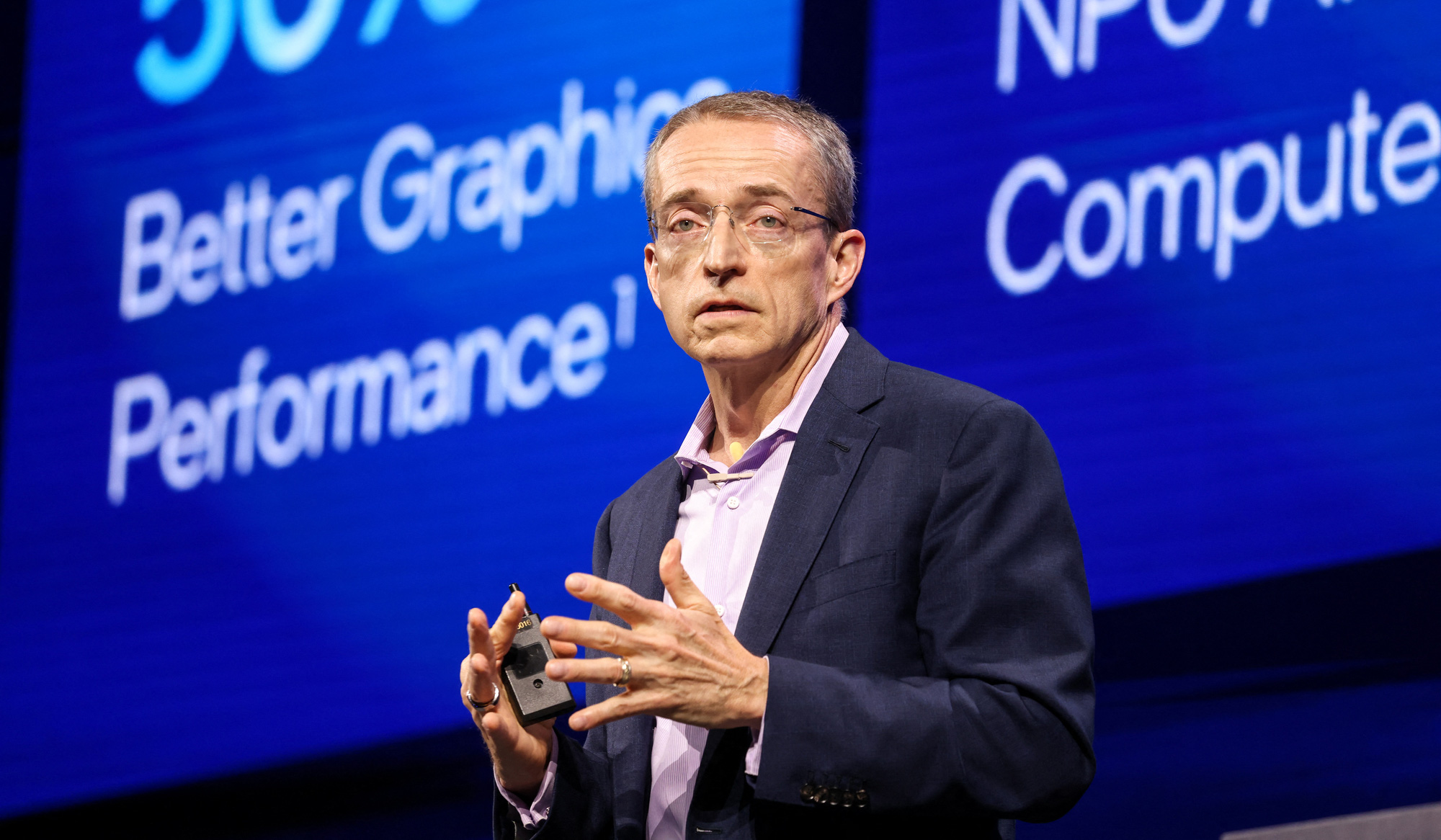

Intel announced that CEO Pat Gelsinger has resigned and left the board of directors effective December 1, ending nearly four years of efforts to restore the glory of the former chip giant.

Former Intel CEO Pat Gelsinger - Photo: AFP

Contrary to expectations when he first took office, Mr. Gelsinger not only failed to maintain Intel's position in the semiconductor industry but also caused the company to increasingly fall behind its competitors.

The humiliating ending

According to Bloomberg, in the face of declining business, Intel's board of directors met last week and gave the 63-year-old CEO two options: resign or be fired.

Mr. Gelsinger joined Intel in 1979, when he was only 18 years old. At 32, he became the youngest vice president in the company's history. He held many important positions, contributing greatly to making Intel the most valuable chip company in the world.

In 2021, he became CEO with the task of leading Intel through restructuring pressures from investors. He proposed an extremely ambitious long-term plan: turning Intel into the second largest chip manufacturer in the world, competing directly with the giants in the field such as TSMC (Taiwan) and Samsung Electronics (South Korea).

This plan is considered bold as it pushes Intel away from its traditional strength of designing microprocessors for personal computers or servers. Previously, Intel had never outsourced to third parties. To carry out this plan, Intel has started many chip factory projects around the world with a total investment value of up to tens of billions of USD.

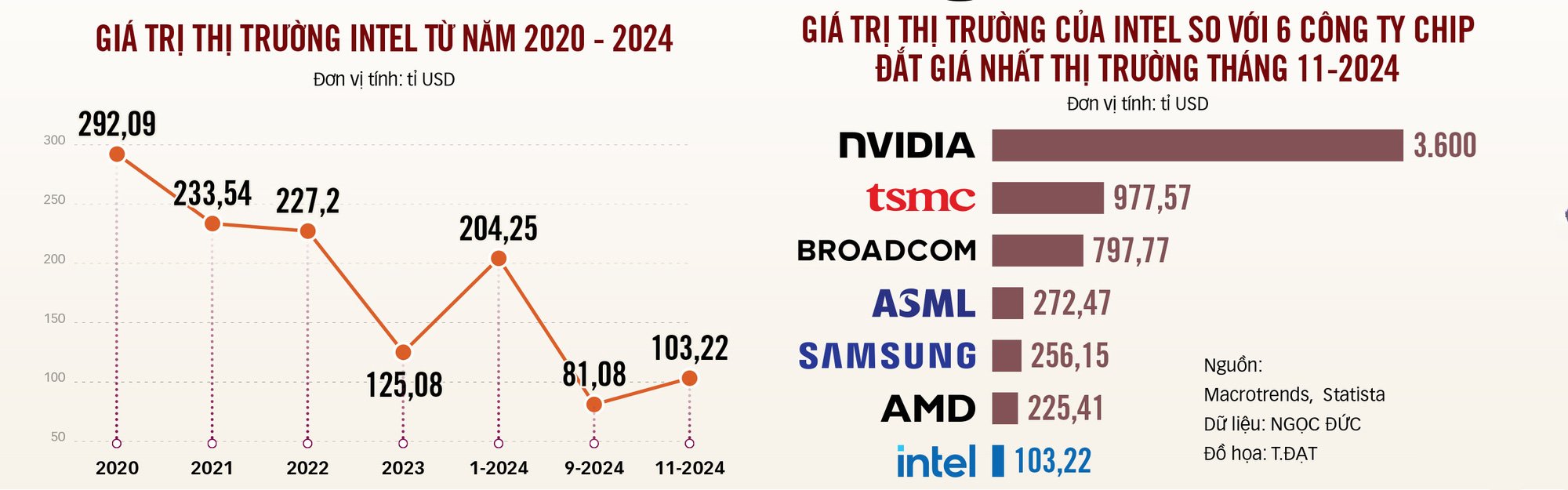

Despite its ambitions, Intel has been on a downward spiral under Gelsinger. By early 2022, PC chip sales were down 25%, while the data center chip market was lost to AMD. By 2023, Intel’s revenue was down a third from when Gelsinger took over.

The company has been forced to cut $10 billion in operating costs by 2025 by laying off more than 15,000 employees and postponing several projects, including a 30 billion euro ($31.5 billion) factory in Germany.

In October, Intel reported a $16.6 billion loss in the second quarter, its largest loss in history. Analysts expect the company to lose $3.68 billion in 2024, its first net loss since 1986.

In less than four years under Gelsinger, Intel’s market value has nearly halved, hovering around $100 billion, while Nvidia, which had been in Intel’s shadow for decades, has grown to $3.35 trillion.

Missed the AI train

Despite its ambitions, Intel’s efforts to become a chip foundry have so far been unsuccessful. Large contracts are not enough to cover the costs of building new factories, while its production lines are inferior to those of its competitors. Despite having its own chip factories, Intel still has to outsource some of its new chip lines to TSMC.

David Yoffie, a former Intel board member, said company leaders wanted to replace Gelsinger because his growth strategy took too long to produce profits. Moreover, Intel, under his leadership, missed opportunities in artificial intelligence (AI) because it focused on chip manufacturing.

Techcrunch said Intel misjudged the AI craze and was slow to react to the explosion of this technology. The former Intel CEO was overly optimistic about the competitiveness of self-developed AI chips, despite the fact that they were far behind Nvidia's products.

Not only did Intel lose customers, but it also faced pressure as many investors shifted money to Nvidia during the AI boom, losing a vital source of capital. In addition, missing out on the previous mobile phone chip boom further left Intel behind in the context of the rapidly growing semiconductor industry.

Opportunity or challenge for Intel?

The departure of Pat Gelsinger gives Intel an opportunity to adjust its strategy, but also poses a major challenge in finding a successor with the right mindset and vision. According to Bloomberg, Intel currently has no internal candidates that meet these criteria, so it is likely that Gelsinger's replacement will come from outside.

Many analysts predict that after Mr. Gelsinger leaves, Intel may consider splitting its product development (chips, data centers, AI, etc.) and manufacturing businesses into two independent companies. This would give both areas more autonomy and more efficiency.

Analysts at Citi Bank even predict that Intel could sell its manufacturing division entirely to raise capital and focus on product design - an area that is considered to bring higher profits.

Another scenario is that Intel sells itself to a major tech company. Qualcomm has previously expressed interest in buying Intel, but the size and complexity of the deal have significantly dampened its interest.

Source: https://tuoitre.vn/that-bai-cay-dang-cua-intel-20241204081526893.htm

![[Photo] Opening of the 11th Conference of the 13th Party Central Committee](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/10/f9e717b67de343d7b687cb419c0829a2)

![[Photo] April Festival in Can Tho City](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/10/bf5ae82870e648fabfbcc93a25b481ea)

![[Photo] Unique folk games at Chuong Village Festival](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/10/cff805a06fdd443b9474c017f98075a4)

![[Photo] Prime Minister Pham Minh Chinh commends forces supporting Myanmar in overcoming earthquake consequences](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/10/e844656d18bd433f913182fbc2f35ec2)

Comment (0)