After 15 years of miraculous breakthroughs, TPBank continues its pioneering journey to new heights, affirming its leading digital position. From the smallest bank, TPBank now has a distinct position, is among the top leaders in business efficiency and is constantly growing strongly to become the No. 1 digital bank in Vietnam.

After 10 years, the "outsider" bosses from FMCG have successfully restructured a weak bank, turning TPBank into a bright star in terms of profit growth rate, total assets and a successful example of digital banking.

|

The Vietnamese banking industry has been established and developed for over 70 years, and now the system has more than 30 commercial banks. Through many ups and downs, the position of banks in the market has been strongly differentiated. There are young banks, but thanks to their different business strategies, they have risen to the top, affirming their position in the market.

TPBank - one of the "youngest" banks in the system is a typical case of a "small but mighty" bank. Looking at TPBank's current position, few people remember that the bank went through a very difficult period when it fell into 9 weak credit institutions in 2011. While most banks chose to merge and consolidate, Tienphongbank (TPBank's name at that time) restructured itself and became a typical case of the most successful self-restructuring in the Vietnamese banking system to date. On May 5, 2023, this bank officially celebrated its 15th anniversary with many brilliant successes.

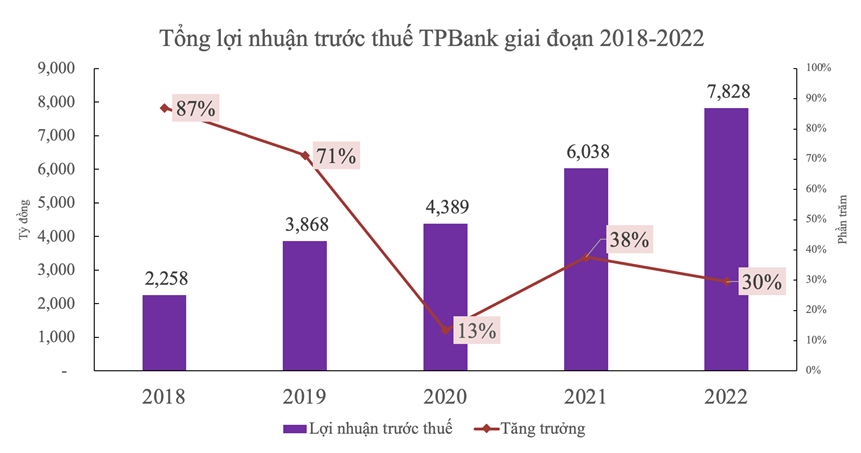

TPBank currently has the 15th largest credit balance in the system. In 2022, pre-tax profit reached more than 7,800 billion VND, an increase of 120 times compared to the first year of establishment. In recent years, TPBank has continuously been in the Top 10 private banks with the highest profits.

15 years of pioneering the digital journey, 10 years after restructuring, TPBank has now affirmed its position as the number 1 bank in terms of technical infrastructure and technology human resources as well as owning a comprehensive digital ecosystem in all customer communication channels. When it comes to digital transformation in the banking industry, TPBank is mentioned. That recognition is demonstrated by many domestic and international awards and rankings as well as through the most impressive indicators of TPBank after restructuring.

|

Thanks to pioneering digitalization, TPBank's customer base has grown at a rapid pace, especially in 2022, attracting an additional 3.7 million customers, bringing the total number of individual customers to 8.5 million. Previously, it took the bank 11 years to get the first 3 million customers. In addition, another indicator showing the effectiveness of LiveBank and the digital banking app is that the rate of regular customers has improved day by day, increasing 4.5 times in the past 5 years. Taking a technological shortcut 7 years ago was a major turning point that contributed to TPBank's current success.

No matter how dreamy, it is difficult to imagine the success of TPBank after 15 years of transformation. From a "small guy" who always had a "big dream" about digital banking, TPBank is becoming a "big boy" of the banking system. But in reality, TPBank only has the path of promoting digitalization, to serve millions of customers when the number of branches is only at a moderate level. If it did not switch to leading with digital banking, always keeping in mind and implementing, TPBank would not be able to reach the scale and be trusted by customers as much as it is today. That is also the basis for TPBank to invest heavily, deploy breakthrough digital banking solutions, "tailored" to each financial need and habit of each customer. Not afraid of competition, not afraid of being copied, TPBank always has a constantly innovative approach to serve customers on all communication channels.

In the current digital innovation stage, TPBank's focus on digitizing internal processes, setting up smart bots applying AI & API, ChatGPT, minimizing manual work, and taking advantage of the latest technology also maximizes human resources capacity, especially IT staff. Increasing automation and digitalization levels, as well as building a strong digital capacity system, not only helps TPBank increase efficiency in serving customers but also creates sustainable development and inspires sustainable transformation for the community.

TPBank also appeared in many major domestic and international rankings with very high rankings. For example, thanks to its leadership in many criteria such as capital adequacy ratio, profitability, asset quality, liquidity, etc., TPBank ranked Top 1 among Vietnamese banks in the list of strongest banks in Asia - Pacific announced by The Asian Banker in 2022. In addition, from 2018 to present, TPBank has been continuously ranked A by the State Bank, the highest ranking based on Circular 52/2018/TT-NHNN regulating the ranking of credit institutions and foreign bank branches. This shows the comprehensive strength of TPBank's management system.

In the message on the occasion of the 15th anniversary, Mr. Do Minh Phu, Chairman of TPBank, said: “At the age of 15, TPBank is ready for the vast opportunities of the digital era, with the new term of the Board of Directors just elected by the 2023 Annual General Meeting of Shareholders and the Third Strategy Cycle 2023-2028, we will continue to be a bank that enthusiastically creates and accompanies to inspire the digital life of tens of millions of Vietnamese customers. TPBank will continue to grow on the path to becoming a strong private financial group, raising its position domestically and reaching the regional level. TPBank will always carry the spirit of a Pioneer who braves the wind and waves, crosses thousands of oceans, and firmly holds the sea to continue to grow strongly, leaving its name on the top of generations”.

|

In the coming journey, TPBank can be completely confident with its experience and capacity, will continue to create success to pioneer and lead, maintain a distinct position, constantly change to rise up to new developments of the economy. In particular, digital transformation and customer-centricity are still identified by the bank as a long-term strategy to continue providing new financial solutions, superior to the market.

Source link

![[Photo] General Secretary To Lam receives Russian Ambassador to Vietnam](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/2/b486192404d54058b15165174ea36c4e)

![[Photo] Prime Minister Pham Minh Chinh receives Deputy Prime Minister of the Republic of Belarus Anatoly Sivak](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/2/79cdb685820a45868602e2fa576977a0)

![[Photo] Prime Minister Pham Minh Chinh receives CEO of Standard Chartered Group](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/2/125507ba412d4ebfb091fa7ddb936b3b)

Comment (0)