Pepper output decline creates momentum for price increase

On January 16, the Vietnam Pepper and Spices Association (VPSA) held its 2024 annual conference in Ho Chi Minh City.

According to the International Pepper Community (IPC), global pepper production in 2024 will decrease by about 4% (22,000 tons) compared to 2023, to only 558,000 tons. This decrease in pepper volume mainly comes from Brazil and Vietnam.

Pepper export prices (FOB prices) of countries increased by about 45% for black pepper and by about 34% for white pepper compared to last year.

Vietnam Pepper and Spice Association Annual Conference 2024 held in Ho Chi Minh City. Photo: Nguyen Vy

IPC forecasts that global pepper output in 2025 will continue to decrease compared to 2024. The main reason is that pepper is no longer the main crop of many farmers, especially in the context of the economic value of other crops being more competitive.

Furthermore, climate change with extreme weather events has reduced productivity, while the cost of maintaining pepper production has increased.

Domestically, VPSA said that production in some areas was affected by climate change. However, other areas recorded favorable weather.

For example, in Dak Nong, the “capital” of Vietnam’s pepper, output was recorded to be equivalent to last year.

Vietnam's pepper production situation in 2024 fluctuates in many different regions. Photo: Nguyen Vy

Production in other key provinces such as Gia Lai, Binh Phuoc, Dong Nai and Ba Ria – Vung Tau has shown positive signs as pepper prices have increased. Therefore, farmers have boldly invested in caring for and restoring their existing pepper gardens.

On the contrary, in Dak Lak, production decreased as people switched to growing durian and there was not much new planting.

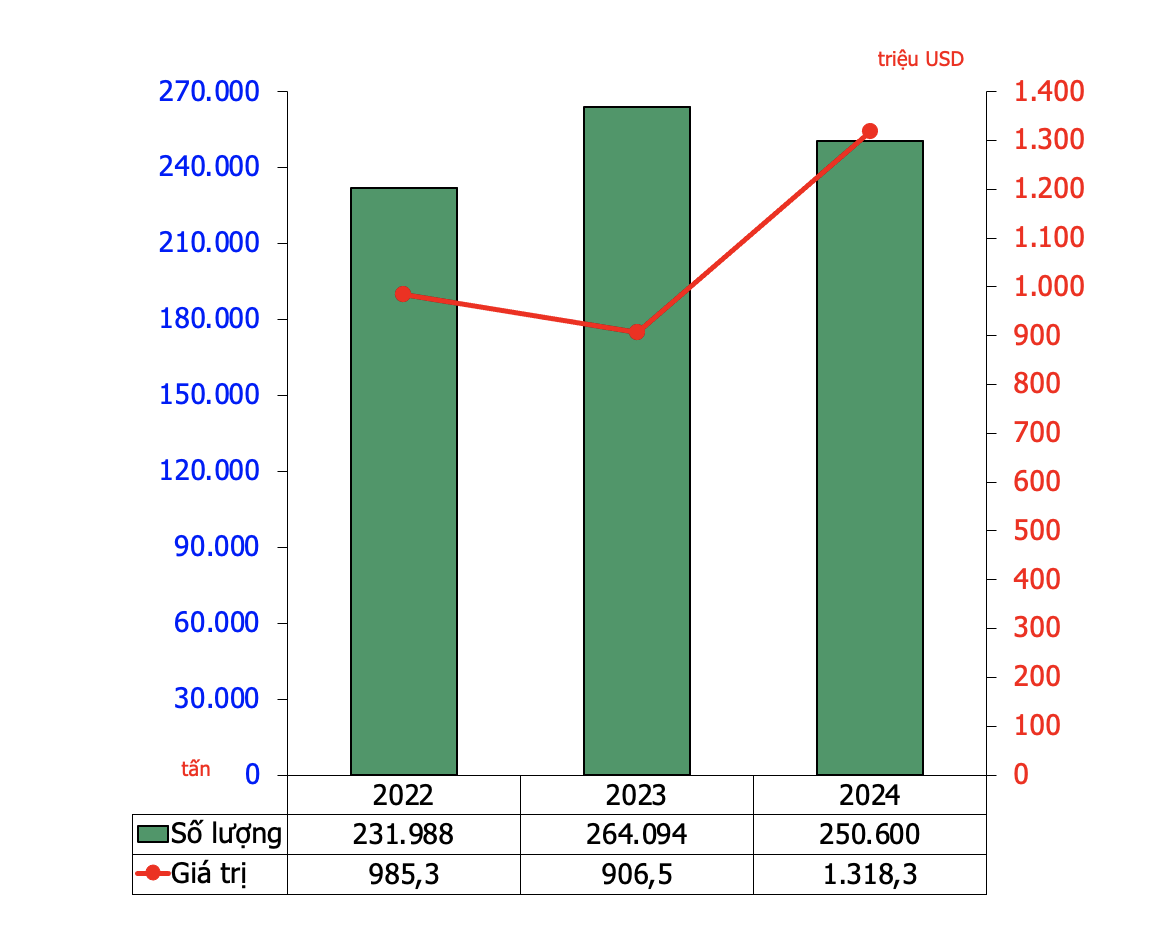

Mr. Le Viet Anh - Chief of Office of VPSA Association said that pepper output in 2024 will reach 250,600 tons, down 5.1% compared to 2023 (264,094 tons).

Vietnam pepper output and value in 2024. Photo: VPSA

It is expected that farmers will start harvesting pepper after Tet. The crop season will last until the end of April 2025.

VPSA believes that China will likely wait until Vietnam's main harvest (after Tet) to start buying again.

Previously, in 2024, China reduced pepper imports from Vietnam by 82.4% while increasing imports from Indonesia by 76.8%.

However, this increase in imported pepper is still not enough to meet the total consumption demand in China. Pepper inventories in this market are at a low level. These are the reasons VPSA believes that China will increase its purchases again.

In 2025, Brazil's pepper output is forecast to recover, while Indonesia's output may decrease due to investment difficulties and unfavorable weather conditions.

India, a major consumer, is also forecasting a drop in pepper output due to the impact of floods, leading to farmers limiting investment and liquidating inventories as domestic prices fall.

Global pepper prices in 2025 are expected to remain high due to reduced supply, while demand in major markets such as the US and Europe remains stable. In addition, the demand for pepper in the food and spice processing industries remains the main driver of the market.

Comment (0)