Tien Phong Bank (TPBank) has lowered its deposit interest rates for the first time since September 13. The 1-month and 3-month terms have both decreased by 0.2 percentage points to 3.6% and 3.8% per year, respectively.

The 6-month term decreased by 0.2 percentage points to only 4.8%/year. Similarly, TPBank reduced the 12-month term deposit interest rate to 5.35%/year.

Terms of 18 months and above all decreased by 0.3 percentage points. The 18-month term is 5.7%/year, while the 24- and 36-month terms are 6%/year.

Dong A Bank reduced deposit interest rates for the second time in November. Term of 1-5 months decreased by 0.3 percentage points to 3.9%/year.

The 6-8 month term simultaneously decreased by 0.3 percentage points to 4.9%/year. Dong A Bank became one of the few banks to bring deposit interest rates for these terms below 5%/year.

For 9-11 month term deposits, interest rates were adjusted down by 0.2 percentage points to 5.1%/year. Meanwhile, interest rates for 12-month term deposits decreased by 0.15 percentage points to 5.4%/year.

The 13-month term, which used to have the highest interest rate at Dong A Bank, has now also decreased by 0.15 percentage points to 5.8%/year.

Deposit terms from 18-36 months are adjusted down by 0.15 percentage points to 5.7%/year.

However, customers who deposit savings for a term of 13 months or more, from 200 billion VND, will enjoy interest rates of up to 7.5%/year.

In addition, for individual customers depositing for a term of 6-12 months and receiving interest at the end of the term, the bank adds 0.05-0.25% depending on the deposit amount from 500 million to 10 billion VND or more.

Since the beginning of November, 22 banks have reduced deposit interest rates, including Sacombank, NCB, VIB, BaoVietBank, Nam A Bank, VPBank, VietBank, SHB, Techcombank, Bac A Bank, KienLongBank, ACB, Dong A Bank, PG Bank, PVCombank, VietA Bank, SCB, Eximbank, OceanBank, BVBank, OCB, TPBank.

Among them, VietBank and Dong A Bank are the banks that have reduced interest rates twice this November.

On the contrary, OCB and BIDV are the banks that have increased their deposit interest rates since the beginning of the month. With OCB, the bank increased interest rates for terms from 18 to 36 months. Meanwhile, BIDV increased interest rates for terms from 6 to 36 months.

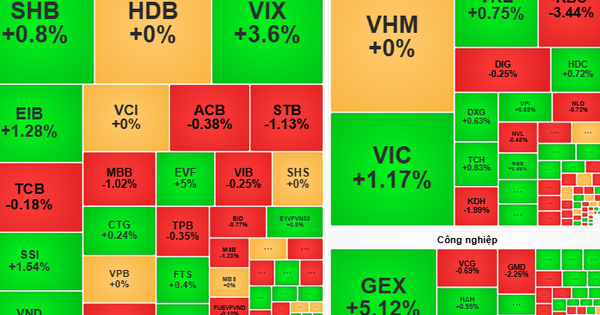

| HIGHEST DEPOSITS INTEREST RATE TABLE ON NOVEMBER 15 (%/year) | ||||||

| BANK | 1 MONTH | 3 MONTHS | 6 MONTHS | 9 MONTHS | 12 MONTHS | 18 MONTHS |

| OCEANBANK | 4.6 | 4.6 | 5.8 | 5.9 | 6 | 6 |

| CBBANK | 4.2 | 4.3 | 5.7 | 5.8 | 6 | 6.1 |

| HDBANK | 4.05 | 4.05 | 5.7 | 5.5 | 5.9 | 6.5 |

| PVCOMBANK | 3.65 | 3.65 | 5.6 | 5.6 | 5.7 | 6 |

| BAOVIETBANK | 4.4 | 4.75 | 5.5 | 5.6 | 5.9 | 6.2 |

| NCB | 4.45 | 4.45 | 5.5 | 5.65 | 5.8 | 6 |

| GPBANK | 4.25 | 4.25 | 5.45 | 5.55 | 5.65 | 5.75 |

| VIET A BANK | 4.4 | 4.4 | 5.4 | 5.4 | 5.7 | 6.1 |

| BAC A BANK | 4.35 | 4.35 | 5.4 | 5.5 | 5.6 | 5.95 |

| KIENLONGBANK | 4.55 | 4.75 | 5.4 | 5.6 | 5.7 | 6.2 |

| VIETBANK | 3.9 | 4 | 5.4 | 5.5 | 5.8 | 6.2 |

| BVBANK | 4 | 4.15 | 5.25 | 5.4 | 5.5 | 5.55 |

| OCB | 3.8 | 4.1 | 5.2 | 5.3 | 5.5 | 6.2 |

| SHB | 3.5 | 3.8 | 5.2 | 5.4 | 5.6 | 6.1 |

| SAIGONBANK | 3.4 | 3.6 | 5.2 | 5.4 | 5.6 | 5.6 |

| VIB | 3.8 | 4 | 5.1 | 5.2 | 5.6 | |

| LPBANK | 3.8 | 4 | 5.1 | 5.2 | 5.6 | 6 |

| MB | 3.5 | 3.8 | 5.1 | 5.2 | 5.4 | 6.1 |

| EXIMBANK | 3.6 | 3.9 | 5 | 5.3 | 5.6 | 5.7 |

| SACOMBANK | 3.6 | 3.8 | 5 | 5.3 | 5.6 | 5.75 |

| VPBANK | 3.7 | 3.8 | 5 | 5 | 5.3 | 5.1 |

| MSB | 3.8 | 3.8 | 5 | 5.4 | 5.5 | 6.2 |

| SCB | 3.75 | 3.95 | 4.95 | 5.05 | 5.45 | 5.45 |

| DONG A BANK | 3.9 | 3.9 | 4.9 | 5.1 | 5.4 | 5.4 |

| PG BANK | 3.4 | 3.6 | 4.9 | 5.3 | 5.4 | 6.2 |

| NAMA BANK | 3.6 | 4.2 | 4.9 | 5.2 | 5.7 | 6.1 |

| ABBANK | 3.7 | 4 | 4.9 | 4.9 | 4.7 | 4.4 |

| TPBANK | 3.6 | 3.8 | 4.8 | 5.35 | 5.7 | |

| SEABANK | 4 | 4 | 4.8 | 4.95 | 5.1 | 5.1 |

| TECHCOMBANK | 3.55 | 3.75 | 4.75 | 4.8 | 5.25 | 5.25 |

| AGRIBANK | 3.4 | 3.85 | 4.7 | 4.7 | 5.5 | 5.5 |

| VIETINBANK | 3.4 | 3.75 | 4.6 | 4.6 | 5.3 | 5.3 |

| ACB | 3.3 | 3.5 | 4.6 | 4.65 | 4.7 | |

| BIDV | 3.2 | 3.5 | 4.6 | 4.6 | 5.5 | 5.5 |

| VIETCOMBANK | 2.6 | 2.9 | 3.9 | 3.9 | 5 | 5 |

As of the end of last week, interbank interest rates for overnight, 1-week, and 2-week terms decreased by 0.2%; 0.27%; 0.22% to 0.73%; 0.91%; 1.26% to 0.73%; 0.91%; 1.29%, respectively. The central exchange rate decreased by 70 VND/USD from 24,084 to 24,014 VND/USD. Meanwhile, the exchange rate at commercial banks decreased by 236 VND/USD from 24,561 VND/USD to 24,325 VND/USD. With the Fed expected to stop raising interest rates in the next meetings, the strength of the US Dollar Index is expected to gradually decrease, thus reducing pressure on the VND/USD exchange rate. |

Source

![[Photo] Third meeting of the Organizing Subcommittee serving the 14th National Party Congress](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/2/3f342a185e714df58aad8c0fc08e4af2)

![[Photo] General Secretary To Lam receives Russian Ambassador to Vietnam](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/2/b486192404d54058b15165174ea36c4e)

![[Photo] Relatives of victims of the earthquake in Myanmar were moved and grateful to the rescue team of the Vietnamese Ministry of National Defense.](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/2/aa6a37e9b59543dfb0ddc7f44162a7a7)

Comment (0)