July revenue drops 11%, following a dismal first half of the year with profits falling 98%

Mobile World Corporation (MWG) has just announced its business results for July with revenue of over VND9,800 billion, down 11% compared to the same period last year. Of which, revenue from the Mobile World and Dien May Xanh chains reached VND6,700 billion, equivalent to the revenue achieved in June.

Bach Hoa Xanh chain recorded revenue exceeding VND2,800 billion, up 10% compared to the previous month. According to MWG, BHX's average revenue has improved to an average of VND1.6 billion/store.

MWG's cumulative revenue by the end of July reached VND 66,400 billion, only completing 49% of the 2023 target. Thus, MWG is currently behind in revenue compared to the target set at the beginning of the year.

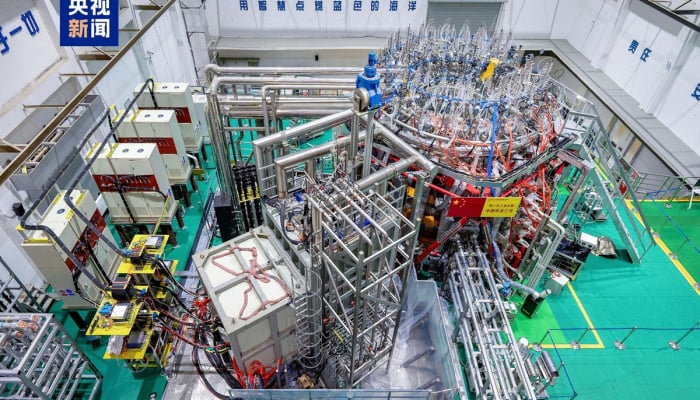

Mobile World (MWG) Q2 profit dropped 98%, July revenue also dropped 11% (Photo TL)

Regarding business plans for the last months of the year, Mobile World, Dien May Xanh and Topzone are following a good price strategy to meet customers' saving needs. Because MWG's management believes that this is still a difficult period for consumers, so spending needs will be limited.

For Bach Hoa Xanh, this chain will focus on fresh products, improving the quality of these products to increase consumers' shopping frequency.

Regarding the An Khang pharmacy chain, MWG has no plans to expand this pharmacy chain this year. The goal will still be to increase revenue and optimize store operations.

The decision to not continue expanding the chain of stores comes amid MWG's business situation continuously recording negative signals. Profits in the first two quarters of 2023 were both very low compared to the same period last year, showing the difficulties that this unit is facing.

Second quarter profit plunges 98%, gross profit margin declines

Previously, MWG's Q2/2023 financial statements showed that the gloomy colors continued to increase in the financial picture of this unit.

Consolidated net revenue in the second quarter reached only VND 29,465 billion, while in the same period last year it reached VND 34,338 billion, a decrease of 14.2%. Cost of goods sold accounted for a high proportion of VND 24,024 billion, gross profit reached VND 5,441 billion, gross profit margin decreased from 21.4% to only 18.5%.

During the period, financial revenue increased sharply from VND298 billion to VND585 billion thanks to interest on deposits. However, financial expenses also increased to VND397 billion, mainly due to interest expenses. Selling expenses increased from VND4,808 billion to VND5,211 billion while business management expenses decreased from VND500 billion to only VND229 billion.

After deducting all expenses and corporate income tax, MWG's consolidated profit after tax in the second quarter was only 17 billion VND, down 98% compared to the same period last year.

It can be seen that if it were not for the sudden increase in financial revenue from interest on deposits, MWG's business results in the second quarter would have been almost a loss. This situation has also lasted since the first quarter of this year when MWG's after-tax profit reached only VND21 billion, also down 98% compared to the same period. At the end of the first 6 months of the year, MWG recorded only VND39 billion in after-tax profit.

Estimated profit for the whole year decreased by 80%, MWG is recording profit thanks to deposit interest

By the end of the second quarter of 2023, MWG's total assets reached VND59,369 billion. Of which, cash and cash equivalents decreased by 32% compared to the beginning of the year, remaining at VND3,442 billion. However, the company's bank deposits doubled, from VND10,069 billion to VND20,979 billion.

It can be considered that MWG is holding a total amount of cash of about 24,000 billion VND. As mentioned above, MWG's financial revenue in the second quarter recorded a large amount of interest on deposits, showing that this unit is living and recording interest from bank deposits, not its main business activities.

In MWG's capital structure, the company is having to increase short-term debt, total debt payable in the first 6 months of the year increased by nearly 3,500 billion VND, to 35,405 billion VND. Short-term debt increased by 34.6%, from 10,688 billion to 16,337 billion VND, equivalent to an increase of nearly 6,000 billion VND.

Long-term debt decreased slightly to VND5,899 billion. Owners' equity at the end of the second quarter reached VND23,964 billion with VND8,763 billion in undistributed profit after tax.

Another notable point is that MWG's gloomy business situation has been predicted by many securities companies. In particular, BVSC Securities has predicted that MWG's after-tax profit will decrease to only VND 1,231 billion, equivalent to a decrease of up to 80% compared to 2022.

Source

![[Photo] Ministry of Defense sees off relief forces to the airport to Myanmar for mission](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/30/245629fab9d644fd909ecd67f1749123)

![[Photo] Prime Minister Pham Minh Chinh chairs meeting to remove difficulties for projects](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/30/7d354a396d4e4699adc2ccc0d44fbd4f)

![[REVIEW OCOP] An Lanh Huong Vet Yen Cat](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/27/c25032328e9a47be9991d5be7c0cad8c)

Comment (0)