ANTD.VN - Ho Chi Minh City Real Estate Association (HoREA) proposed to amend the regulation in Circular 22/2023/TT-NHNN on banks not being allowed to lend to individuals to buy future commercial housing that is mortgaged with that house.

Circular 22/2023/TT-NHNN takes effect from July 1, 2024. The biggest positive point of the Circular is the adjustment of the credit risk coefficient.

Accordingly, loans for buying social housing, buying houses, building houses under government support programs and projects will have their risk coefficient adjusted down to a maximum of 50%. The loan-to-value ratio (LTV) will also be adjusted from 100% or more and the income ratio (DSC) will be over 35%. The minimum risk coefficient is 20%, corresponding to a loan-to-value ratio below 40% and an income ratio below 35%.

In addition, Circular 22 also adjusts the credit risk coefficient for assets that are specialized credit facilities in the form of credit facilities to finance industrial park real estate business projects from 200% to 160%...

These amendments are expected to encourage credit institutions to promote lending to social housing projects and housing projects under the Government's support programs and projects. At the same time, they will contribute to removing difficulties and promoting the safe, healthy and sustainable development of the real estate market.

|

HoREA proposes to allow individuals to borrow money to buy houses using future housing as collateral |

However, according to HoREA, some regulations of Circular 22, if not amended immediately, could have negative consequences for the recovery and development of the real estate market both in the short and long term.

Specifically, HoREA is deeply concerned about the provisions in Circular 22 on real estate-secured loans for individuals to buy houses, including commercial houses. Accordingly, commercial banks and foreign bank branches are only allowed to lend to individuals to buy houses that are “completed for handover”, i.e. “available houses”.

“Thus, Circular No. 22/2023/TT-NHNN does not allow commercial banks and foreign bank branches to lend to individuals to buy unfinished commercial housing for handover (i.e. commercial housing formed in the future) secured (mortgaged) by that house itself, so individuals who want to borrow credit to buy commercial housing formed in the future must implement other security measures or secure with other assets,” Mr. Le Hoang Chau, Chairman of HoREA, worried.

Therefore, HoREA believes that if the above regulation is not amended immediately, when Circular No. 22 takes effect from July 1, 2024, it may lead to bad consequences, causing difficulties and hindering the normal operation of the real estate market, which will negatively impact the recovery and development process of the real estate market both in the short term and in the long term.

Furthermore, not allowing credit institutions to lend credit to individuals to buy future commercial housing mortgaged with that house is inappropriate, inconsistent, and inconsistent with relevant legal provisions such as: Civil Code 2015, Housing Law 2014 and Housing Law 2023, Real Estate Business Law 2014 and Real Estate Business Law 2023, Investment Law 2020, Law on Credit Institutions 2010 and Law on Credit Institutions 2024...

From comparing the relevant legal regulations (mentioned above) and the practical situation, the Association proposes to amend and supplement Clause 11, Article 2 of Circular No. 41/2016/TT-NHNN (amended and supplemented in Clause 1, Article 1 of Circular 22/2023/TT-NHNN) in the direction of adding regulations allowing credit institutions to lend credit to individuals to buy "future-formed commercial housing" secured (mortgaged) by that house.

Source link

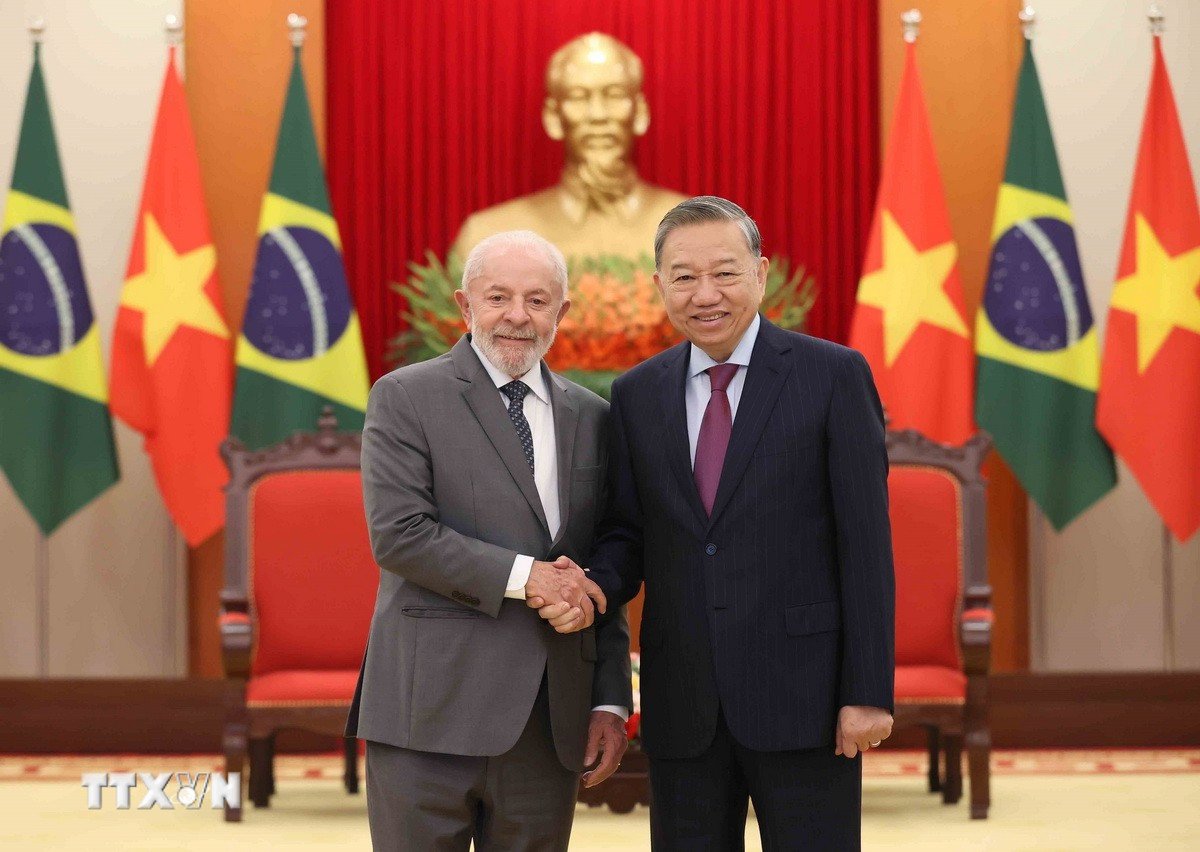

![[Photo] General Secretary To Lam receives Brazilian President Luiz Inácio Lula da Silva](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/28/7063dab9a0534269815360df80a9179e)

![[Photo] Prime Minister Pham Minh Chinh meets with Brazilian President Luiz Inacio Lula da Silva](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/28/41f753a7a79044e3aafdae226fbf213b)

![[Photo] Helicopters and fighter jets practice in the sky of Ho Chi Minh City](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/28/3a610b9f4d464757995cac72c28aa9c6)

![[Photo] Vietnam and Brazil sign cooperation agreements in many important fields](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/28/a5603b27b5a54c00b9fdfca46720b47e)

Comment (0)