ANTD.VN - The General Department of Taxation said that Temu has been registered for tax by its owner company through the General Department of Taxation's Electronic Information Portal for Foreign Suppliers.

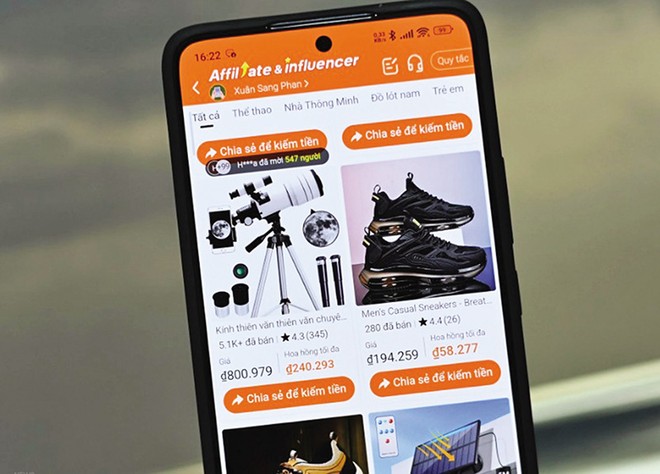

Currently, public opinion is concerned about tax management for some new cross-border e-commerce platforms that have recently appeared and are being advertised on social networking platforms, typically the Temu platform.

Regarding this issue, the General Department of Taxation said that on September 4, 2024, the Temu e-commerce platform was registered for tax by its owner, Elementary Innovation Pte. Ltd., through the Electronic Information Portal (TTĐT) for foreign suppliers of the General Department of Taxation. Temu was granted tax code number 9000001289.

Regarding the deadline for tax declaration and payment, the General Department of Taxation said that according to the provisions of Circular No. 80/2021/TT-BTC, Temu exchange will start submitting declarations from the third quarter of 2024 (the deadline for tax declaration for the third quarter of 2024 is October 31, 2024) to declare revenue from the time of starting operations in Vietnam.

Thus, according to regulations, it is expected that tax revenue will be generated in October 2024 and revenue will be declared in the tax declaration period of the fourth quarter of 2024, the deadline for payment is January 31, 2025 if the state management agency, the Ministry of Industry and Trade, grants an operating license.

|

Temu has registered for tax in Vietnam but has not been licensed by the Ministry of Industry and Trade. |

The General Department of Taxation affirms that, according to the provisions of Decree No. 52/2013/ND-CP dated May 16, 2013 of the Government on e-commerce (amended and supplemented by Decree No. 85/2021/ND-CP), e-commerce platform business activities must be licensed and subject to state management by the Ministry of Industry and Trade.

As for tax management for e-commerce and digital platform businesses, tax authorities are responsible for managing them according to the provisions of the Law on Tax Administration and Circular No. 80/2021/TT-BTC. Accordingly, e-commerce platform managers are responsible for registering, self-calculating, self-declaring, and self-paying taxes directly through the General Department of Taxation's e-commerce portal.

For cross-border e-commerce business activities on digital platforms, if foreign suppliers generate revenue in Vietnam but have not yet registered for tax, the tax authority will review and take appropriate measures to ensure effective, transparent and fair tax management for traditional business activities.

In case the foreign supplier has incorrect revenue, the tax authority will compare data to determine the revenue, request the foreign supplier to fulfill its obligations and conduct inspections and checks according to regulations if there are signs of fraud or tax evasion.

Currently, the General Department of Taxation has been and is continuing to assess the practical situation of tax management for foreign suppliers and refer to international experience to continue to perfect the draft Law on Tax Management, Law on amending and supplementing a number of laws, Law on Value Added Tax, Law on Corporate Income Tax, Decree amending and supplementing Decree No. 123/ND-CP on invoices to manage taxes for this activity to ensure effective tax management, correct and full collection for foreign suppliers when doing business in Vietnam.

E-commerce platforms operating in Vietnam are all strictly licensed and tax-managed, but also create maximum convenience for taxpayers on the basis of registering, declaring and paying taxes on the Tax Industry's e-Portal platforms.

At the same time, the General Department of Taxation also continues to strengthen the propaganda of tax policies to entities, especially new entities with production and business activities in Vietnam, to create the most favorable conditions for them to feel secure in production and business and contribute tax obligations to the State budget.

Source: https://www.anninhthudo.vn/tong-cuc-thue-temu-da-dang-ky-thue-tai-viet-nam-post594422.antd

![[Photo] Looking back at the impressive moments of the Vietnamese rescue team in Myanmar](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/11/5623ca902a934e19b604c718265249d0)

![[Photo] "Beauties" participate in the parade rehearsal at Bien Hoa airport](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/11/155502af3384431e918de0e2e585d13a)

![[Photo] Summary of parade practice in preparation for the April 30th celebration](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/11/78cfee0f2cc045b387ff1a4362b5950f)

Comment (0)