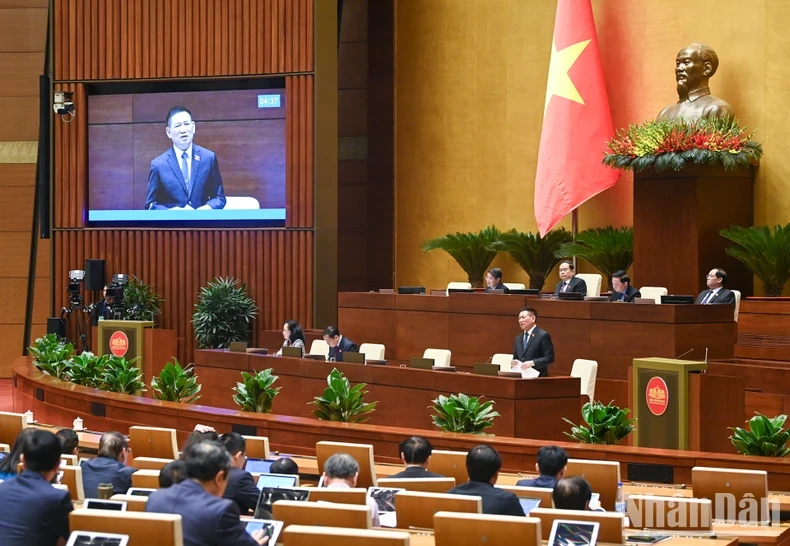

On the afternoon of November 28, under the direction of Vice Chairman of the National Assembly Nguyen Duc Hai, the National Assembly discussed in the hall the draft Resolution of the National Assembly on reducing value added tax.

At the beginning, Deputy Prime Minister Ho Duc Phoc presented a report on the draft Resolution of the National Assembly on reducing value added tax (VAT).

Need to continue reducing VAT by 2% to suit the current economic context

According to the Deputy Prime Minister, in 2024, the Government will continue to proactively research, propose to competent authorities as well as issue, according to its authority, solutions to support businesses and people associated with the work of building and assigning annual state budget estimates to ensure the balance of the state budget as well as for localities to be proactive in implementing local budget balance estimates.

However, in addition to positive factors, there are also many challenges and risks that may affect the implementation of the economic growth target for 2025. Therefore, it requires additional solutions to support businesses, people and the economy to continue to maintain the momentum of recovery and growth.

"From the practices and experiences in implementing tax solutions commonly applied by countries; summarizing and evaluating the implementation of support solutions in the past time and from the results achieved from the policy of reducing value added tax by 2%, it is necessary to continue implementing this policy to stimulate consumption, in line with the current economic context," the report stated.

The application of the 2% value-added tax reduction policy will also help promote production and business activities to recover and develop soon to contribute back to the state budget as well as the economy to implement the 5-year socio-economic development plan 2021-2025, the annual socio-economic development plan, and the economic restructuring plan for the period 2021-2025.

This Resolution adjusts the groups of goods and services currently subject to a tax rate of 10%, except for the following groups of goods and services: Telecommunications, information technology, financial activities, banking, securities, insurance, real estate business, etc.

The Resolution is applicable from January 1, 2025 to June 30, 2025.

On behalf of the review agency, Chairman of the Finance and Budget Committee Le Quang Manh affirmed: The Finance and Budget Committee agrees with the scope of policy application as proposed by the Government.

There is a need for synchronous, long-term solutions and optimization of budget revenue.

At the meeting, delegates agreed with the Government's proposal to continue implementing the policy. 2% reduction in value added tax rate to help businesses overcome difficulties after the Covid-19 pandemic to stabilize and promote production and business development, and stimulate consumption. However, according to delegates, in addition to tax reduction, it is necessary to assess the impact on policies as well as other sustainable solutions.

Delegate Ha Sy Dong (Quang Tri Province Delegation) emphasized: The 2% reduction in value added tax rate to promote economic recovery and sustainable growth for the economy is a correct and timely policy to stimulate consumption and promote production and business, while reducing the cost burden for people and businesses in the context of many economic challenges. The policy of reducing value added tax not only supports production and business but also contributes to controlling inflation.

However, this policy will impact the state budget. The reduction in value-added tax in the first 6 months of 2025 is expected to reduce budget revenue by about VND 26.1 trillion in the short term. This could affect the ability to balance the budget, especially for local budgets.

According to delegate Ha Sy Dong, although reducing value-added tax is a short-term, effective solution, there needs to be synchronous, long-term solutions to improve domestic production capacity, enhance the quality of goods and especially increase competitiveness in the international market.

Along with tax reduction, according to delegate Ha Sy Dong, it is necessary to optimize budget revenue and the Government also needs to develop and implement measures to increase budget revenue from sources other than value added tax to compensate for this shortfall. In addition, it is necessary to strengthen tax inspection and supervision; coordinate with inter-sectoral agencies, tax authorities, customs and other functional agencies in monitoring tax evasion and transfer pricing, especially from foreign-invested enterprises.

Agreeing with the above viewpoint, delegate Nguyen Truc Son (Ben Tre Provincial Delegation) said: Continuing to implement the policy of reducing 2% of value added tax rate will stimulate production, business reinvestment and stimulate consumer demand.

However, the tax reduction policy must be sustainable and should not be interrupted so that businesses can catch up with their investment, production and business plans. Therefore, when the Government issues a policy, it should be extended. In addition, the Government needs to evaluate the items that are not eligible for VAT reduction to ensure fairness for manufacturing businesses.

Explaining and clarifying the opinions of the delegates, Deputy Prime Minister Ho Duc Phoc emphasized: The implementation of the policy of reducing the value added tax rate by 2% has affected businesses, contributing to GDP growth but still contributing to the State's tax revenue. This shows that the Government's policy has had a great impact on economic growth and is a great encouragement for businesses to overcome difficulties in order to continue to stabilize and promote production and business.

However, according to Deputy Prime Minister Ho Duc Phoc, solving difficulties for businesses should not only be about reducing value added tax, but also need to resolve problems related to licensing procedures, investment procedures, land, credit support, human resources, technology, etc.

Source

![[Photo] National Assembly Chairman Tran Thanh Man meets with outstanding workers in the oil and gas industry](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/17/1d0de4026b75434ab34279624db7ee4a)

![[Photo] Nhan Dan Newspaper announces the project "Love Vietnam so much"](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/17/362f882012d3432783fc92fab1b3e980)

![[Photo] General Secretary To Lam receives French Ambassador to Vietnam Olivier Brochet](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/17/49224f0f12e84b66a73b17eb251f7278)

![[Photo] Closing of the 4th Summit of the Partnership for Green Growth and the Global Goals](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/17/c0a0df9852c84e58be0a8b939189c85a)

![[Photo] Promoting friendship, solidarity and cooperation between the armies and people of the two countries](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/17/0c4d087864f14092aed77252590b6bae)

![[Photo] Welcoming ceremony for Chinese Defense Minister and delegation for friendship exchange](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/17/fadd533046594e5cacbb28de4c4d5655)

![[Video] Viettel officially puts into operation the largest submarine optical cable line in Vietnam](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/17/f19008c6010c4a538cc422cb791ca0a1)

Comment (0)