Digitizing real assets into virtual assets opens up many opportunities for innovation, contributing to promoting digital economic development in Vietnam.

Vietnam is affirming its position as one of the countries with the highest rate of digital asset ownership in the world. Virtual assets are a broad concept, including many different types, of which RWA (Real World Asset) - virtual assets linked to real assets - is becoming a trend and attracting significant attention.

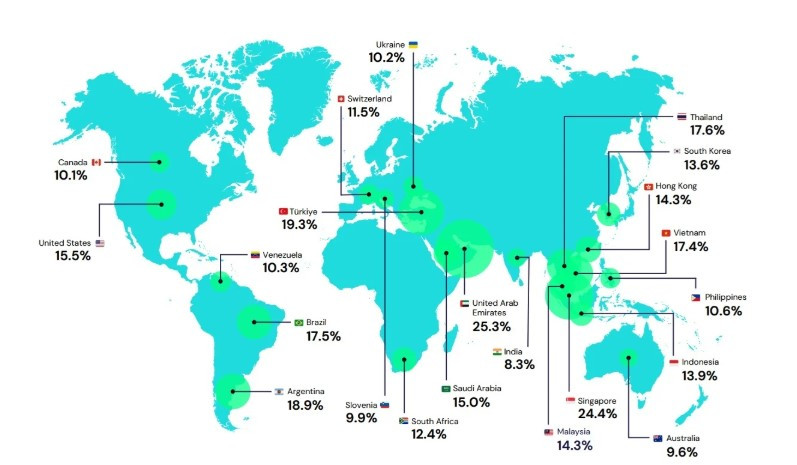

According to a report by Triple-A, more than 17 million Vietnamese people own cryptocurrencies, accounting for 17% of the population, much higher than the global average of 6.5%. This reflects the strong interest of the people in digital assets.

In addition, Blockchain capital flows into Vietnam are recording impressive growth. According to Chainalysis, Vietnam is currently in the top 3 globally in terms of cryptocurrency adoption index.

In the period from July 2022 to July 2023, the flow of cryptocurrencies and virtual assets into Vietnam will reach 120 billion USD, an increase of 20% compared to the 100 billion USD level of the 2021-2022 period.

In that context, tokenizing real assets into virtual assets brings many new opportunities to the Vietnamese financial market, especially in increasing liquidity and expanding investor access.

Traditional assets such as real estate or bonds often require large capital outlays and long transaction times. Digitizing these assets as tokens allows them to be traded quickly on the Blockchain platform, reducing barriers and making them accessible to more investors.

One of the key benefits of virtual assets is their ability to help businesses raise capital effectively. Instead of relying solely on traditional funding channels such as banks or issuing shares, businesses can use tokenization to raise capital from the community, thereby increasing financial flexibility and expanding their operations.

For example, startup KulaDao successfully raised $9 million by tokenizing mining assets, demonstrating the model’s potential in connecting global capital flows to real-world projects.

In addition, KulaDao also applies the DAO (decentralized governance) model to mining projects, helping to increase transparency and optimize benefits for both investors and local communities.

At a recent event, Mr. Nguyen Duy Hung, Chairman of SSI Securities Company, stated that digital assets are no longer a strange concept but have become an indispensable part of the global financial system.

Pioneering countries in this field not only promote innovation but also establish a strategic position in the world economy.

Despite its great potential, Vietnam still faces many challenges in implementing real asset tokenization, the biggest barrier of which is the incomplete legal framework.

Currently, regulations related to digital assets in Vietnam still have many gaps, causing difficulties for businesses in the process of implementing asset digitization projects.

At the same time, the lack of investor protection mechanisms is also an important issue that needs to be addressed to ensure sustainable market development.

To overcome these limitations, Vietnam can learn from the experiences of pioneering countries such as Singapore and Switzerland.

Singapore has issued many specific regulations on digital assets, facilitating financial institutions to participate in the tokenization process while still strictly adhering to legal standards.

Meanwhile, Switzerland has developed a “crypto valley” model in Zug, building a transparent digital asset ecosystem with close cooperation between government and businesses.

In fact, in order to promote growth and catch up with global trends, the Prime Minister has assigned the Ministry of Finance to develop a report to issue a resolution allowing a pilot operation of a virtual currency exchange.

This will create a legal environment for investors, organizations and individuals in Vietnam to trade, invest and buy and sell digital assets.

Speaking at the regular Government press conference in March 2025, Deputy Minister of Finance Nguyen Duc Chi emphasized that digital assets and digital currencies are complex and new issues, requiring careful research to build a transparent legal framework, contributing to promoting socio-economic development.

Source: https://vietnamnet.vn/tiem-nang-cua-viet-nam-trong-cuoc-dua-so-hoa-tai-san-thuc-2383132.html

![[Photo] General Secretary To Lam and Prime Minister Pham Minh Chinh attend the first Congress of the National Data Association](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/22/5d9be594d4824ccba3ddff5886db2a9e)

Comment (0)