 points, to the 1,241 area. The total transaction value of all three floors reached more than 26,500 billion VND.

Along with the increase in Vingroup's stock price, the assets of Mr. Pham Nhat Vuong - the richest person in Vietnam according to Forbes ' ranking, have just set a new record of 8.4 billion USD.

With an increase of 300 million USD in just one day, Mr. Vuong surpassed many other billionaires, climbing to the position of 344th richest person in the world.

How is VN-Index forecasted in 2025?

Returning to the general stock market story, the recovery happened very quickly right after the US temporarily suspended tariffs on many countries, including Vietnam.

However, in a recently published report, KB Securities Vietnam (KBSV) still forecasts that the VN-Index will reach 1,100 points in 2025.

The main factor that makes KBSV cautious in making such a forecast is the concern that Mr. Trump's tariff policies will affect the macro outlook, investment environment, interest rates, foreign capital flow trends, as well as domestic investor sentiment.

However, KBSV still believes that the Vietnamese stock market still has many positive internal factors that help the market experience alternating recoveries.

These include the introduction of the KRX trading system and market upgrade in September, increased public investment, policies to remove difficulties for real estate businesses, low interest rates, etc.

Tien Phong Securities (TPS) is concerned that the current downward trend of foreign cash flow will put pressure on the stock market, not only affecting liquidity, but also affecting market sentiment, especially in large-cap stocks and industries with high foreign ownership ratios.

In addition, according to TPS, the acceleration of gold prices is also accompanied by a tendency for speculative and short-term investment flows to shift to gold - an asset with high liquidity and a "safe haven" mentality. In this context, gold becomes a direct competitor to the stock market.

Source: https://tuoitre.vn/bo-doi-co-phieu-vingroup-lai-tim-tran-tai-san-nguoi-giau-nhat-viet-nam-them-300-trieu-usd-20250414153059278.htm

![[Photo] National Assembly Chairman Tran Thanh Man meets with Thai Prime Minister Paetongtarn Shinawatra](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/15/e71160b1572a457395f2816d84a18b45)

![[Photo] Prime Ministers of Vietnam and Thailand visit the Exhibition of traditional handicraft products](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/15/6cfcd1c23b3e4a238b7fcf93c91a65dd)

Comment (0)